Capital Market : Overall market activities across segments surge MoM by Motilal Oswal Financial Services Ltd

Overall market activities across segments surge MoM

MAAUM and SIP flows scaled to new highs

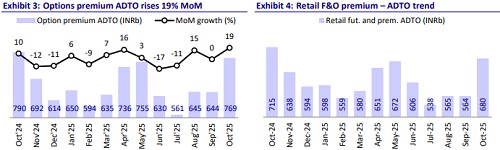

* In Oct’25, total ADTO rose 16% MoM to INR507t, led by a 16% MoM increase in notional F&O ADTO. The options premium ADTO was up 19% YoY, while the cash segment ADTO remained flat MoM.

* Retail participation experienced mixed growth across segments, with retail cash ADTO witnessing flat MoM growth to INR407b, while the retail futures and options premium ADTO rose 20% MoM growth to INR680b.

* The commodity market achieved a new peak, driven by strong volumes in the precious metals segment. Volumes grew 36% MoM to INR152.5t (~3x YoY) across key commodities, with ADTO at INR6.9t (INR5.1t in Sep’25). However, the premium-tonotional turnover ratio improved slightly MoM.

* Demat additions rose MoM to 3m in Oct’25 (2.5m in Sep’25). IPO activity gained significant momentum with 18 IPO offerings, INR408b in Oct’25.

* MF MAAUM rose 2.6% MoM in Oct’25 (new highs) to INR79.8t (up 17% YoY), with equity AUM at INR34.8t (up 2% MoM). SIP flows scaled to a new high of INR295b (INR294b in Sep’25).

* The industry posted MoM growth in total ADTO, broadly led by a 16% rise in Options Notional ADTO. MF AAUM also rose sequentially, supported by growth in Equity AAUM. Rising volumes in the precious metal segment and increasing participation led to a strong rise in commodity volumes. We expect that a stable growth trajectory for volumes and rising retail participation should support the performance of market intermediaries. Stable MF flows and SIP trajectory will bode well for AMCs.

Equity: Cash activity remains stable; F&O activity surges

* Total ADTO grew 16% MoM in Oct’25 to INR507t, driven by 16% MoM growth in notional F&O ADTO to INR506t.

* Option premium ADTO grew 19% MoM to INR769b, which is the highest for CY25 and near the volumes reported just before implementation of F&O regulations. Cash ADTO was flattish MoM at INR1.06t.

* Retail futures and premium ADTO witnessed a strong 20% MoM growth in Oct’25, while retail cash ADTO inched up 1% MoM.

* In the cash segment, NSE maintains its leadership position, with a market share of 93% in Oct’25.

* In the F&O segment, BSE’s notional turnover market share recovered after the decline due to a shift in expiry, increasing to 44% (38% in Sep’25), and the premium turnover market share increased to 26.7% (from 24.7% in Sep’25).

Commodities: Volumes at a new peak; precious metals driving growth

* Total volumes on MCX grew 36% MoM to a new high of INR152.5t in Oct’25 (~3x YoY), with ADTO nearing the INR7t mark (INR6.9t in Oct’25 vs INR5.1t in Sep’25).

* Option volumes rose 34% MoM to INR132.7t, and futures volumes rose 60% MoM to INR19.7t.

* Growth in options ADTO was aided by 74%/4%/8%/29% MoM growth in gold/silver/crude oil/natural gas ADTO. Base metals ADTO also witnessed strong growth of 128% MoM. The option premium ADTO rose 46% MoM to INR69b, while the premium-to-notional turnover ratio improved slightly to ~1.1%.

* In commodity futures, ADTO growth was driven by a 57%/82%/9%/15% MoM rise in gold/silver/crude oil/natural gas futures ADTO. Base metals futures ADTO also witnessed a strong rise of 71% MoM.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

India Strategy : Ownership analysis ? DIIs fortify their grip by Motilal Oswal Financial Ser...