Commodity Flash Insights - Gold by Axis Securities

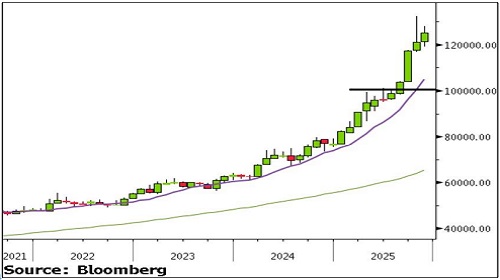

MCX Gold Monthly Chart

* Gold continues to display a strong structural uptrend on the monthly timeframe. The breakout above the multi-month resistance zone near Rs 1,01,500–Rs 1,06,000 has been decisive, supported by expanding bullish candles and healthy volume follow-through.

* The price is trading well above both the 9 and 60-month SMA, confirming long-term trend strength and sustained institutional buying. Post-breakout, gold has shown strong momentum, recently hitting a fresh lifetime high near Rs 1,32,000.

* The candlestick formation indicates aggressive dip-buying, with no clear signs of trend exhaustion. However, the steep vertical rise may warrant a short-term consolidation or a healthy pullback.

Outlook

Key Levels to Watch:

* Immediate Support: Rs 1,02,000 (prior breakout zone)

* Secondary Support: Rs 95,000 (trend support near rising 9-EMA zone)

* Upside structure: As long as price holds above Rs 1,02,000, the trend remains firmly bullish with potential for further highs in 2026.

Strategy:

* Traders may consider accumulating Gold on dips in the range of Rs 1,17,000 - 1,08,000, with a potential upside target of Rs 1,40,000/1,45,000 by the end of 2026.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633