Commodity Research - Morning Insight - 15 October 2025 by Kotak Securities Ltd

Bullion – Spot gold surged to another record high of $4,179.7 per ounce, while silver briefly topped $51.35 before closing lower amid worries that escalating U.S.–China trade tensions could weigh on global growth and industrial demand. Gold remained supported by safe-haven buying, a weaker dollar, and China’s move to sanction five U.S. units of Hanwha Ocean Co., deepening the tit-for-tat trade measures. Comments from Fed Chair Powell in Philadelphia were seen as mildly dovish, reinforcing expectations of a rate cut at the Oct 28–29 FOMC meeting. Powell noted that the economy may be “on a somewhat firmer trajectory” but warned of higher risks to the labor market and inflation from tariffs. Today, Gold surged to a record high of $4,186.6 amid escalating U.S.–China tensions and expectations of two Fed rate cuts this year. Moreover, ongoing U.S. government shutdown supports safe-haven demand while traders eye Empire State Manufacturing Index and FOMC officials remarks.

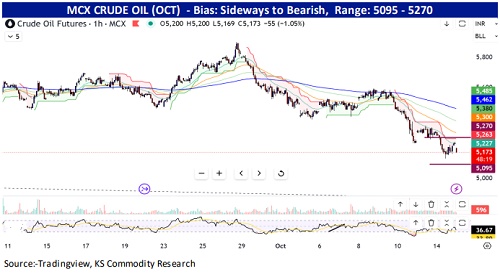

Crude Oil – WTI crude oil slipped to a fresh five-month low of $57.7/bbl as China sanctioned five US entities linked to Hanwha Ocean Co., one of South Korea’s biggest shipbuilders, accusing them of assisting US government actions against China’s maritime, logistics, and shipbuilding sectors and reignited concerns about the US-China trade war. Also, IEA warned of a potential 4 million bpd oil market glut next year, citing soaring supply and subdued demand. IEA revised down its global oil demand growth forecast to 700,000 bpd for both 2025 and 2026, contrasting with OPEC’s more optimistic outlook of 1.3 million bpd growth in 2025 and 1.4 million bpd in 2026. Still, oil prices rebounded from session lows to close at $58.7/bbl, owing to softer US dollar following dovish remarks from Fed Chair. Today, prices edged lower to $58.5/bbl as markets assess impact of US-China tensions and surplus concerns.

Natural Gas – NYMEX natural gas futures fell 3% to $3 per mmBtu, weighed down by mild weather projections and ample storage though further losses were capped owing to uptick in LNG exports.

Base metals – Base metals fell sharply on Tuesday, with copper and zinc down about 2% as escalating US–China trade tensions dented sentiment. LME copper closed at $10,578 per ton, giving up recent gains after Beijing imposed restrictions on five US firms and both nations introduced new port fees. On the supply side, Chile’s Codelco reported its lowest output in over two decades, while Indonesia’s Grasberg mine remained constrained. Zinc dropped the most in eight months as China prepared to export metal amid weak domestic demand and rising global prices. Base metals may likely trade higher supported by a weaker dollar, easing deflation in China, and dovish cues from the Fed. However, lingering trade tensions and broader macroeconomic uncertainties are likely to keep overall sentiment cautious.

Please refer disclaimer at https://www.kotaksecurities.com/disclaimer

SEBI Registration No. INZ000200137