Daily Derivatives Report 29th July 2025 by Axis Securities Ltd

The Day That Was:

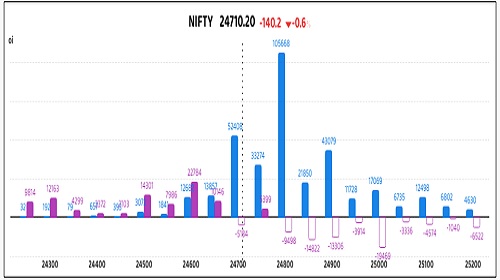

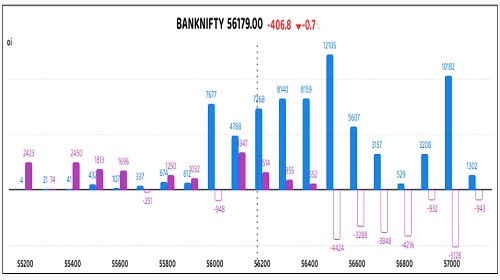

Nifty Futures: 24,710.2 (-0.6%), Bank Nifty Futures: 56,179.0 (-0.7%).

Nifty Futures declined by 140.2 points, indicating a short build-up with open interest increasing 1.4% to 2,04,29,400 shares (an increase of 2,75,475 shares). Similarly, Bank Nifty Futures dropped by 406.8 points, also reflecting a short build-up as open interest rose 2.3% to 25,12,370 shares (an increase of 55,755 shares). Indian equities overall saw a significant decline for the third consecutive session on Monday. This downturn was largely attributed to disappointing quarterly earnings from Kotak Mahindra Bank and Tata Consultancy Services' layoff plans, alongside lingering uncertainty regarding US-India trade talks. Sectorally, Financials, IT, Realty, Media, and Private Bank shares registered losses, while Pharma, FMCG, and Healthcare stocks posted gains. The market's expectation of near-term volatility, as gauged by the India VIX, surged 7% to 12.06, underscoring heightened trader nervousness. The rupee weakened, closing 15 paise lower at 86.67 against the U.S. dollar, as investors remained cautious ahead of upcoming monetary policy decisions from the U.S. Federal Reserve and the Bank of Japan. Nifty futures premium expanded from 13 to 29 points, and Bank Nifty premium increased from 57 to 94 points.

Global Movers:

US stocks extended their gains and closed at fresh records, as investors cheered the EU trade deal. The S&P 500 rose 0.02%, its sixth successive gain, while the Nasdaq 100 advanced 0.4%. So far, 82% of the companies that have declared earnings have beaten profit forecasts, and that's keeping optimism high. That said, the current week is data-heavy, with the FOMC rate decision and quarterly results from four of the Magnificent 7 stocks coming through. Coming to markets, the VIX remained above 15, the dollar index rose one percent in what was its biggest gain since mid-May while the US 10-year treasury yield fell a little. Elsewhere, gold continued its drop for the fifth day, while brent rose 2.3% to close just above $70 as President Trump pushed Russia to end its conflict with Ukraine or risk facing potential economic penalties.

Stock Futures:

Laurus Labs, Adani Green, Kotak Mahindra Bank, and Lodha are currently experiencing heightened market activity, marked by a sharp increase in trading volumes and price volatility. This surge signals a notable shift in investor sentiment as market participants actively reposition their holdings in anticipation of upcoming earnings announcements or in response to recently released reports.

Laurus Labs soared to a new 52-week high in intraday trade, buoyed by exceptionally strong Q1FY26 financial results that saw net profit skyrocket by a staggering 1219% and net sales climb 31.4%, propelled by robust growth in its Contract Development and Manufacturing Organisation (CDMO) division and increased formulation sales. This upward momentum was further evidenced by a Long Addition, with the stock registering a price gain of 6.1% and open interest expanding by 9.3% to 13,777 contracts, marking a new addition of 1,174 contracts. In the options arena, call option open interest stood at 12,350 contracts with an addition of 576 contracts, while put option open interest reached 13,459 contracts, witnessing a significant addition of 1,574 contracts, indicating a cautious yet optimistic outlook with option writers perceiving potential upside resistance.

Adani Green Energy Ltd. (AGEL) displayed a positive movement, driven by strong Q1FY26 financial results, which showcased a substantial 31% YoY increase in net profit to Rs 824 Cr and a parallel 31% rise in revenue from power supply to Rs 3,312 Cr. AGEL also experienced a Long Addition, with its price gaining 3% and open interest increasing by 3.8% to 35,405 contracts, representing a new addition of 1,307 contracts. Option positioning revealed total call option open interest at 17,786 contracts with a robust addition of 4,334 contracts, contrasting with total put option open interest at 8,772 contracts and an addition of 1,105 contracts, suggesting that option writers anticipate a price ceiling while option buyers are hedging against upside potential.

Lodha Developers Ltd. experienced a decline, despite reporting robust Q1FY26 financial results that included a 42% rise in consolidated net profit, 24.2% growth in total income, and a 10% YoY increase in pre-sales. This downturn manifested as a Short Addition, with the price decreasing by 5.9% and open interest increasing by 20.8% to 20,501 contracts, adding 3,526 new contracts. In option positioning, total call option open interest was 10,381 contracts with an addition of 3,347 contracts, while put option open interest was 5,360 contracts with an addition of 854 contracts, indicating that option writers foresee further downside while option buyers anticipate limited recovery.

Kotak Mahindra Bank suffered its highest single-day fall for the year, coupled with the largest single-day volume for the month, closing below its four-month lows. This sharp decline was primarily due to Q1FY26 financial results missing investor expectations; despite a 6% YoY growth in Net Interest Income (NII) and robust 14% YoY credit growth (particularly in corporate), standalone net profit, adjusted for a one-time general insurance stake sale gain, declined 7% YoY. Kotak Bank witnessed a Short Addition, with its price decreasing by 7.6% and open interest increasing by 3.9% to 84,089 contracts, including a new addition of 3,166 contracts. In option positioning, total call option open interest stood at 44,347 contracts, with a substantial addition of 20,587 contracts, compared to total put option open interest at 25,460 contracts and an addition of 4,279 contracts, suggesting that option writers are betting on continued bearish momentum while option buyers are hedging against further steep declines.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR) fell to 0.64 from 0.7 points, while the Bank Nifty PCR fell from 0.75 to 0.69 points.

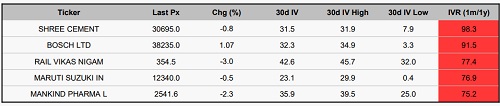

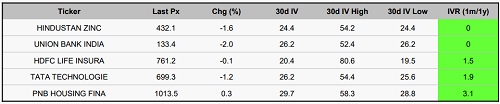

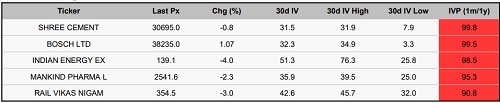

Implied Volatility:

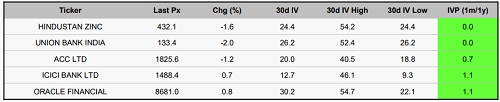

Shree Cement and Bosch Ltd have recently faced notable stock fluctuations, driven by their high implied volatility (IV) rankings of 98 and 92, which indicate significant market uncertainty. Presently, both companies have an IV of 32%. These heightened IVs suggest that options premiums are likely elevated, resulting in higher costs for traders and increasing the risks associated with options trading. Since volatility is a key factor in option pricing, traders may need to modify their strategies to account for these increased premiums and the potential for significant market swings. In contrast, Hind Zinc and Union Bank boast the lowest IV rankings, showing implied volatilities of 24% and 26%, respectively. This suggests a period of relative price stability and reduced uncertainty. For options traders, these lower IVs indicate more manageable premiums and diminished price volatility, creating a favorable environment for implementing cost-effective strategies, like basic call or put positions, while seasoned traders might consider writing options. As market dynamics evolve, stocks with lower IVs may become more attractive for steady and strategic trading.

Options volume and Open Interest highlights:

Syngene International and Sun Pharmaceutical are showing strong bullish momentum, with call-to-put ratios of 4:1, signaling optimism for short-term gains. However, these high ratios could imply that options are overpriced, so it's important to exercise caution before taking new long positions. On the other hand, Indusind Bank and Eternal Ltd are exhibiting bearish signals due to their high put-to-call ratios and rising volumes. While the increase in put activity could indicate an oversold condition, it may also present contrarian opportunities. In the options market, Lodha Developers is seeing significant activity in both calls and puts, suggesting expectations for notable price movements. Poonawalla Fincorp shows a preference for calls, while Apl Apollo Tubes is leaning towards puts, indicating possible volatility. The elevated call-to-put ratios call for a cautious stance on bullish positions, while the heavy put activity could offer contrarian opportunities. Overall positioning in both calls and puts indicates an anticipated period of volatility, favouring strategies designed to capitalize on large price fluctuations. (This data covers only stock options with at least 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

In the index futures segment, a notable 10,390 contract increase by clients directly offset decreases from Foreign Institutional Investors ((FIIs) and Proprietary traders, who reduced their positions by 6,208 and 2,179 contracts respectively. This collective client long build-up, fully absorbing the reductions from institutional and proprietary desks, strongly suggests a bullish retail bias and perhaps a contrarian view against the more cautious stance adopted by FIIs and proprietary traders on the broader market index. Conversely, the stock futures landscape presents a contrasting picture. Despite a total change of 46,956 contracts, clients demonstrably decreased their positions by 8,711 contracts. This reduction was more than compensated by significant additions from FIIs (33,392 contracts) and Proprietary traders (13,564 contracts), indicating a strong institutional and proprietary bullish conviction at the individual stock level.

Nifty

Bank Nifty

Stocks with High IVR:

Stocks with Low IVR:

Stocks With High IVP:

Stocks With Low IVP:

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

More News

Daily Technical Report 17th February 2026 by Axis Securities Ltd

.jpg)