Gas Utilities : Another steep APM allocation cut for CGDs by Kotak Institutional Equities

The saga of APM allocation flip-flop continues. According to MGL and IGL, their APM gas allocations have been cut by 18-20% effective April 16, 2025. This cut effectively reverses the partial reversal in Jan 2025 for allocation cuts in 3QFY25. Even as lower volumes are replaced by NWGs, CGDs will need to take a CNG price hike of Rs1.5-2.0/kg. Price increases have been difficult politically and due to the likely impact on demand. Similar to previous cuts, CGDs will likely seek some relief apart from raising prices. We maintain our negative views; reiterate SELL on IGL (FV of Rs150) and MGL (FV of Rs1,030).

APM allocation flip-flops continue: New cuts reverse January relief

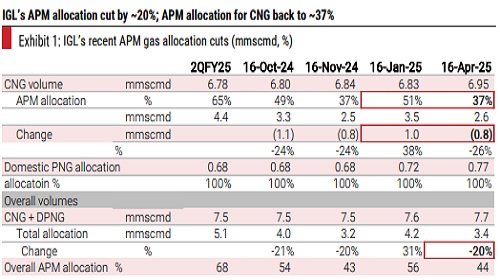

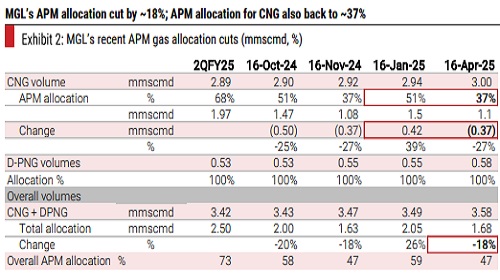

According to MGL and IGL, their APM gas allocations for priority CNG/domestic PNG have been reduced by 18%/20%. With this cut, the APM allocation for the CNG segment is reduced back to 37%. This is a similar allocation after two cuts in 3QFY25. As cuts were sudden and sharp, and price increases were difficult, there was partial relief in January and allocation for CNG was increased to ~51%. The latest cut nearly reverses the entire relief.

CNG price hike of Rs1.5-2.0/kg needed; hikes have been difficult

With CGDs now having first priority on NWG, the reduced APM gas (priced at US$6.75/mmbtu) will be replaced by NWG (12% of oil price). On our estimate, to pass on the entire cost, CGDs will need CNG price hikes of Rs1.5-2.0/kg. With reduced arbitrage versus petrol/diesel, the likely impact on demand and political sensitivity, price increases have been difficult. CGDs’ earnings have sharply declined. With further allocation cuts, the outlook is weaker.

We expect CGDs to seek relief; respite may not be much or for long

We note that this allocation cut has been necessitated by the classification of ~3 mmscmd of ONGC’s APM gas to NWG. The entire reduction in allocation has been made from the CGD sector and other consuming sectors such as fertilizer, power and LPG fractionation have been spared for now. We will not be surprised, if similar to January, some relief is given by reducing allocation for other consuming sectors. In our view, such respite will not be high. With APM volumes declining, there will be further allocation cuts in the coming quarter, and thus, respite may not be long.

Maintain our bearish view on CGDs; reiterate SELLs on IGL and MGL

We have been bearish on CGDs on volume and margin outlook, driven by a combination of the declining price advantage of CNG (versus petrol/diesel) and rising EV share. Respite seems unlikely on both. With further APM allocation cuts (and potential price cuts for petrol/diesel), CNG’s arbitrage will be further reduced. The Delhi government’s new EV policy 2.0 targets aggressive EV rollout and weakens the CNG growth outlook. In our view, with the Delhi government taking measures against CNG, even other big metros such as Mumbai may come up with similar policies. Maintain SELL on IGL with an FV of Rs150 (unchanged) and MGL with an FV of Rs1,030 (unchanged).

Above views are of the author and not of the website kindly read disclaimer

.jpg)