Daily Updates Report 16th September 2025 from Ventura Securities

Market Commentary

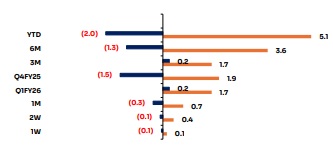

Overnight global action was positive : On 15 th Sept , U.S. markets were positive with S&P 500 up by +31.02 pts (+0.47%), Dow Jones was up by +49.97 pts (+0.11%) and Nasdaq was up by +201.59 pts (+0.84%). India VIX was down by ~2.72%. GIFT Nifty is trading flat at ~25,167 (-13.50 pts, +0.05%) indicating Indian markets will open positive.

On 15 th Sept, advance decline ratio on NSE was 1711 : 1356 and BSE was 2209 : 2008, which showed strength in the overall markets.

Index Options Data Analysis:

Sensex max call OI and max put OI both are at 82,000 with PCR of 0.91

Nifty max call OI is at 25,100 and max put OI is at 25,000 with PCR of 1.03

Bank Nifty max call OI is at 55,000 and max put OI is at 54,000 with PCR of 1.00

Securities in Ban for F&O Trade for 16-SEP-2025:

RBLBANK, OFSS, HFCL, ANGELONE

Sectors in Focus:

REALTY: Nifty Realty index was up by +2.41% with ANANTRAJ (+9.98%), PRESTIGE (+3.44%) and BRIGADE (+2.58%) contributing positively to the index.

PSU Bank: Nifty PSU Bank index was up by +0.60%, UCO Bank (+1.62%), MAHA Bank (+1.48%) and CANBank (+1.39%) were supporting the index.

Energy: Nifty Energy index was up by +0.54% with AEGISLOG(+6.66%), CESC (+4.09%) and NHPC (+3.53%) among the top gainers.

Pharma: Nifty Pharma index was down by -0.64% with CIPLA (- 1.75%), BIOCON (-1.68%) and GLENMARK (-1.66%) among the laggards.

IT: Nifty IT index was down by -0.58%, top losers were INFY (- 1.12%), PRESISTENT (-0.81%) and TCS (-0.67%).

AUTO: M&M (-1.66%), EICHERMOTO (-1.11%) and BOSHLTD (- 0.78%) dragged the Nifty Auto index by -0.39%

Stocks in the News

1. Larsen & Toubro Limited (CMP: 3585.35, MCap: 493,184, Sector: Infrastructure, Valuation: 18.42x FY26 EV/EBITDA) Larsen & Toubro won a large order in the Bullet Train Project, as announced on September 15, 2025. This significant contract underscores their role in high-speed rail infrastructure development in India, further strengthening their position in the infrastructure sector.

2. Maruti Suzuki India Limited (CMP: 15263.15, MCap: 479,877, Sector: Automobile, Valuation: 30.03x FY26 P/E) Maruti Suzuki announced introductory prices for the VICTORIS model, starting at Rs. 10,49,900, in a press release dated September 15, 2025. This pricing strategy aims to attract customers and boost sales in the competitive auto market.

3. Ircon International Limited (CMP: 183.65, MCap: 17,272, Sector: Infrastructure, Valuation: 20.58x TTM EV/EBITDA) Ircon International reported a capacity addition, enhancing its operational capabilities as shared in the disclosure on September 15, 2025. This marks a significant step in their infrastructure development efforts.

4. Lemon Tree Hotels Limited (CMP: 176.45, MCap: 13,979, Sector: Hospitality, Valuation: 20.3x FY26 EV/EBITDA) Lemon Tree Hotels signed a License Agreement for a new hotel in Gaya, Bihar, named Lemon Tree Hotel, on September 15, 2025. This expansion strengthens their presence in the region and aligns with their growth strategy in the hospitality sector.

5. Sandur Manganese & Iron Ores Limited (CMP: 480.8, MCap: 7,790, Sector: Mining, Valuation: 10.63x TTM EV/EBITDA) Sandur Manganese received in-principle approval for a bonus issue, as disclosed on September 15, 2025. This move aims to reward shareholders and could impact stock valuation positively. SANDUMA

6. Redtape Limited (CMP: 137.65, MCap: 7,609, Sector: Footwear, Valuation: 42.7x TTM P/E) Redtape Limited is under scrutiny due to a reported income tax investigation. The Exchange sought clarification regarding news captioned "Redtape shares in focus amid reported ongoing income tax investigation," with the company's response attached for reference, indicating the matter is under active review.

Above views are of the author and not of the website kindly read disclaimer