F & O Rollover Report 26th November 2025 by Axis Securities

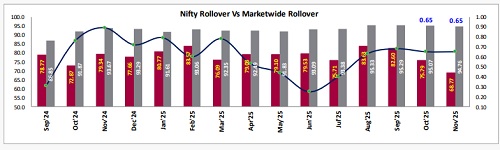

Nifty Rollover Analysis: The Nifty November series rollover retreated to 68.8% on Tuesday, trailing the previous expiry’s 75.8% and falling significantly short of the three-month and six-month averages of 80.7% and 79.4%, respectively, signaling a cautious approach by traders as fewer positions are being carried forward.

Bank Nifty Rollover Analysis: Bank Nifty recorded a rollover of 70.4%, which, while lower than the preceding expiry’s 79.6% and the three-month mean, remains notably above the six-month average of 65.3%, suggesting that underlying sentiment in the banking index is relatively more resilient compared to the broader benchmark.

Market-Wide Rollover Trends: Market wide rollover activity remained robust at 94.76%, marginally below the prior expiry and three-month average but surpassing the six-month mean of 94.0%, indicating that aggregate market participation remains stable despite localized volatility in key indices.

Open Interest and Price Action: Nifty Futures initiated the December series with an Open Interest (OI) base of approximately 1.45 crore shares, marking a reduction of over 6.18 lakh shares alongside a marginal price contraction of 0.2%, indicative of long unwinding; conversely, Bank Nifty Futures saw a decline in OI base by 4.82 lakh shares accompanied by a 1.0% price appreciation, pointing towards potential short covering.

Rollover Cost: The cost of carry for Nifty into the December series remained steady at 0.65%, whereas Bank Nifty saw a slight compression to 0.56% from 0.58%, reflecting a lack of aggressive bullish positioning at the onset of the new series.

Stocks with Increased Interest: Energy and PSU constituents such as BPCL, HINDPETRO, COALINDIA, NUVAMA and ONGC demonstrated improved rollover figures compared to the previous expiry, while the highest absolute rollover momentum for the day was concentrated in heavyweights like HDFCBANK and JSWSTEEL, alongside defensive plays like MARICO and NESTLEIND.

Stocks with Decreased Interest: Counters such as LTF, BIOCON, PIIND, SBICARD and ASIANPAINT witnessed a deceleration in rollover activity compared to the previous expiry, with the lowest absolute rollover traction observed in financial service names including ANGELONE and BSE.

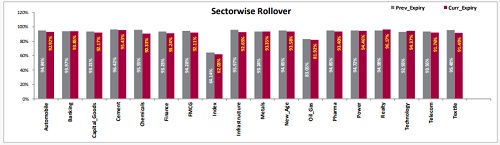

Sectoral Rollover: On a sectoral basis, growing conviction in Technology, Realty and Metals which witnessed higher rollover activity, whereas defensive and cyclical pockets like Chemicals, Textiles, Infrastructure, Finance and FMCG saw subdued interest compared to the same period in the previous expiry.

NIFTY HIGHLIGHTS

Nifty November rollovers retreated to 68.8% on Tuesday, sharply trailing the previous expiry’s 75.8%. The figure significantly undershoots the three-month average of 80.7% and the six-month mean of 79.4%. The data points to a cautious start for the December series as traders lighten overall exposure. Bank Nifty rollovers stood at 70.4%, down from the prior month's 79.6%. Despite the month-on-month decline, it remained well above the six-month average of 65.3%. Open positioning appears more resilient here than in the broader benchmark. Rollover costs signal muted aggression. The Nifty rollover spread held flat at 0.65%. Bank Nifty costs eased slightly to 0.56% from 0.58%, reflecting a lack of fresh bullish conviction at current levels. The Market wide rollovers held at 94.76%, marginally below the threemonth trend but outpacing the six-month average of 94.0%. Broad-based sentiment holds steady even as headline indices see reduced carry-forward activity. The option data for the December indicates a strong Call Open Interest (OI) at the 27,000-strike price, followed by 26,500. In contrast, a substantial concentration of Put OI is observed at 25,000, with additional levels at 25,500. This suggests the likely range for the current expiry is between 25,500 and 26,500, with 26,000 acting as a pivotal level.

Nifty Rollover Vs Market-wide Rollover

Fii’s , Stock & Sector Highlights

* BPCL, HINDPETRO, COALINDIA, NUVAMA, and ONGC witnessed strong momentum, recording higher rollover figures on Tuesday compared to previous expiry.

* LTF, BIOCON, PIIND, SBICARD, and ASIANPAINT, which saw a decline in positions carried forward compared to the previous series.

* Fii’s Futures Index Long ratio for the current expiry is 15%, down from 20% in the previous expiry, indicating a cautious outlook.

* FIIS have initiated their positions in the current series with 20,420 contracts on the Future Index Long, a decrease from 9,072 contracts in the previous expiry. In contrast, the Future Index Short begins with 1,15,109 contracts, a decrease from 1,21,658 contracts at the last expiry.

Sector wise Rollover

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633