Derivative Rollover Note by Motilal Oswal Wealth Management

April to continue the comeback of the bulls with action

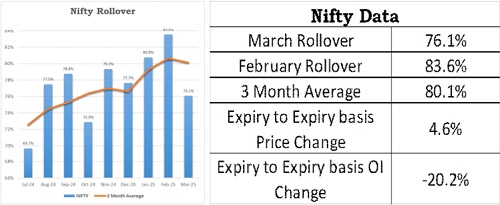

Nifty

Nifty index witnessed a comeback of the bulls in the March series which was much required after the continuous selling of the last five series. After dropping to 21950 zones in the first week, it saw unilateral movement upwards and recovered by 1900 points to cross 23850 zones. Nifty formed a bullish engulfing candle and an outside bar on expiry to expiry basis which indicates strong dominance of the bulls at support levels. March series witnessed a reduction in open interest by 20.2% with a rise in price by 4.6% on an expiry-to-expiry basis which indicates shorts have been covered in the index. Rollover of Nifty stood at 76.1%, which is lower than the previous month's and its quarterly average of 80.1%.

On option front, Maximum Call OI is at 24500 then 24000 strike while Maximum Put OI is at 23500 then 23000 strike. Call writing is seen at 23600 then 24000 strike while Put writing is seen at 23600 then 23300 strike. Option data suggests a broader trading range in between 23000 to 24000 zones while an immediate range between 23400 to 23800 levels.

Nifty closed near 23600 zones and At The Money Straddle (Apr Monthly 23600 Call and 23600 Put) is trading at net premium of around 750 Points, giving a broader range of 22850 to 24350 levels. Considering overall Derivatives activity, we are expecting Nifty to continue with the buying interest emerged at lower levels as we head into the April series with a positional support of 23000 & 22800 zones and hurdles placed at 24000 and 24500 zones.

We have witnessed continues buying interest in the Financial sector while fresh buying interest is witnessed in sectors like Private Banking, PSU Banking, Metals, Infra, Pharma and Healthcare while short covering is seen in the sectors like Energy, FMCG, Consumption, Auto, IT, Realty and Defense.

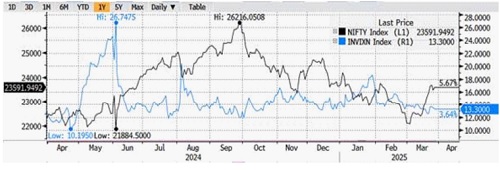

India VIX decreased by 0.08% from 13.31 to 13.30 levels in the March series. Volatility cooled off and provided comfort to the bulls which paved way for buying and gradual shift of the base higher.

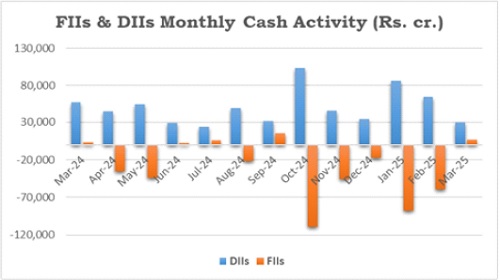

FIIs broke their selling streak of the last five months and bought worth Rs 6,367 crores in the March month so far. DIIs continued their buying stance of the last twenty two months and bought to the tune of Rs 29,939 crores in March so far. The FIIs 'Long Short Ratio' in index futures improved in the entire series and ranged in between 15.2% to 39.9% to close near its higher band.

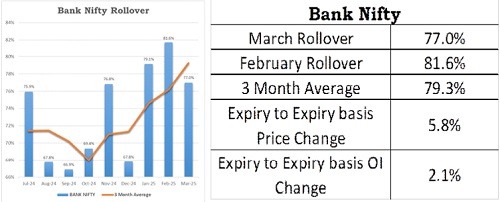

Bank Nifty

Bank Nifty started the March series with some underperformance but was taken over by the bulls in the private heavyweights from the second week followed by PSU towards the end of the series. It dropped to 47700 zones but saw a massive recovery of more than 4350 points and recouped all the losses of the previous two series. Long built up was seen as open interest increased by 2.1% and price was up by 5.8% on an expiry-to-expiry basis. Rollover in Bank Nifty stood at 77%, which is lower than its quarterly average of 79.3%. Bank Nifty has to hold 51000 zones for a bounce towards 52250 then 53000 zones while support can be seen at 50750 & 50500 levels.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)