Global Liquidity Tracker: Largest outflow from US Largecap funds in CY25. India-Focused funds break 2-month inflow streak by Elara ecurities India

Largest outflow from US Largecap funds in CY25. India-Focused funds break 2-month inflow streak

* US domestic fund outflows intensified this week, rising to a five-week high of $10bn, marking outflows in 10 of the last 12 weeks, and totalling $40.8bn since mid-March. In contrast, foreign investors remain net buyers in US markets, contributing an additional $1.3bn this week. A clear divergence is emerging in the trend of domestic vs. foreign flows following the Trump tariff-related volatility.

* Notably, 38% of foreign inflows into the US since Ap’25 have originated from Japan-domiciled funds ($9.5bn), followed by Ireland (32%, $7.8bn) and Canada (19%, $4.6bn). These three geographies have played a key role in cushioning the impact of continued domestic redemptions.

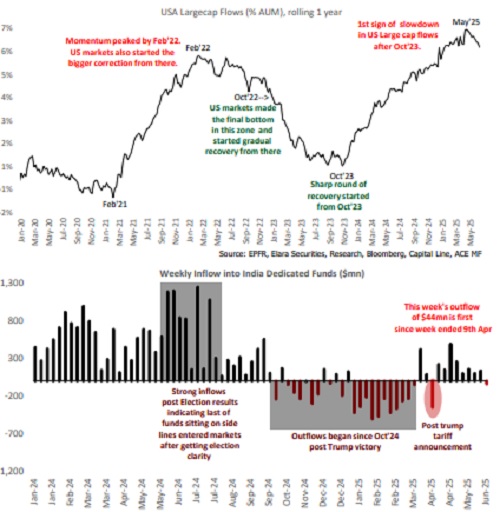

* US large cap funds witnessed their largest weekly outflow of 2025, amounting $9.7bn. This also marks the first three-week streak of large cap fund redemptions since Aug’23. The longer-term trend in US flows is turning fragile for the first time since Feb’22 — a period that preceded a sharp eight-month correction in the US market led by large cap stocks.

* Emerging Markets (EMs) continue to attract foreign capital for the eighth consecutive week, with the most robust inflows seen in S.Korea ($704mn) and Brazil ($239mn).

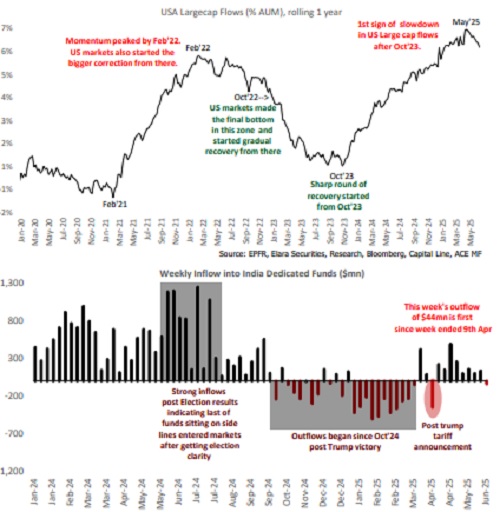

* India, however, saw a moderation in flows to $73mn after receiving $388mn over the previous two weeks. Importantly, India-focused funds recorded their first weekly redemption since April 9 (post-tariff announcement), amounting to a modest $44mn. While the outflow is not significant, it potentially signals a pause in the two-month positive flow trend that had added up to $1.6bn.

* Gold funds continued their strong rebound, recording $3.9bn in inflows this week. Last 3 weeks’ inflows of $12.4bn has nearly recovered all of the prior four weeks’ redemptions.

Above views are of the author and not of the website kindly read disclaimer

Tag News

Aditya Birla SL AMC changes risk-o-meter of schemes