Indian gold consumer demand soared to its highest level in 8 years: Zerodha Fund House

On the occasion of Akshaya Tritiya, Zerodha Fund House notes that in India, gold is far more than just a precious metal with its significance deeply ingrained in the country’s history and culture. The last three decades have seen India's relationship with gold develop in notable ways. From a demand of 340 tonnes in 1992, the nation's appetite for Gold surged to more than 800 tonnes by the end of 2024.

India Stands as the Largest Consumer for Gold Jewellery In 2024

In 2024, India stands as the largest consumer of gold jewellery globally, with consumption reaching more than 563 tonnes with the annual demand valued at ?3.6 lakh crores. Gold jewellery remains an integral part of India's cultural fabric, used in celebrations from grand weddings to auspicious festivals, symbolizing tradition and prosperity.

India's Appetite for Gold Coins and Bars is Among the Strongest Globally

Beyond its aesthetic appeal, gold holds a prominent position in India's investment landscape. Both urban and rural consumers alike recognize its enduring value as a reliable store of wealth. This conviction is evident in India's strong appetite for gold coins and bars, with investment reaching about 239 tonnes in 2024, second only to China. In INR terms, this translates to a demand of ?1.5 lakh crore, a significant 60% increase over the previous record set in 2023, demonstrating a broadening investment interest.

Indian Gold ETF Holdings Up by Over 200% in 5 Years

There's a growing inclination towards regulated investment avenues such as Gold ETFs and related funds. Gold ETF holdings refers to the total amount of gold that is held by the various Gold ETFs listed and traded on Indian stock exchanges. The substantial growth in ETF holdings from about 21 tonnes to more than 63 tonnes suggests that Gold ETFs might be becoming an increasingly important avenue for Indians to gain exposure to gold as an asset class, alongside traditional methods like buying jewelry or physical gold. It may also suggest a greater demand for gold as an investment vehicle in its dematerialized form in the Indian market.

Indian Gold ETF Folios Up by More Than 13x in 5 Years

The number of Gold ETF folios has witnessed more than a 13-fold increase from March 2020 to March 2025, offering investors a convenient and efficient way to participate in the gold market without the hassle of physical storage.

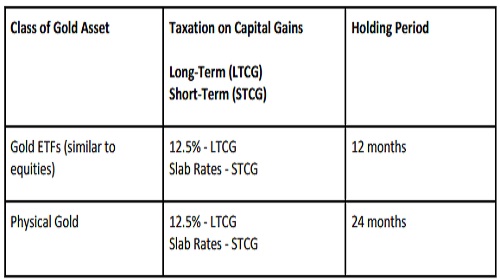

When it comes to taxation, Gold ETFs are taxed similar to equities. LTCG is taxed at flat 12.5% after 12 months of holding. On the other hand, STCG is taxed as per slab rates. In case of Physical Gold - the LTCG is taxed at 12.5% if held for more than 24 months and STCG is taxed as per Slab Rate.

Vishal Jain, CEO of Zerodha Fund House said, “The growth of Gold ETFs in India signifies a growing investment landscape where investors are increasingly embracing the ease and accessibility of gold through the mutual fund route.”

Sources:

ndia’s Gold Consumer Demand (“Consumer” Sheet - From year 2016 to 2024)

Above views are of the author and not of the website kindly read disclaimer