Spot Gold is likely to trade with the positive bias and rise towards $4250 level on weak dollar - ICICI Direct

Metal’s Outlook

Bullion Outlook

* Spot Gold is likely to trade with the positive bias and rise towards $4250 level on weak dollar and softening of US treasury yields across curve. Further, prices may rally as most of the Fed members turned dovish amid weaker set of economic numbers from US. Today investors will await the speech from FOMC member Bowman. As per CME Fed-Watch tool traders are now pricing almost 87% chance of a rate cut in December, up 84% a week ago. Moreover, prices may rally on strong central bank demand for gold and as the concern over Fed independence resurfaced after White House National Economic Council Director Kevin Hassett emerged as the front-runner to serve as the next Fed chair.

* MCX Gold Feb is expected to rise towards Rs132,000 level as long as it stays above Rs 129,500 level.

* MCX Silver March is expected to rise towards Rs 183,000 level as long as it stays above Rs 176,000 level

Base Metal Outlook

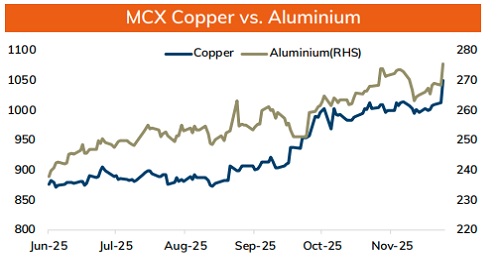

* Copper prices are expected to hold its gains and move higher on concerns over supply shortage. A drop in Chilean production and higher premiums would keep copper price elevated. Chile’s October production of copper fell by 7% YoY to 458,405 tonnes. Additionally, growing prospects of US Fed rate cut in next week would improve investors risk sentiments and support the red metal to trade higher. Meanwhile, weaker manufacturing activity in US and renewed worries about the China’s property sector could check its upside.

* MCX Copper Dec is expected to hold support near Rs 1037 and move higher towards Rs 1055 level. Only break below Rs1037 level it may fall towards Rs 1030-Rs1025 level.

* MCX Aluminum Dec is expected to rise towards Rs 277.50 level as long as it stays below Rs 273 level. MCX Zinc Dec is likely to move in the wide range of Rs 305 level and Rs 311 level

Energy Outlook

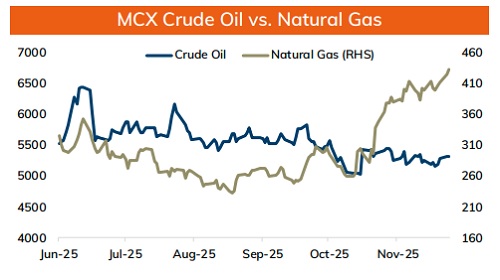

* Crude oil is likely to trade with positive bias and move towards $60 level on escalating geopolitical risks between US and Venezuela. President Donald Trump warned that the country’s airspace should be considered closed. His threat came as Washington strengthened its military buildup in the region. Further, recent drone attacks on Russian Caspian Pipeline Consortium has caused halt to oil supplies. Additionally, OPEC+’s plan to leave output levels unchanged at its Sunday meeting would also provide some support.

* MCX Crude oil Dec is likely to hold support near Rs 5240-Rs 5250 level and move higher towards Rs 5400 level.

* MCX Natural gas Dec is expected to rise towards Rs 446 level as long as it stays above Rs 424 level. Colder US weather forecast would boost heating demand.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631