Gold is expected to move in tight range ahead of this week`s FOMC policy - ICICI Direct

Metal’s Outlook

Bullion Outlook

* Gold is expected to move in tight range ahead of this week’s FOMC policy. On the upside $3300 would act as immediate resistance, whereas $3220 would hold key support for the day. A drop in net longs again last week signaled profit booking in the metal. Meanwhile, no specific timeline on US-China trade deal would provide support to the yellow metal. Additionally, weakness in the dollar would help the metal to hold its ground. Meanwhile, investors will eye on key economic numbers rom US to get more clarity on timing of US Fed rate cut.

* On the data front unwinding of OI in ATM calls indicates a recovery in prices. But, higher OI concentration at 3300 OTM call strike would act as key hurdle for now. On the downside, a higher OI base at 3200 put strike indicates prices to find support. For the day, MCX Gold June is expected to rise towards immediate resistance at Rs.93,500. A move above ?93,500, would open the doors towards Rs.94,000 level. On the downside, Rs.92,200, holds key support. MCX Silver June is expected to hold the support near Rs.93,200 and rebound towards ?96,000 level.

Base Metal Outlook

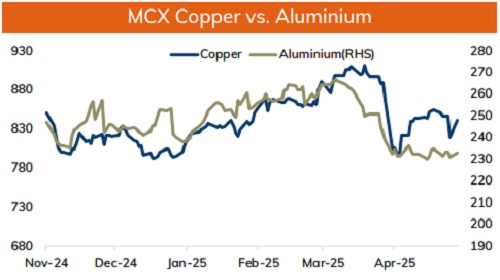

* Copper prices to hold its ground and move in a positive territory on supply concerns and softness in the dollar. Disruption from two biggest mines in Peru would provide support to prices. Further, a rise in copper import premiums which hit highest in six months indicates tightness in the physical market. The Yangshan premium jumped from a low of $35 a ton in late February to $94 this week, reflecting sharp demand in China as warehouse stocks noted a sharp drawdown. Moreover, scope of fresh round of stimulus from China to counter the tariffs would support prices to stay higher.

* MCX Copper May is expected to hold the support near Rs.835 and move higher towards Rs.852. Above Rs.852 it would open the doors towards Rs.860.

* MCX Aluminum May is likely to consolidate in the band of Rs.230 and ?237 level. Only below Rs.230 level, it would turn bearish towards Rs.226. MCX Zinc May is hovering near key support at Rs.244. If holds then it would rebound towards Rs.250 level. On the other hand, a move below would open the doors towards Rs.240.

Energy Outlook

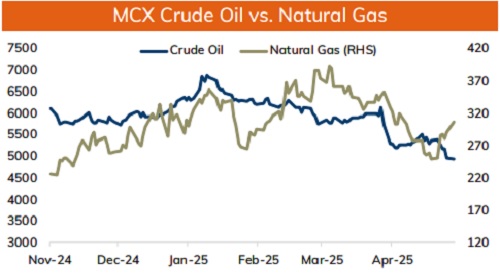

* NYMEX Crude oil is expected to trade lower following the OPEC+’s decision to increase output from June onwards. Its June increase will take the total combined hike for April, May and June to 960,000 bpd, representing more than 40% unwinding of the 2.2 million bpd cut. Meanwhile, growing bets of trade negotiation between US and China and improved risk sentiments might limit its losses.

* On the data front, unwinding of OI in ATM and OTM put indicates more downside towards $55 level. On the call side, addition of OI has been observed near 60 strike, which could act as key resistance for now. MCX Crude oil May is likely to hit the initial support ?4800. A move below would open the doors towards Rs.4650 level. On the upside Rs.5050 would act as key hurdle.

* MCX Natural gas May is expected to rise towards Rs.314, as long as it holds above Rs.295. Only a move above Rs.314 it would turn bullish and rise towards Rs.324. A drop in US gas production and improved export numbers would provide support to price.

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631