Cement Sector Update : Q1FY26 Result Review by Choice Institutional Equities

Volume & Realizations Driven Thrust!

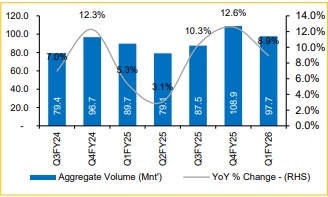

Strong YoY growth in volumes underpins sector: In Q1FY26, cement companies under our coverage delivered a healthy 8.9% YoY volume growth, driven by strong infrastructure spending. Among the major players, ACEM posted the highest growth at 16.7% YoY, followed by UTCEM at 15.0% YoY and JKCE at 14.3% YoY. We expect this growth momentum to continue through FY26, further supported by the GST rate cut. That said, Q2FY26 volumes could witness some moderation sequentially due to the impact of monsoons.

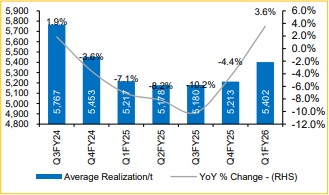

Cement prices firm up in Q1FY26: In Q1FY26, all-India cement prices rose 5% YoY, supported by stronger realizations in the South, East, and West regions, while prices in the North and Central markets remained largely stable. However, our channel checks indicate a sequential decline of ~INR 4–5 per bag in August. That said, we expect a recovery with a price hike of INR 10–15 per bag in September/October, as receding monsoons improves cement demand. For our coverage universe, realizations grew by ~3.6% YoY and QoQ, supported by price increases across regions.

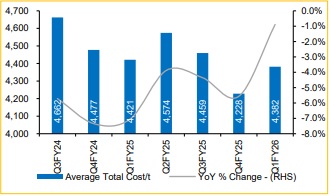

Revenue growth YoY driven by volume and realisation improvement: Cement companies in our coverage posted 11.6% YoY revenue growth, led by an 8.9% increase in volumes, and a 3.6% increase in realizations. On the cost front, operating expenses fell ~0.9% YoY and were supported by reductions in power & fuel costs.

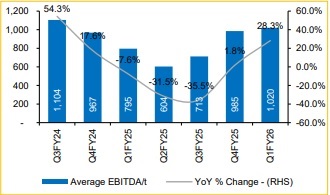

EBITDA/t sees strong YoY rebound: In Q1FY26, EBITDA/t for our coverage companies registered a strong 225/t YoY recovery and rose 36/t QoQ, reaching an average of INR 1,020/t compared to INR 985/t in Q4FY25. The improvement was driven by higher realizations, operating leverage benefit due to higher volume and cost efficiency. Going forward, continued focus on cost-reduction initiatives is expected to support further EBITDA/t gains to different extent for different companies.

FY26 Outlook: For FY26, the cement sector is expected to be driven by cost optimization, premium product mix, and sustained healthy realizations. Industry volumes are projected to grow by ~8% YoY, supported by GST rate cut, pent-up demand, rising construction activity, infrastructure spending by states, and steady demand from IHB and real estate. While Q2FY26 may witness seasonal softness due to the monsoon, the overall pricing outlook remains favorable. On the cost front, UTCEM is targeting a reduction of INR 200–300/t, and ACEM plans to cut INR 500–530/t over the next 3–4 years, reinforcing the sector’s focus on efficiency and margin improvement.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131