2024-04-27 10:33:03 am | Source: Elara Capital

Global Liquidity Tracker : Global flows stabilise after 2 weeks despite macro concerns. India Dedicated flows contn. but pressure from GEM funds by Elara Capital

Global flows stabilise after 2 weeks despite macro concerns. India Dedicated flows continue. but pressure from GEM funds

- Despite the surge in US 10 Year bonds, concerns of rate hikes in US and the Iran- Israel war situation, Global flows have not shown any major dent yet.

- This week we saw small inflow of $5.2bn into Global equities after slower redemption of $24.7bn over the previous 2 weeks. Overall flow momentum has slowed down but when compared with the underlying events, markets doesn’t seem to be showing bigger panic in flows until now.

- US Tech flows have lost some momentum and will be crucial to watch for getting a view on the US markets. This week US Tech saw inflow of $2.4bn after outflows of $6.7bn over the past 2 weeks.

- EM flows remain soft led by outflows from GEM funds for 3rd week. China, Korea and Brazil are major regions with redemption pressure. Taiwan flows remain strong.

- After 2 weeks of outflows totalling $1.8bn from Japan, flows recovered sharply with strongest inflow since Jan 2018 of $5.8bn (largely on back of strong inflows from domestic investors). Foreign flows into Japan have seen only one outflow in the past 4 months (in week ended 27th Mar).

- Inflows into India dedicated funds continued for straight 58th week but momentum slowed to $274mn this week from $450mn in previous week. All inflows continued to be led by Large cap funds. India dedicated Midcap funds see slower redemptions for 8th week in a row totalling $170mn. Redemptions from GEM funds is creating pressure on overall India flows.

- Total India flows were negative to the tune of $170mn (largest since 1st Nov 23) on back of pressure from GEM funds, while dedicated inflows continue.

- Global High Yield & Corporate bond flows stabilised marginally this week after 2 weeks of strong outflows. Global risk appetite, as measured by Junk bonds, is not showing big panic until now. IG funds NAV line is negotiating a crucial support.

Above views are of the author and not of the website kindly read disclaimer

Disclaimer:

The content of this article is for informational purposes only and should not be considered financial or investment advice. Investments in financial markets are subject to market risks, and past performance is not indicative of future results. Readers are strongly advised to consult a licensed financial expert or advisor for tailored advice before making any investment decisions. The data and information presented in this article may not be accurate, comprehensive, or up-to-date. Readers should not rely solely on the content of this article for any current or future financial references.

To Read Complete Disclaimer Click Here

Latest News

Income Tax Department extends date for filing ITRs f...

India developing electric 2-seater trainer aircraft,...

Akums` profit falls nearly 33 pc sequentially in Q4,...

India`s energy future steadily moving towards self-s...

BSNL clocks first back-to-back quarter profits in FY...

Laxmi Dental`s profit drops nearly 44 pc in Q4, expe...

FIIs stood as net buyers in equities as per May 27 d...

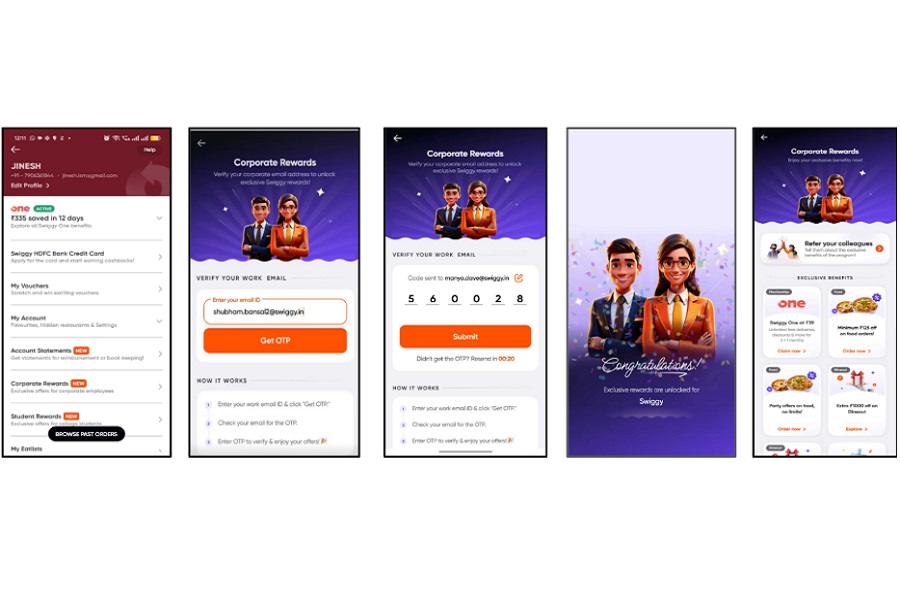

Swiggy Rolls out Corporate Rewards Program in 7000 C...

Venus Pipes & Tubes Limited reports robust performan...

Evening Roundup : A Daily Report on Bullion Energy &...