Crude Compass: Risk Premium Keeps Prices Elevated by Choice Institutional Equity

Developments over the past week:

* Brent prices climbed closer to USD 70/b as US – Iran tensions rose and a major naval buildup unfolded in the Gulf. However, the Iranian president said his country was open to admitting international inspectors to demonstrate that its nuclear programme was peaceful.

* According to market reports, Lukoil’s Volgograd refinery, a major facility with a 300kbd capacity, caught fire following overnight drone strikes on February 10-11. The refinery supplies Russia’s southern regions and export markets.

* In January 2026, OPEC+ members participating in the production-cut agreement collectively produced about 37.2 million bpd, roughly 643 kbd below the target they had set – reflecting slower implementation.

In our opinion:

* Oil markets continue to bake in about USD6-8/b of geopolitical risk premium in the current prices. If tensions de-escalate or diplomatic progress occurs, the risk premium could unwind, pulling prices down. However, an escalation may lead to further spikes in oil prices.

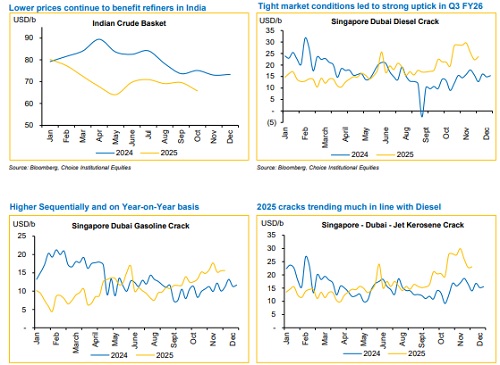

* Disruptions at Russian refinery facilities have tightened the supply of middle-distillate fuels, lifting Asian crack spreads higher and strengthening refining margins. This has bolstered profitability for India’s pure-play refiners amid ongoing supply-side stress.

* OPEC+ should hike the output during the meeting scheduled on March 1 in order to continue to its effort to regain the market share. However, the real impact on oil markets will depend on the extent of the production increase and not merely the announcemen

Overall, we continue to expect Brent to average at USD 61.5/b in 2026 in the backdrop of increased competition as a result of (a) relentless supply of oil from the US, (b) gradual unwinding of cuts by OPEC+ and (c) possible removal of sanctions.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131