Global Liquidity Tracker: India-Focused active funds under renewed pressure; Anti-Dollar trades accelerate- New high GEM & Commodity flows by Elara Capital

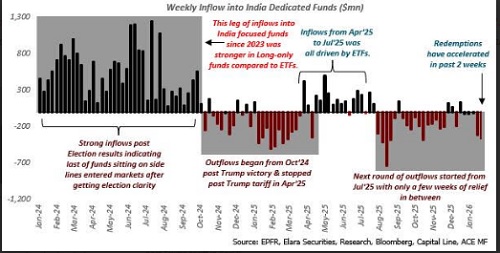

* A fresh leg of redemptions has re-emerged in India-focused funds, following a 6-week lull between 20 Nov ’25 and 6 Jan ’26. In our 1 August 2025 report, “Strategic flows retreating from India after 3-years”, we outlined why India-dedicated, bottom-up long-only flows were likely to remain structurally weak. Subsequent developments have reinforced this view. While intermittent pauses in redemptions have occurred, the underlying long-term trend remains negative.

* Over the past 2 weeks (since 8 Jan’26), India-dedicated funds witnessed outflows of $680mn ($320mn last week and $360mn this week). The selling pressure is entirely concentrated in long-only strategies ($645mn).

* The current redemption cycle has been driven primarily by Luxembourg-domiciled funds ($330mn), followed by Japan funds ($170mn). Notably, redemptions from Japan-based funds are largest in 14 weeks, extending a trend of sustained pressure since Nov’24. In contrast, US- and Ireland-domiciled funds have remained largely stable, with US exposure to India remaining ETF-driven and relatively resilient.

* This divergence highlights a growing structural shift: India is increasingly being approached as a top-down allocation rather than a bottom-up conviction trade by foreign investors.

* While India-focused active funds continue to face persistent redemption pressure, accelerating GEM inflows are simultaneously driving tactical, index-led allocations into India, masking the weakness in dedicated long-only participation.

* At the global level, the anti-dollar theme remains firmly in play, reflected in strong inflows into GEM and commodity-linked assets. GEM fund inflows accelerated further to record $8bn this week, following $6.6bn last week, marking the strongest inflow phase since Jan–Mar ’23.

* Industrial commodity and gold funds recorded 8 weeks of inflows, while silver flows have softened modestly over past four weeks. Meanwhile, commodity equity fund inflows surged to a fresh record of $6.5bn.

Above views are of the author and not of the website kindly read disclaimer

Tag News

Fund Folio : Equity AUM rises for the 12th successive year; net inflows moderate in CY25 by ...

More News

Shriram AMC Expands Fixed Income Suite with Launch of Shriram Money Market Fund