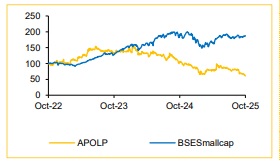

Daily Morning Briefing : Buy Apollo Pipes Ltd for the Target Rs. 420 by Choice Institutional Equities

See through H1FY26 Weakness, Seasonally Strong Period Ahead

We maintain our BUY rating on Apollo Pipes (APOLP) with a revised target price of INR 420/share (INR 475/sh earlier) as we lower our PEG multiple from 1.0x to 0.85x. We continue to be positive on APOLP due to:

1) Robust volume CAGR of 21% over FY25-28E driven by demand growth for the industry and market share gains from unorganized players in the Pipes business. Higher infra spends by state and central govts coupled with demand boost from construction completion of Real Estate projects launched between FY22 to FY25, would drive volume growth for pipes during FY26-28E.

2) EBITDA margin improvement of 358bps over FY25-28E driven by a) operating leverage benefit due to strong volume growth, b) margin improvement in the Kisan Mouldings asset due to initiatives by APOLP and c) improving contribution from higher margin products like CPVC.

Basis our assumptions of 21% volume CAGR, minor realisation increase, and EBITDA margin improvement of 358bps over FY25-28E, we forecast APOLP EPS to grow at a CAGR of 63.5%. Consol ROCE is expected to reach 18.3% in FY28E vs 6.7% in FY25

We incorporate a PEG ratio based valuation framework that allows us a rational basis to assign a valuation multiple that better captures earnings growth. We arrive at a 1-year forward TP of INR 420/share for APOLP. We assign a PEG ratio of 0.85x on FY25-28E core EPS CAGR, which we believe is a conservative.

We do a sanity check of our PEG ratio based TP using implied EV/EBITDA, P/BV, and P/E multiples. On our TP of INR 420, FY27E implied EVEBITDA/PB/PE multiples are 11.4x/2.0x/20.8x all of which are reasonable in our view. Higher volatility in PVC resin prices, slowdown in infra spends by government are risks to our BUY rating.

Q2FY26 Review: Nothing to cheer about apart from volume growth YoY

Volumes came in at 21.6KT (-14.3% QoQ, +7.6% YoY). YoY improvement in volumes is encouraging. However, realisations came in at INR 1,08,699 per ton (+0.1% QoQ, -12.5% YoY).

Revenue/EBITDA/PAT came in at INR 2,357Mn (-14.3% QoQ, -5.9% YoY) / INR 158Mn (-23.7% QoQ, -18.7% YoY) / INR 16Mn (-80.1% QoQ, -60.9% YoY).

EBITDA is lower than CIE estimates of INR 190Mn. Margins are down by 106/83bps YoY/QoQ to 6.7%. EBITDA per ton came in at INR 7,271/MT (-11.0% QoQ, -24.5% YoY).

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

.jpg)