Consumer Durables Sector Update : Growth diversity continues; broad-based positive commentary by Motilal Oswal Financial Services Ltd

Jewelry and liquor categories maintain outperformance; paint shows recovery

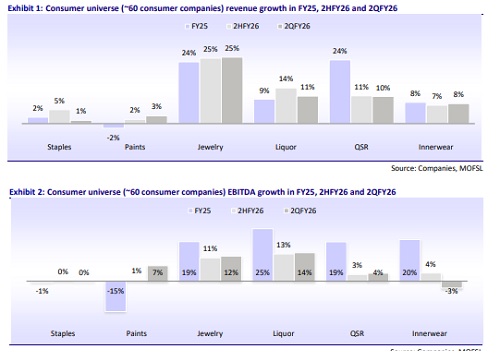

* Our widespread consumer coverage universe, a compendium of ~60 consumer companies with combined revenue of ~INR1.2t in 2QFY26/~INR2.5t in 1HFY26 (INR4.6t in FY25) and a market cap of ~INR35t, delivered aggregate revenue/EBITDA growth of 8%/4% in 2QFY26 and 10%/3% in 1HFY26. Consumption trends were temporarily impacted by GST transition for FMCG categories; hence, performance was not comparable. Jewelry and liquor categories maintained their outperformance compared to other categories. Paint category saw signs of demand revival at the quarter end, aided by festive demand pickup.

* Revenue/EBITDA/APAT performance of all our coverage sub-segments in 2QFY26: staples +1%/0%/0%, paint +7%/+17%/+13%, innerwear +4%/+0%/+0%, liquor +11%/+16%/+24%, QSR +10%/+4%/NA (loss widened in 2QFY26), and jewelry +26%/+25%/+26% YoY.

* In 2QFY26, demand trends were mixed across categories. Staples witnessed steady underlying demand, though the GST transition and extended monsoon led to temporary disruptions, particularly in personal care, while packaged foods posted a relatively better performance. Most companies expect stability from Nov’25 onward as GST-led volatility eases and price/grammage adjustments reach consumers. Companies have pre-loaded their winter portfolios into the market in anticipation of a strong season and healthy offtake. In paints, demand revival became evident from Sep, supported by festive buying, stronger trade sentiment, and improved secondary movement, with further acceleration expected in 2HFY26. In alcobev, spirits continued to perform well, driven by strong P&A-led consumption and premiumization across key players, while beer demand remained soft due to weather-led disruptions. Innerwear demand was subdued during Jul-Aug but began recovering from mid-Sep, with early festive purchases and improving sentiment. QSR players continued to report muted demand despite a supportive base, with dine-in ADS remaining soft and samestore sales largely flat to lower, barring JUBI and RBA. Jewelry players reported strong revenue growth, aided by an early festive season and store additions despite high gold prices.

* Gross margin pressure persisted due to high-cost commodity inventory, especially in agri inputs, and limited price hikes. While key commodity prices remain volatile MoM, they are expected to stabilize in 2HFY26. EBITDA margin was also muted in 2Q, though partially offset by cost controls. Paint companies saw meaningful margin improvements, aided by benign RM prices and a favorable mix. In alcobev, spirits players reported margin gains, supported by stable ENA and glass costs, while beer margins were impacted by negative operating leverage. Innerwear margins remained soft as higher marketing spends offset sourcing-led gross margin benefits. QSR margins remained under pressure due to negative operating leverage. Jewelry companies witnessed EBITDA margin expansion despite rising gold prices, supported by a superior product mix and a higher studded share.

* Outliers and underperformers in 2QFY26: Among our coverage companies, APNT, BRIT, NEST, RDCK, JUBI, Titan and Kalyan Jewelers were the outliers, whereas CLGT, Dabur, Page, UBBL, Sapphire Devyani, Westlife and Senco underperformed.

* Sector outlook and recommendation: With trade stabilizing after the GST reduction, staples are expected to see a gradual pickup in demand, supported by a steady rural recovery and improving urban sentiment. A favorable winter should further drive offtake of health supplements, personal care, hot beverages, and other winter-sensitive products. Government measures to boost rural incomes and revive urban consumption are likely to boost consumption from 3QFY26 onward. Positive commentary for paints, liquor, innerwear, and jewelry during the festive season is certainly a good indicator for consumption recovery. The extended monsoon has impacted paint demand, but growth recovery was encouraging. After registering weak numbers during the last few quarters, it will be interesting to track if the recovery was limited to festive period or pent-up demand is holding the similar trend. In liquor, premiumization continues to support healthy double-digit growth in spirits. The innerwear segment is seeing a slow but steady recovery as channel inventory normalizes, with the winter season expected to boost thermal and winterwear demand. QSR companies expect eating-out frequency to gradually pick up in 2HFY26. In jewelry, the strong demand momentum is likely to remain intact during the upcoming wedding season, aided by steady footfalls.

* We downgraded Dabur to Neutral due to ongoing execution challenges and upgraded Britannia to BUY on improving demand trends, grammage-led volume support, and potential market share gains from local players.

* Our top picks are Titan, HUL, BRIT, MRCO, PN Gadgil, and RBA.

Performance summary of all categories and key areas to monitor

* Staples: Our staple companies reported sales growth of 1% (est. 5%); excl. ITC, revenue growth was 5%. EBITDA growth was flat (est. flat), with flat APAT YoY (est. +2%). The GST impact was more pronounced in personal care categories compared to packaged foods. All such transition changes will be interim and stability is expected from Nov’25 onward. About 2-3% of revenue of most companies was affected by the GST-led transition. Many companies have reduced prices and started increasing grammage in low-unit packs (LUPs) to pass on the GST benefits to consumers. Companies have also pre-loaded their winter portfolios into the market, anticipating a strong season and a robust offtake. Key raw material prices remained firm, thereby gross margin pressure persisted for most consumer companies. Copra price correction can boost the margin for Marico in the coming quarters. EBITDA margins for most companies were under pressure in 2Q. According to NIQ data, the FMCG industry posted 13% value growth and 5.4% volume growth, with rural volume growth much higher at 5.7% vs. 1.9% in urban areas. For staple companies under our coverage, gross margin contracted 40bp YoY and EBITDA margin contracted 30bp YoY. Excl. ITC, GM contracted 150bp YoY and EBITDA margin contracted 90bp YoY. We downgraded Dabur to Neutral given persistent execution challenges, and upgraded Britannia to BUY owing to improving demand trends, benefits of grammage play and possible share gain from local and regional firms. In terms of revenue, Marico (+31%) and Nestle (+11%) were outliers, while Colgate (-6%) came in below expectations.

* Paints: Paint companies reported clear signs of a demand revival in Sep-Oct’25, supported by festive demand and improving trade sentiments. The industry expects this uptrend to accelerate further in 2HFY26. Overall Paints category revenue/EBITDA grew 3%/7% in 2QFY26. Asian Paints reported 6% YoY growth, Indigo Paints 4%, Berger ~2%, Kansai Nerolac was flat, and AkzoNobel saw a 2% decline (LFL) in revenue growth. Asian Paints and Indigo Paints saw margin improvement, aided by benign RM prices, a favorable product mix, and efficiency measures. Berger and AkzoNobel saw margin pressure due to weak value growth, higher contribution from low-value products, and increased investments in brand building and manpower. Asian Paints outperformed its peers in 2Q, but its 2-year CAGR was on par with them.

* Liquor: Liquor universe delivered sales/EBITDA growth of 11%/14% in 2Q. The AlcoBev sector delivered healthy growth in 2QFY26, driven by premiumization and stable input costs. The P&A segment remained strong, with UNSP posting 8% volume growth, Radico Khaitan delivering 22% P&A growth (overall volumes +38%), ABDL growing 30%, and Tilaknagar rising 16%. UBBL saw a 3% volume decline but delivered strong 17% growth in premium beer. Input costs such as ENA and glass stayed benign, though margin trends diverged: UNSP saw sharp EBITDA margin expansion, Radico reported a 130bp gain, ABDL saw steady improvement, and Tilaknagar, UBBL and Sula faced margin pressure due to mix and operating leverage. Premiumization, regulatory stability, and strong brand momentum support a positive near-term outlook. Radico outperformed its peers in the category.

* QSR: The operating environment remained challenging through Aug and Sep, as out-of-home consumption was impacted due to both Shraavana and Navaratri falling in the same quarter, as well as unseasonal rains. Oct saw improvement, backed by a change in the festive season. QSR companies expect eating-out frequency to gradually pick up in 2HFY26. The sector benefited indirectly from GST-related advantages through lower raw material costs, particularly in cheese and sauces, which contributed ~50bp to margins. The benefit was passed on to consumers through price reductions in certain SKUs. However, weak underlying growth continued to impact operating margins, exerting pressure on restaurant and EBITDA margins for most brands. QSR companies continued to focus on value offerings. While delivery channels remain strong, dine-in is showing a gradual improvement. Our coverage universe posted revenue growth of 10% YoY in 2QFY26 vs. 11% in 1QFY26 and 5% in 2QFY25. JUBI outperformed in 2Q.

* Jewelry: The jewelry category delivered sales/EBITDA growth of 26%/12% in 2QFY26. Titan and Kalyan Jewelers outperformed the peers. Jewelry companies continued to deliver robust sales growth despite facing challenges such as the Shraddh period, heavy rainfall and a significant rise in gold prices (up ~45% YoY and ~8% QoQ, crossing the INR100k mark (per 10gm) in the retail market). Consumer demand remained strong, fueled by the early festive season. Titan (jewelry standalone, ex-bullion), Kalyan, P N Gadgil (retail), and Senco delivered revenue growth of 19%, 31%, 29%, and 2% in 2Q. Thangamayil sales grew 45%, while DP Abhushan sales declined by 4%. SSSG of Titan/Kalyan/Thangamyil stood at 14%/16%/14%, while Senco reported a same-store sales decline of 4% in 2Q. The studded mix improved for most jewelry companies.

* Innerwear: Innerwear demand stayed muted for most of 2QFY26, with pressure on discretionary spending at the mass end affecting category momentum. However, the industry witnessed recovery in late Sep, supported by improved secondary sales and a better-than-expected festive season. Among key players, PAGE posted 4% revenue growth, Dollar Industries 5%, Lux Industries 16%, and Rupa 9%. E-commerce and Tier-3/4 cities led growth, followed by Tier-1, Tier-2, and metros. Inventory management improved, with PAGE’s inventory days now standing at normal levels. PAGE’s gross margins expanded due to sourcing efficiencies; however, high marketing spends dented EBITDA. PAGE delivered 4% YoY growth in revenue and flat EBITDA/APAT in 2QFY26. Overall Innerwear category revenue/EBITDA grew 8%/-3% in 2QFY26.

Consumption tracker

Our consumption tracker consists of various categories from the staple and discretionary baskets. The index comprises a diverse range of categories, from essentials, such as oral care, hair care, personal care, and home care, to discretionary items such as F&B, OTC FMCG, cigarettes, footwear, paints, QSR, dairy, liquor, jewelry and innerwear. The index is based on the weighted average revenue growth of various companies included in their respective categories.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

Tag News

Capital Goods Sector Update : Assessing Middle East risk exposure in light of US-Iran war b...