Evening Track : Crude oil jump on tariff fears; Gold steadies as dollar strengthens by Kotak Securities Ltd

Comex gold futures held steady near $2,830 per ounce, as a stronger dollar countered safe-haven demand amidst escalating trade tensions. The dollar index rose to a two-year high following the U.S. imposition of tariffs on Canada, Mexico, and China. These tariffs, particularly on Canadian energy imports, have triggered retaliatory measures from affected nations. Concerns about the inflationary consequences of these trade disputes could lead to sustained higher borrowing costs, posing a challenge for non-yielding gold. Moreover, the appreciating dollar makes gold more expensive for international buyers. Further tariff threats loom against the European Union, which has vowed a strong response.

WTI crude oil futures rose above $74.30 per barrel on Monday following tariff impositions on Canada, Mexico, and China raised concerns about potential crude supply disruptions from two major US suppliers. The oil price increase occurred despite a strengthening dollar, which typically makes commodities more expensive, and declining equity markets. However, anticipated lower fuel demand limited price gains. While Canadian energy products face a 10% duty, Mexican imports will be charged 25%. The 10% levy on Canadian energy, including approximately 4 million barrels of daily crude flow, has already led to price increases by refiners like Irving Oil Ltd. Although Canada is the primary focus due to its large export volume, the US also imports around 500,000 barrels daily from Mexico.

LME base metals prices declined following US tariff announcements on imports from China, Canada, and Mexico, raising concerns about a potential trade war and its impact on global economic growth. LME copper, a key industrial metal, fell by as much as 1.5% before partially recovering to trade near $8,972 per ton. While LME Aluminium, Zinc and Lead are down close to 0.50%. The tariffs, including a 10% levy on Chinese imports and 25% on Canadian and Mexican goods, take effect Tuesday. A stronger US dollar further pressured metal prices. China, the largest metals consumer, expressed its intent to take countermeasures and file a WTO complaint. Despite ongoing economic recovery challenges, China is expected to implement further stimulus measures to boost growth.

European natural gas prices surged, mirroring the rise in oil prices, as trade tensions escalated. Benchmark futures hit a 15-month peak, marking a continued upward trend. Oil prices climbed following the imposition of significant tariffs on imports, including crude oil from Canada and Mexico. This move coincided with heightened trade disputes, as the US administration threatened tariffs on the European Union, prompting a firm response from the bloc. The US has previously encouraged the EU to increase purchases of American oil and gas to potentially avoid such levies, while also signaling potential sanctions on Russia

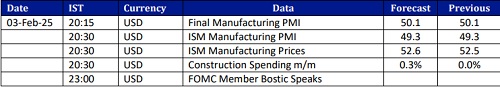

Today, Investors now focus on Final Manufacturing PMI, ISM Manufacturing PMI and Prices for further economic insights.

Above views are of the author and not of the website kindly read disclaimer