Cotton Report 13th November 2025 by Amit Gupta, Kedia Advisory

Fundamentals

Performance

The cotton market entered November 2025 with a complex blend of supportive fundamental factors and a stabilizing technical structure. Despite weather disruptions, shifting global trade flows, and mild demand pressures, the broader picture suggests a market that is moving sideways with a slight upward bias, yet firmly contained within a multi-month trading range. The combination of lower domestic acreage, weather-affected yields, and tightening global stocks offsets the weight of high imports and muted textile demand, creating a balanced but cautious outlook for the months ahead

Swot Analysis

Strengths

* Cyclone Montha rains in Telangana–AP impacted cotton crop, creating localized production stress.

* India’s cotton acreage at 110.03 lh, showing 2.60% yearly decline.

* CCI initiated cotton procurement from October 1 across 14 centres at MSP.

* Excess rains in AP–Telangana created yield concerns, tightening crop outlook regionally.

* Government increased MSP for 2025–26 season by nearly 11.84% annually.

* Third estimates show production falling 5.6% to 30.69 million bales.

Strengths Weaknesses

* Spot 29mm cotton dropped over 3% amid US tariff concerns.

* India’s 2024–25 cotton imports surged to 39 lakh bales on cheaper global prices.

* Brazilian cotton imports rose nearly tenfold, intensifying pressure on domestic producers.

* Weak Chinese textile demand and synthetic competition continued weighing heavily on lint prices.

* China trimmed 2024–25 cotton import forecast by 300,000 tonnes, reducing demand expectations.

Opportunities

*- Unseasonal rains delayed harvesting, slowing arrivals and creating near-term availability uncertainty.

* CAI estimates 2024–25 output at 312.40 lakh bales versus 336.45 lakh earlier.

* Global 2025–26 cotton consumption raised by nearly 850,000 bales, improving demand outlook.

* Beginning 2025–26 global stocks lowered by almost 1 million bales versus previous month.

* Global ending stocks cut by 800,000 bales to 73.1 million, four-year low.

* Pakistan cotton production dropped 30%, with only 594,000 bales reaching ginning centres.

* USDA projects 2% decline in India’s 2025–26 production, tightening supply outlook

Threats

* Import duty exemption on raw cotton extended till December 31, 2025, encouraging imports.

* September 2025 closing stocks estimated at 60.59 lakh bales versus 30.19 lakh previously.

* Global 2025–26 cotton production expected over 1 million bales higher year-on-year.

* Imports likely rising further due to domestic production shortfall across major states.

* Higher MSP raises mill input costs, weakening India’s competitiveness in global markets.

CAI Crop Report

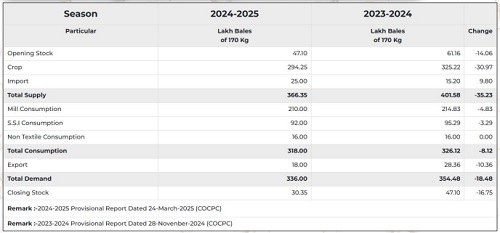

CONSUMPTION

As per the crop report submitted by upcountry associations and trade sources at the meeting of the CAI Crop Committee, the Committee has arrived at its cotton pressing estimate at 305.00 lakh bales of 170 kgs. each (equivalent to 320.06 lakh running bales of 162 kgs. each) as against the corresponding figure of 312.40 lakh bales of 170 kgs. each (equivalent to 327.83 lakh running bales of 162 kgs. each) in 2024-25 season. The Committee members will have a close watch on the pressing numbers of cotton in the subsequent months and if any addition or reduction is required to be made in the pressing numbers, the same will be made in the CAI reports of the subsequent months.

COTTON PRESSING

As per the crop report submitted by upcountry associations and trade sources at the meeting of the CAI Crop Committee, the Committee has arrived at its cotton pressing estimate at 305.00 lakh bales of 170 kgs. each (equivalent to 320.06 lakh running bales of 162 kgs. each) as against the corresponding figure of 312.40 lakh bales of 170 kgs. each (equivalent to 327.83 lakh running bales of 162 kgs. each) in 2024-25 season. The Committee members will have a close watch on the pressing numbers of cotton in the subsequent months and if any addition or reduction is required to be made in the pressing numbers, the same will be made in the CAI reports of the subsequent months.

IMPORTS

The cotton imports into India during 2025-26 season are estimated at 45.00 lakh bales of 170 kgs. each (equivalent to 47.22 lakh running bales of 162 kgs. each) as against 41.00 lakh bales of 170 kgs. each (equivalent to 43.02 lakh running bales of 162 kgs. each) estimated for the last season. Upto 31st October 2025, about 8.00 lakh bales of 170 kgs. each (equivalent to 8.40 lakh running bales of 162 kgs. each) are estimated to have arrived the Indian Ports

EXPORTS

The Committee has estimated cotton exports during the 2025-26 season at 17.00 lakh bales of 170 kgs. each (equivalent to 17.84 lakh running bales of 162 kgs. each) as against 18.00 lakh bales of 170 kgs. each (equivalent to 18.89 lakh running bales of 162 kgs. each) estimated for the last season. Upto 31st October 2025, about 1.50 lakh bales of 170 kgs. each (equivalent to 1.57 lakh running bales of 162 kgs. each) are estimated to have been shipped by the country.

CLOSING STOCK AS AT 30TH SEPTEMBER 2025

The closing stock at the end of 2025-26 season on 30th September 2026 is estimated at 93.59 lakh bales of 170 kgs. each (equivalent to 98.21 lakh running bales of 162 kgs. each) which is higher by 33 lakh bales of 170 kgs. each from the closing stock of 60.59 lakh bales of 170 kgs. each (equivalent to 63.58 lakh running bales of 162 kgs. each) for the previous year on 30th September 2025.

Fundamentals

Domestic Supply Tightness Intensifies

At the domestic level, cotton fundamentals remain structurally tighter. Cyclone Montha’s impact across Telangana and Andhra Pradesh brought heavy rainfall, affecting boll development, fibre quality, and slowing harvesting operations. These key producing states experienced localized yield stress that is now evident in lower production expectations. Furthermore, India’s cotton acreage is down 2.60% at 110.03 lakh hectares, tightening the supply base even before weather disruptions occurred

MSP Hike and CCI Procurement Support Farmers

The government’s decision to increase the MSP by 11.84% for 2025–26 and the CCI’s procurement at 14 centres from October 1 has offered significant support to growers. However, these measures cannot offset the drop in overall output. According to the third advance estimates, India’s cotton production has fallen 5.6%, declining from 32.52 million bales to 30.69 million bales. Additionally, unseasonal rains through late October have slowed arrivals further, adding uncertainty regarding immediate supply.

Imports Surge to Record Highs

Domestic tightness is being counterbalanced by a steep rise in imports. India’s cotton imports for the 2024–25 crop year have reached a record 39 lakh bales, supported by global price advantages and domestic supply shortfalls. Imports from Brazil have surged tenfold, reflecting a clear preference among textile mills for competitively priced overseas fibre. Weak Chinese textile demand, increased adoption of synthetic fibres, and lower global lint prices have collectively exerted pressure on spinning margins in India.

Global Demand Softens but Stocks Tighten

China’s agriculture ministry reducing its 2024–25 cotton import forecast by 300,000 tonnes signals subdued global consumption trends. Despite this, the global cotton balance sheet remains tightening. For 2025–26, the USDA has raised global consumption by 850,000 bales while cutting beginning stocks by nearly 1 million bales from last month. Global ending stocks are now projected at 73.1 million bales, marking the lowest level in four years. Additionally, Pakistan’s cotton sector continues to struggle, with production down 30% and only 594,000 bales reaching ginning factories by end-July.

Policy Measures and Their Market Impact

The Indian government’s extension of import duty exemption until December 2025 is likely to support continued high import volumes. At the same time, CAI estimates closing stocks at 60.59 lakh bales, almost double last year, ensuring near-term supply comfort for mills. However, the higher MSP significantly inflates mill input costs and may erode India’s competitiveness in global yarn and fabric markets.

Overall Fundamental Outlook

Taking all factors into account, the cotton market displays a neutral-to-slightly supportive fundamental tone. Domestic supply remains tight due to lower acreage and weather-related disruptions, but record imports and weak downstream demand prevent an overly bullish setup. Globally, tightening stocks and reduced production in key countries counterbalance softer Chinese buying, creating a fundamentally balanced market with mild upward undertones.

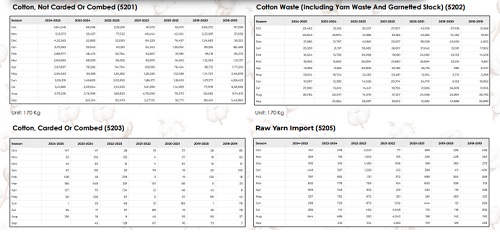

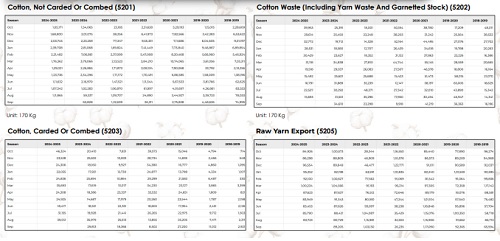

Cotton Imports

Cotton Exports

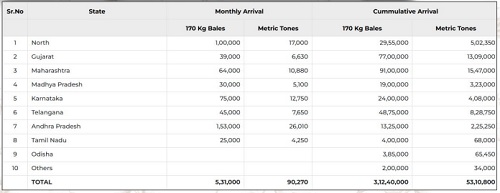

Arrivals

Balance Sheet - 2024/25

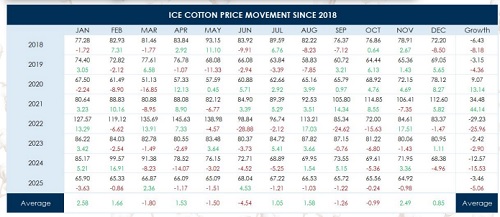

Seasonality - ICE Cotton

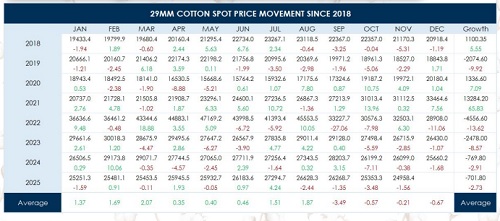

Seasonality - 29mm Cotton Spot

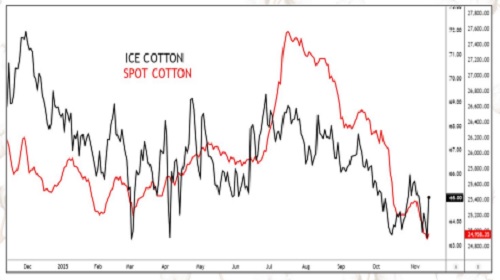

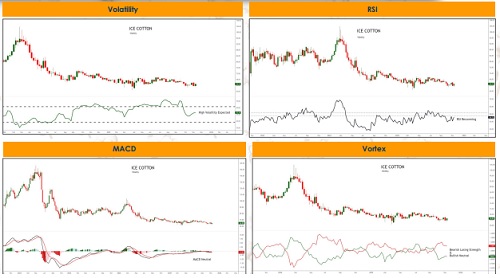

Technicals - ICE Cotton

Technicals - 29mm Cotton Spot

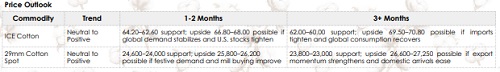

Outlook - ICE Cotton

Outlook - 29mm Cotton Spot

Conclusion

Price Performance: Cotton prices have been trading within a sideways yet mildly positive range, supported by lower acreage and yield losses in Telangana–AP from cyclone rains. However, record imports and weak Chinese textile demand continue to cap any sustained upside momentum for now.

Supply–Demand Dynamics: India’s 2025–26 acreage slipped 2.6% to 110.03 lakh ha, with production estimated at 30.69 million bales, down 5.6% YoY. Despite supply tightening, imports surged to 39 lakh bales, led by cheaper Brazilian cotton and subdued global yarn demand.

Global Market Trends: Global consumption is forecast to rise by 850,000 bales, while ending stocks are at a four-year low of 73.1 million bales. Yet, a 2% fall in India’s production and Pakistan’s 30% drop keep global fundamentals balanced with a slightly firm undertone.

Policy & Trade Developments: Government extended import duty exemption on raw cotton till December 2025, supporting mills but limiting local price gains. The MSP hike of 11.84% improved farmer sentiment, though higher costs risk reducing India’s export competitiveness in global markets.

Technical Overview: Both ICE and Spot cotton exhibit stable technical structures. RSI remains neutral with mild bullish bias, while MACD shows consolidation. Volatility readings imply range-bound trade, and Vortex signals steady trend strength, confirming a neutral-to-positive market outlook.

Above views are of the author and not of the website kindly read disclaimer

More News

Quote on Surge in Gold prices from Vaibhav Porwal, Co-Founder, Dezerv