Nifty Open Interest Put Call ratio fell to 0.98 levels from 1.14 levels - HDFC Sescurities Ltd

NIFTY : Minor Profit Booking Seen at Highs; Bullish Structure and Uptrend Intact

NIFTY AUTO INDEX: Momentum Oscillators Flash Bullish as Uptrend Holds—Buy on Dips

F&O Highlights

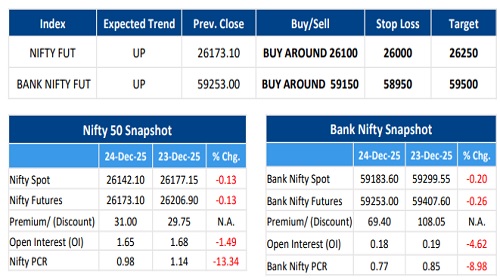

LONG UNWINDING WAS SEEN IN THE NIFTY & BANK NIFTY FUTURES

Create longs with the SL of 26000 levels.

* In a day before yesterday session after a flat start, buying lifted Nifty to an intraday high of 26,235 in the first hour. However, momentum shifted after 10:30 AM as correction set in, pulling the index down more than 100 points from its intraday highs. The Nifty finally ended the session with a loss of 35 point to close at 26,142. .

* Long Unwinding was seen in the Nifty Futures where Open Interest fell by 1.49% with Nifty falling by 0.13%.

* Long Unwinding was seen in the Bank Nifty Futures where Open Interest fell by 4.62% with Bank Nifty falling by 0.20%.

* Nifty Open Interest Put Call ratio fell to 0.98 levels from 1.14 levels.

* Amongst the Nifty options (30-Dec Expiry), Call writing is seen at 26300-26400 levels, indicating Nifty is likely to find strong resistance in the vicinity of 26300-26400 levels. On the lower side, an immediate support is placed in the vicinity of 26000-26100 levels where we have seen Put writing.

* Short covering was seen by FII's’ in the Index Futures segment where they net bought worth 1,032 cr with their Open Interest going down by 7847 contracts.

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ00017133

More News

Quote on Pre-Market Comment 08th January 2026 by Aakash Shah, Technical Research Analyst, Ch...