Daily Outlook on Gold by Dr. Renisha Chainani, Head of Research at Augmont

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Below the Daily Outlook on Gold by Dr. Renisha Chainani, Head of Research at Augmont

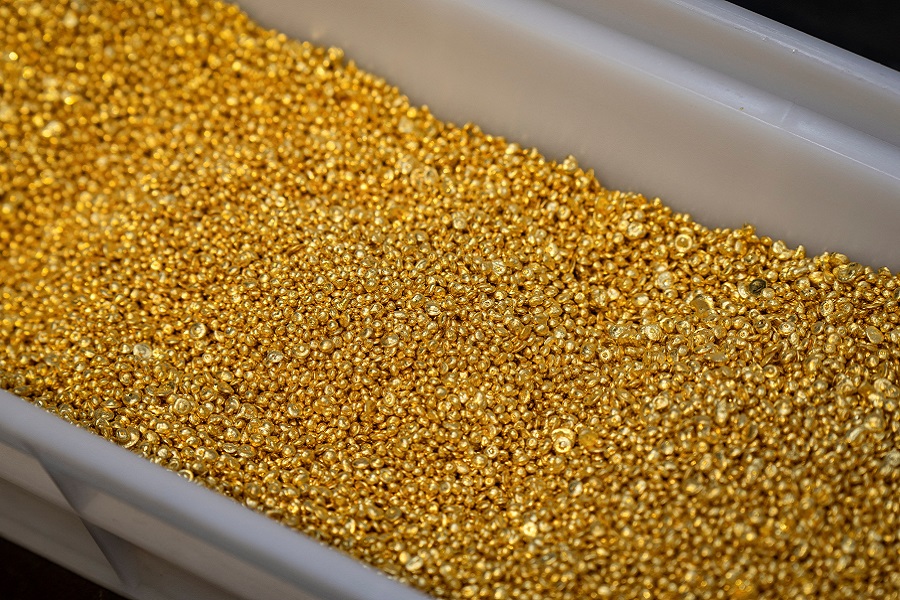

Strong investment and Industrial demand supporting precious metals

* In response to Fed minutes that suggested a possible delay in the rate-easing cycle, gold is trading strongly. Furthermore, investors are turning to precious metals for stability as a result of increased market volatility brought on by elevated geopolitical tensions.

* Moreover, the Indian government has made the biggest modification to its gold import projections in history, cutting them by an extraordinary $5 billion (56 tons) in November. According to DGCIS, India imported $9.84 billion (117 tonnes) of gold in November, which was far less than the $14.86 billion (173 tonnes) preliminary estimate that was released last month.

* Additionally, solid growth in 2024 has increased industrial demand for silver, which is expected to reach 700 million ounces for the first time. This increase is fueled by silver's crucial role in consumer electronics, 5G networks, electric vehicles, and solar technology, establishing silver as a material that is essential for promoting innovation and aiding in the shift to clean energy solutions.

Technical Triggers

* As suggested earlier, Goldhas achieved a target of towards $2680 (~Rs 78000). Hold on with next target of$2720 (~Rs 79000).

* Silver has formed a base of around $29 (~Rs 87000), and buying could be initiated on every dip for the target of $31(~Rs 92500) and $32 (~Rs 95000).

Above views are of the author and not of the website kindly read disclaimer

Top News

Foxconn to invest $600 million in India's Karnataka for iPhone components, chip-making machi...