Daily Derivatives Report By Axis Securities Ltd

The Day That Was:

Nifty Futures: 22,972.95 (0.3%), Bank Nifty Futures: 49,808.15 (0.8%).

Nifty futures gained 78 points, marking a third consecutive session of gains that were driven by strong performances in financials and key index constituents. Despite Wall Street's subdued signals leading up to the Federal Reserve's policy announcement, the market exhibited resilience, buoyed by positive domestic macroeconomic indicators. Investors keenly awaited the Fed's forward guidance on the U.S. economy and interest rate outlook, particularly in light of potential tariff effects. Bank Nifty futures outshone the others, rising by 386 points. Nifty futures premium rose to 65 points from 61, while that on the Bank Nifty fell slightly to 106 points from 108.

Global Movers:

US stocks continued their rebound yesterday after the Fed held rates, as was expected. The S&P 500 advanced 0.5%, while the Nasdaq 100 and the Dow rose 0.8% and 0.4%, respectively. In a bit of a surprise, though, the FOMC forecasted a slowdown in growth and a pickup in inflation, adding that the economic outlook had become more uncertain. It stated that it expects 50 basis points worth of cuts this year. Coming to other markets, the VIX fell 1.8 points; the dollar rose while the US 10-year trade yield fell; bitcoin rose over 4%; Gold rose to another fresh record of $3052 on economic slowdown risks, and oil rose slightly despite mixed cues.

Stock Futures:

A notable increase in trading volumes indicates greater market engagement among firms such as Phoenix Mills Ltd., Max Healthcare, PB Fintech Ltd., and HUDCO. This heightened activity points to growing investor interest and strong momentum for these stocks.

Phoenix Mills Ltd. experienced a sharp 3.2% decline, driven by a two-month high in trading volume. This price action was accompanied by a substantial 20% surge in open interest, representing 3.2 lakh shares—the largest single-day increase for the series—signalling a pronounced short build-up and driving open interest to a monthly high. Concurrently, put implied volatility spiked from 38.8% to 48.8%, while put open interest reached an all-time high. This confluence of factors—elevated short positioning, heightened put volatility, and record put open interest—suggests a prevailing bearish sentiment and anticipates a further decline, increasing the likelihood of a rapid shift in investor perception.

Max Healthcare Institute experienced a significant price increase of 6.6%, which was the highest single-day gain for the month. This surge was also accompanied by the highest single-day trading volume recorded in the series. Additionally, there was a 3.5% decline in open interest, suggesting that short covering was taking place. This reduction in open positions marked the largest single-day decrease for the series, indicating that short sellers are exiting their positions in anticipation of a potential further increase in prices, at least in the short term.

PB Fintech Ltd. extended its bullish trend for a third consecutive session, surging 6.9% and continuing its recovery from August 2024 lows. Despite this rally, futures open interest declined from a two-series high, with 6.92 lakh shares unwound—the largest single-day decrease in the current series. This retracement followed a previous session's rally, catalyzed by a domestic brokerage upgrade citing strong growth and improved valuations. The stock's 17% price increase from series lows, coupled with prior record-high open interest, indicated significant trader conviction. However, the observed short covering in yesterday’s session raises concerns about a potential reversal of the prevailing bullish momentum, suggesting a possible shift in trader sentiment.

HUDCO experienced a significant 6.3% price surge, closing at a series high and marking the largest single-day percentage gain since early August 2024. This rally was triggered by the announcement of an ?11,000 crore loan agreement with Andhra Pradesh Capital Region Development Authority (APCRDA)for the new capital city Amaravati in Andhra Pradesh. However, the price spike was met with muted derivative activity. A mere 1.4% increase in open interest, amounting to 2.7 lakh shares, suggests a modest long addition. This indicates a minor adjustment in existing long positions rather than a substantial influx of new bullish sentiment. Consequently, while the news spurred a notable price appreciation, the overall market positioning remained largely unchanged, implying limited conviction behind the immediate price movement.

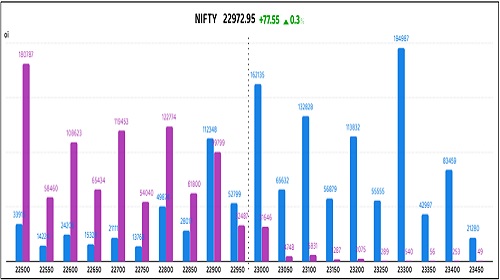

Put-Call Ratio Snapshot:

Nifty's put-call ratio (PCR) fell to 1.20 from 1.29 points, while the Bank Nifty's rose from 1.20 to 1.23 points.

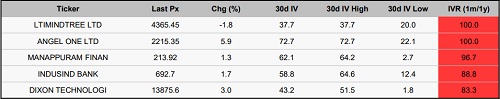

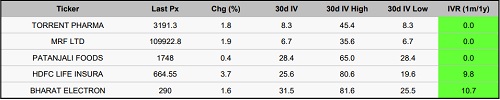

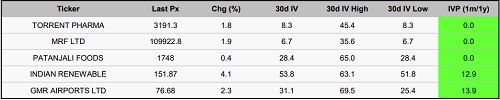

Implied Volatility:

Angel One Ltd. and Manappuram Finance have experienced significant fluctuations in their stock prices, as evident from their high implied volatility rankings of 100 and 97, respectively. Their current implied volatilities are 73% and 62%, respectively, meaning that the increase in implied volatility renders options for these stocks costlier, arguably encouraging traders to adopt hedging strategies to cushion against risks associated with price changes. In contrast, Torrent Pharmaceuticals and Patanjali Foods have shown the lowest implied volatility rankings, with implied volatilities (IVs) of 8% and 28%, respectively. This suggests that their options are more attractive, providing a beneficial chance for traders considering long positions.

Options volume and Open Interest highlights:

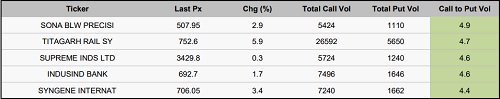

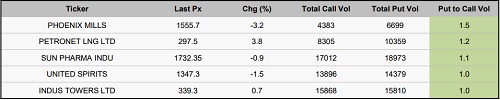

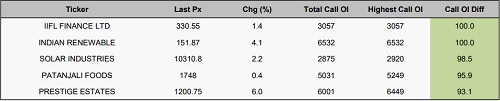

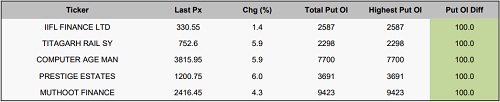

Titagarh Rail Systems and Supreme Industries are capturing significant interest from traders, as evidenced by their impressive call-to-put volume ratios of 5:1 each, reflecting an overall positive market sentiment. However, these ratios may also reveal differing perspectives among investors. In contrast, Phoenix Mills and Petronet LNG are witnessing an increase in put option volumes relative to call options, signalling increased caution concerning potential market downturns. In terms of positioning, IIFL and IREDA hold the highest open interest in call options. At the same time, CAMS and Muthoot Finance lead in put options, suggesting a greater likelihood of price fluctuations ahead. (This data considers only those stock options that saw a minimum of 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

In yesterday's session, index futures saw a net increase of 19,394 contracts. However, a significant reduction of 16,313 contracts by clients indicates a bearish sentiment among retail investors. Conversely, Foreign Institutional Investors (FIIs) exhibited a bullish bias, augmenting their positions by 12,721 contracts, indicating strategic accumulation. Proprietary traders, however, moderated their exposure, reducing positions by 3,081 contracts, suggesting a cautious stance. Shifting to stock futures, the total contract changes of 41,115 masks a similar contrast. Clients again demonstrated a significant retrenchment, shedding 16,908 contracts, which reinforces the prevailing bearish sentiment among clients. FIIs, while still adding positions, displayed a reduced bullish inclination with an increase of 6,054 contracts. Notably, proprietary traders executed a drastic liquidation, decreasing their holdings by 24,207 contracts, reflecting a strong aversion to risk in the stock futures segment.

Securities in Ban for Trade Date 20-March-2025:

1) HINDCOPPER

2) INDUSINDBK

3) SAIL

Nifty

Bank Nifty

Stocks with High IVR:

Stocks with Low IVR:

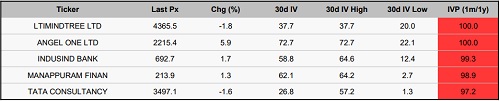

Stocks With High IVP:

Stocks With Low IVP:

Stocks With High Call Volume To Put Volume

Stocks With High Put Volume To Call Volume

Call Open Interest Relative to Record High

Put Open Interest Relative to Record High

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633