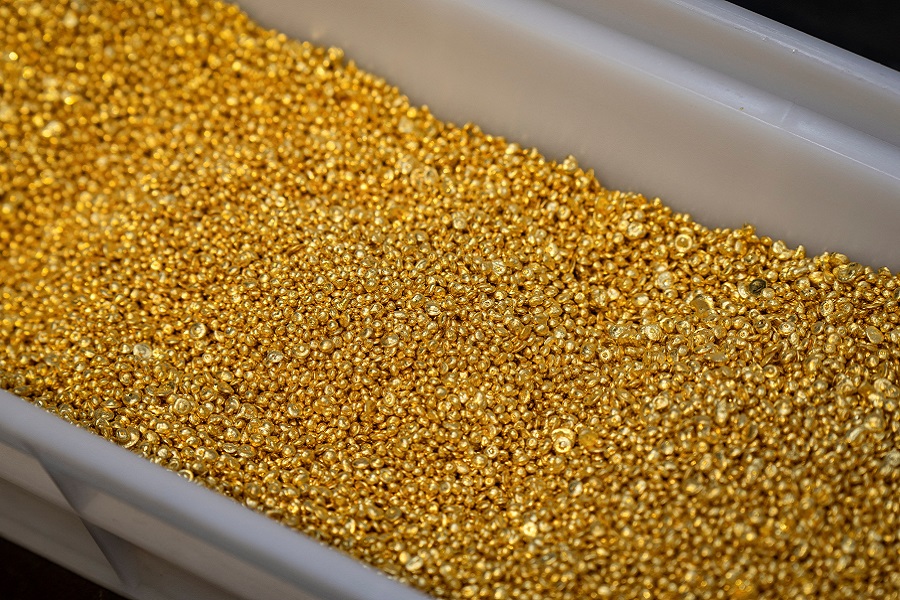

Gold retreats; focus on US data for cues on Fed`s policy path

Gold prices retreated on Thursday on profit-booking after hitting a near four-week peak in the last session, while focus shifted to jobs report due on Friday for clarity on the Federal Reserve's 2025 interest rate path.

Spot gold eased 0.1% to $2,659.62 per ounce, as of 0353 GMT. U.S. gold futures rose 0.2% to $2,678.30.

"Prices are trading in a narrow range and there is some profit-booking in place. A new trigger is needed for gold to breach its resistance," said Ajay Kedia, director at Kedia Commodities in Mumbai.

The bullion hit a near four-week high in the last session after a weaker-than-expected U.S. private employment report hinted that the Fed may be less cautious about easing rates this year. [GOL/]

The ADP National Employment Report on Wednesday showed U.S. private payrolls growth slowed sharply a month ago to 122,000 from 146,000 in November 2024. Economists polled by Reuters had forecast a gain of 140,000.

The market now awaits U.S. jobs report on Friday for more cues on the Fed's policy path.

Policymakers at the Fed's last meeting agreed that inflation was likely to continue slowing this year and saw a rising risk of price pressures remaining sticky due to the potential effect of Trump's policies, the minutes showed.

Trump will take office on Jan. 20 and his proposed tariffs and protectionist policies are expected to fuel inflation.

Bullion is considered an inflationary hedge, but high rates reduce the non-yielding asset's allure.

For 2025, "we forecast firm prices but as gold enters a new paradigm, reduced physical demand and higher supply may curb rallies," HSBC said.

Elsewhere, physically-backed gold exchange-traded funds (ETFs) registered their first inflow in four years, even though their holdings fell by 6.8 metric tons, the World Gold Council said.

Spot silver was flat at $30.12 per ounce, platinum dropped 0.3% to $952.95 and palladium shed 0.2% to $926.50.