Nifty Open Interest Put Call ratio fell to 1.04 levels from 1.16 levels - HDFC Securities

LONG UNWINDING WAS SEEN IN NIFTY & BANKNIFTY FUTURES

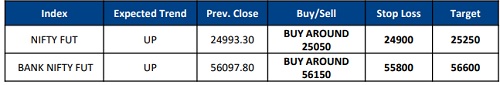

Create Longs with the SL of 24900 Levels.

* The Nifty opened sharply lower, declining 173 points amid escalating geopolitical tensions, then extended losses to an intraday low of 24824. However, it surged 233 points from that low to close at 24971.90 down 140 points (0.56%) for the day.

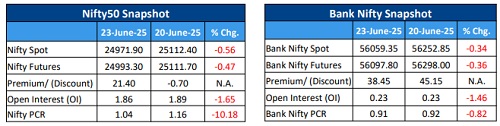

* Long Unwinding was seen in the Nifty Futures where Open Interest fell by 1.65% with Nifty falling by 0.56%.

* Long Unwinding was seen in the Bank Nifty Futures where Open Interest fell by 1.46% with Bank Nifty falling by 0.34%.

* Nifty Open Interest Put Call ratio fell to 1.04 levels from 1.16 levels.

* Amongst the Nifty options (26-Jun Expiry), Call writing is seen at 25100-25200 levels, indicating Nifty is likely to find strong resistance in the vicinity of 25100-25200 levels. On the lower side, an immediate support is placed in the vicinity of 24900-24800 levels where we have seen Put writing.

* Short build-up was seen by FII's in the Index Futures segment where they net sold worth 1,174 cr with their Open Interest going up by 4199 contracts.

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ00017133

More News

Quote on Post market comment for Thursday Feb 19 by Hitesh Tailor, Research Analyst, Choice ...

.jpg)