Gold dipped as US tariffs hit markets, hurting assets worldwide - HDFC Securities Ltd

GLOBAL MARKET ROUND UP

* Gold ended flat in a volatile session on Tuesday. Gold has been reeling along with other asset classes since the US leader last week announced global tariffs on the country’s trading partners. Despite being a haven asset in times of uncertainty, it “is not immune to liquidity-driven global derisking events.

* However, gold prices traded higher in the Asian trading hours as traders braced for the US to increase tariffs on Chinese goods to as high as 104%, a move that Beijing is expected to retaliate against as hopes dim that a brutal global trade war can be avoided.

* Meanwhile, Chinese investors funneled a record amount of cash into gold-backed exchange-traded funds last week, drawn by the safety of the asset as combative trade war rhetoric from the world’s biggest economies shakes global markets.

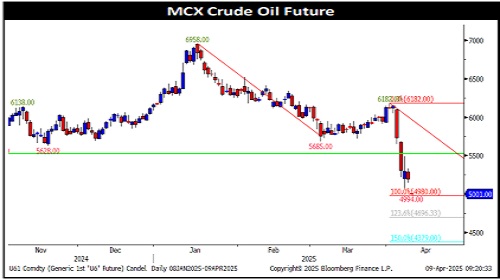

* Crude oil prices have fallen further to fresh four-year lows in Asian trading hours on Wednesday due to the intensifying trade war, which threatens to reduce energy demand. WTI crude oil prices fell below $60 a barrel for the first time since 2021. Crude has collapsed by almost 20% this year as a weak demand outlook and higher supply contributed to the fall.

* Copper extended its slump, with industrial metals hit by the intensifying global trade war and recession fears as the US prepared to implement more import tariffs.

* Asian equity markets dropped, and Treasuries sold off as financial markets were hit by fresh volatility after US President Donald Trump ratcheted up the pressure on China and imposed sweeping global tariffs.

Gold

Trading Range: 87400 to 88520

Intraday Trading Strategy: Buy Gold Mini May Fut at 87800 SL 87580 Target 88305

Silver

Trading Range: 88150 to 90700

Intraday Trading Strategy: Buy Silver Mini Apr Fut at 88450-88475 SL 87700 Target 89680/90300

Crude Oil

Trading Range: 4850 to 5080

Intraday Trading Strategy: Sell Crude Oil Apr Fut at 5005 SL 5080 Target 4925

Natural Gas

Trading Range: 294 to 319

Intraday Trading Strategy: Sell Natural Gas Apr Fut at 309 SL315.0 Target 294

Copper

Trading Range: 775 to 805

Intraday Trading Strategy: Sell Copper Apr Fut at 802-803 SL 807.0 Target 792

Zinc

Trading Range: 239-250

Intraday Trading Strategy: Sell Zinc Apr Fut at 248.0 SL 252.20 Target 244/242

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ00017133