Strait of Hormuz: India Navigating the Uncertainty by CareEdge Ratings

Synopsis

In this report, CareEdge Ratings delves into the likely impact of escalating Israel-Iran conflict on India amid rising fears of the Strait of Hormuz being closed, especially after the US bombed nuclear facilities in Iran on June 22, 2025.

• The ongoing Iran-Israel conflict could disrupt global oil supplies and increase crude prices, increasing India’s import costs. Although India does not import oil directly from Iran, over 40% of India’s crude oil and a significant portion of its liquefied natural gas (LNG) imports from West Asia pass through the Strait of Hormuz. Any disruption in this region by Iran could impact supplies from Iraq, Saudi Arabia, and the UAE, key oil exporters to India.

• Together, the Strait of Hormuz and the Red Sea account for around one-third of the country's total exports. Any further escalation in the Israel-Iran conflict could potentially lead shipping companies to bypass the Red Sea and the Persian Gulf, opting for the longer route via the Cape of Good Hope instead. This would increase transit time, shipping cost and insurance premiums, thereby impacting the profitability of Indian export and import companies.

• In the short term, crude oil prices, LNG, and petrochemical products may experience a surge. Key manufacturing sectors that depend on petroleum-based inputs like aviation, chemicals, paints, tyres, logistics, etc., will likely face some pressure on profit margins due to a rise in raw material costs. However, with adequate global oil supply, container availability, and India’s diversified crude oil import options, the overall impact on the Indian economy is expected to be limited.

The Strait of Hormuz

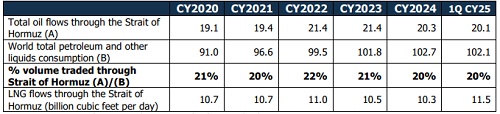

The Strait of Hormuz, extending 90 nautical miles (167 km) between Oman and Iran, is a vital maritime corridor connecting the Persian Gulf with the Gulf of Oman and the Arabian Sea. At its narrowest point, it is only about 21 miles (33 kilometres) wide and 55 miles (88 kilometres) at its widest point. However, the actual navigable channel for ships is just a few kilometres wide in each direction, making it a tightly controlled and high-risk zone. It is the main shipping route for energy exports from major producers like Saudi Arabia, Iraq, Iran, Kuwait, Qatar, and the UAE. About 20% of the global oil consumption and one-third of the world’s liquified natural gas (LNG) flows through the Strait of Hormuz. Exhibit 1 below illustrates the volume of crude oil, condensate and petroleum products transported through the Strait of Hormuz compared to global volumes.

Exhibit 1: Volume of crude oil, condensate and petroleum products transported to the World through the Strait of Hormuz

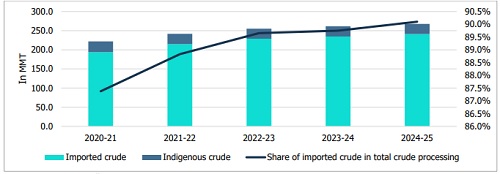

Any disruption around the Strait of Hormuz may affect oil shipments from Iraq, Saudi Arabia, and the UAE, key suppliers for India. Although India does not import oil directly from Iran, over 40% of its crude oil and a significant portion of its liquefied natural gas (LNG) imports from West Asia pass through the Strait of Hormuz, which Iran has now threatened to close. Any disruption could spike global oil prices and pressure India’s inflation rate and fiscal balance. Exhibit 2 below shows India’s share of imported crude oil in total crude processing is ~85-90%. As per the Centre for Monitoring Indian Economy Pvt Ltd (CMIE), out of the overall crude oil imports by India, around 40- 45% of crude oil is imported from the UAE, Saudi Arabia, Kuwait, and Iraq.

Exhibit 2: India’s share of imports out of total crude oil processed

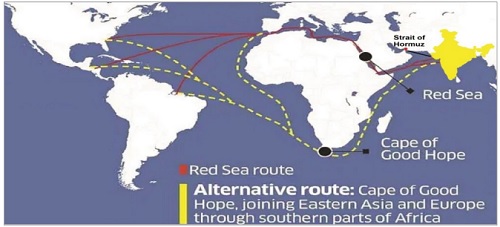

Most of India's merchandise trade with Europe passes through the Red Sea, and substantial trade with the US also takes this route. Together, the Strait of Hormuz and the Red Sea account for around one-third of the country's total exports. Any further escalation in the Israel-Iran conflict could potentially lead shipping companies to bypass the Red Sea and the Persian Gulf, opting for the longer route via the Cape of Good Hope instead. This would increase transit time and shipping costs. Exhibit 3 below illustrates the various routes opted by shipping companies for exports and imports to West Asia, the US and Europe

Exhibit 3: Maritime trade routes for India

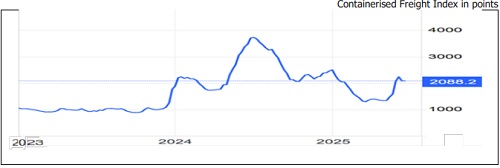

The Red Sea crisis triggered by the Israel-Hamas war and escalated by the Houthi movement in Yemen, which commenced from October 2023, led to rerouting of vessels through longer voyages around the Cape of Good Hope, leading to higher fuel consumption, increased insurance costs and overall transit times. Consequently, shipping companies were forced to pass these higher operational costs onto customers through increased freight rates until a ceasefire was announced in January 2025, after which freight rates were normalised. The same is also evident from the chart in Exhibit 4.

Exhibit 4: Impact of Red Sea crisis on shipping freight rates

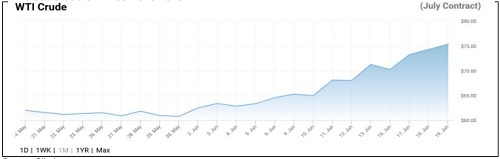

The ongoing Israel-Iran conflict has heightened concerns in global oil markets. While there haven't been any supply cuts, the threat of blocking the Strait of Hormuz and increasing shipping costs has pushed up crude oil prices. Exhibit 5 below indicates that crude oil prices have increased by ~10% since the conflict between Israel and Iran started on June 13, 2025, but with oil supplies so far undisturbed, both US crude oil and the global benchmark Brent remain below $80 per barrel.

Exhibit 5: Crude Oil Price Movement

Likely impact of the West Asia conflict on Indian companies:

• The heightened tensions in the Gulf region may lead merchant shipping fleets to raise shipping charges and insurance premiums even if the Strait of Hormuz remains operational. This could adversely affect the profitability of Indian exporters and importers. The India Inc may find it difficult to fully pass on the entire increase in freight costs to the end users, as observed during the Red Sea crisis, which affected the margins of Indian import-export companies, particularly small and mid-sized.

• In the event of a closure of the Strait of Hormuz and the Red Sea, there would be impact on supply of crude oil, petroleum products and LNG supply from West Asia, which could adversely impact key manufacturing sectors that rely on petroleum-based inputs, as the rise in raw material costs would put pressure on their profit margins. Additionally, the container traffic would be forced to reroute around the southern tip of Africa, via the Cape of Good Hope. It would extend the lead time by ~14-15 days for exports from India to the US and Europe. Consequently, the Indian industry would incur higher logistics costs from prolonged transit times and higher insurance premiums. Consequently, profitability and the operating cycle of Indian import-export companies would be impacted. The impact on cargo routes may primarily affect food grains and other perishable items, along with freight-sensitive or low-value cargo, as their perishable nature and/or lean profit margins shall constrain their capacity to absorb increased costs and impact profitability.

CareEdge Ratings’ View

Puneet Kansal, Director, CareEdge Ratings, said, “As conflict between Israel and Iran is rising, the near-term container freight rates and insurance premiums are expected to increase until the conflict in West Asia is resolved. Additionally, there may be a surge in crude oil prices along with critical energy imports for India, including LNG, natural gas, and petrochemicals, among others. Key manufacturing sectors reliant on petroleum-based inputs like aviation, chemicals, paints, tyres, logistics, etc., will likely see some pressure on profit margins due to a rise in raw material costs.”

“A combination of sustained geopolitical tensions in the Middle East, ongoing shortages of rare earth magnets and unresolved uncertainties surrounding the US-India trade agreement are expected to continue exerting pressure on supply chains and trade flows. A prolonged escalation in geopolitical tensions in West Asia and the consequent increase in shipping costs, insurance premiums, and short-term price fluctuations in Brent crude would potentially impact the profitability of India Inc. However, with adequate global oil supply, container availability and India’s diversified crude oil import strategy with alternative suppliers including Russia, the United States, Nigeria and Brazil, the overall impact on the Indian economy is expected to be limited. Further, Iran itself relies heavily on the Strait of Hormuz for its oil shipments, and any self-imposed blockade would be against its own interest,” concluded Priti Agarwal, Senior Director, CareEdge Ratings.

Above views are of the author and not of the website kindly read disclaimer