Credit Growth Outpaces Deposit Growth for the Fortnight by CareEdge Ratings

Synopsis

* Credit growth has outpaced deposit growth in the current fortnight; however, overall credit offtake remains substantially lower compared to the same period last year. Meanwhile, deposit growth has slipped below the 10% mark, marking the first such decline in the past three months.

* As of September 05, 2025, credit offtake stood at Rs 188.0 lakh crore, reflecting a 10.3% year-on-year rise, majorly due to credit expansion to MSMEs. Additionally, large corporates have shifted some part of their borrowings to banks due to higher yields in the bond market. This growth was substantially lower than the 13.4% growth recorded in the previous year (excluding merger impact), attributed to high base effect, slower lending to corporates, and reduced lending to NBFCs.

* Deposits rose by 9.8% y-o-y, totalling Rs 236.7 lakh crore as of September 05, 2025, a decrease from 11.2% the previous year (excluding merger impact). The slower growth is attributed to a shift towards alternative instruments, while just-in-time government fund releases curtailed idle balances, dampening deposit growth.

* As of September 12 2025, the Short-Term Weighted Average Call Rate (WACR) dropped to 5.36% and is now 14 basis points (bps) below the repo rate of 5.50%. This decline follows three consecutive cuts to the repo rate and the Reserve Bank of India's (RBI) efforts to manage liquidity.

Bank Credit Growth Rate Increases for the Fortnight

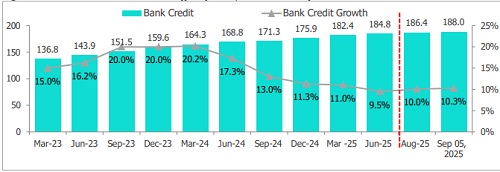

Figure 1: Bank Credit Growth Trend (y-o-y% %, Rs Lakh crore)

* Credit offtake rose 10.3% y-o-y in the fortnight ending September 05, 2025, marking a sequential uptick of 0.8% i.e. Rs 1.55 lakh crore over the previous fortnight, attributed to rapid credit expansion to MSMEs. Additionally, large corporates have shifted some part of their borrowings to banks due to higher yields in the bond market. This growth stayed well below the 13.4% (ex-merger) seen in the same period last year, weighed down by a high base effect, subdued private capex, weaker corporate lending, and reduced credit flow to NBFCs.

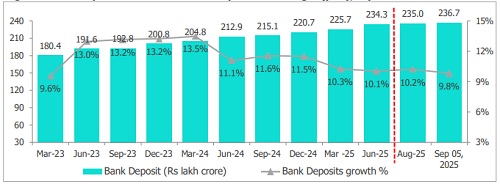

Figure 2: Bank Deposit Growth Rate Inched Up for the Fortnight (y-o-y, %)

* Deposits rose by 9.8% y-o-y and increased marginally by 0.7% over the past fortnight, reaching Rs 236.7 lakh crore as of 5 September 2025. However, they remain lower than the 11.2% growth (excluding merger impact) seen last year. Time deposits grew by 8.8% year-on-year to Rs 207.8 lakh crore, accounting for 88.7% of the total deposits, and slowing from 11.1% growth in the same period last year. Demand deposits, on the other hand, increased by 17.7% y-o-y to Rs 28.9 lakh crore, making up 12.3% of the total deposits.

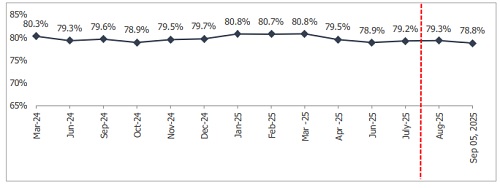

Figure 3: Credit-to-Deposit (CD) Ratio Decreases, Remains Below 80% – Incl. Merger Impact

* The Credit-Deposit (CD) ratio reduced to 78.8% in the current fortnight, remaining below the 80% mark since the last 5.5 months.

Bank Credit Share Stays Flat, Government Investments Decline

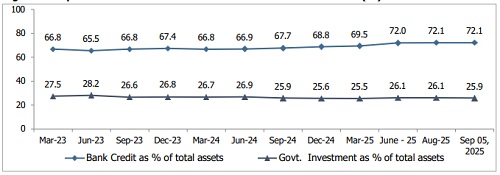

Figure 4: Proportion of Govt. Investment and Bank Credit to Total Assets (%)

* The Bank credit-to-total-assets ratio remained flat at 72.1%, whereas Government Investment-to-total-assets decreased by 20 bps at 25.9% for the current fortnight. Additionally, overall government investments totalled Rs 68.2 lakh crore as of September 05, 2025, reflecting a y-o-y growth of 6.8% and a sequential rise of 0.9%.

Above views are of the author and not of the website kindly read disclaimer

Tag News

India`s API Industry Expected to Grow at a CAGR of 5-7% till FY28 by CareEdge Ratings