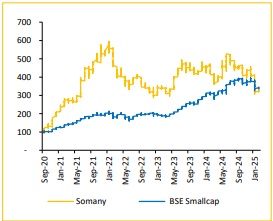

Buy Somany Ceramics Ltd For the Target Rs. 778 by Choice Broking Ltd

SOMC Q3FY25: Revenue and EBITDA in-line but depreciation one-off makes PAT fall sharply; 4.5% YoY volume growth a pleasant surprise in a cyclically contracting market.

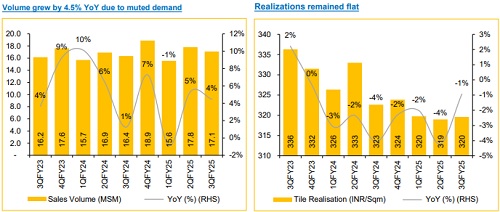

* Q3FY25 consolidated revenues at INR6,401 Mn, (vs CEBPL est. INR6,365 Mn), was up 5.1% YoY and down 3.2% QoQ. Total volume for Q3 stood at 17.1MSM, was up 4.5% on YoY basis.

* Consolidated EBITDA for Q3FY25 was reported at INR535 Mn, (vs CEBPL est. INR539 Mn), down 9.4/4.5% YoY/QoQ. Realizations remained flat at INR 320; down 1% YoY.

* PAT for Q3FY25 reported at INR93Mn, (vs CEBPL est. INR188Mn), down 58.1/45.8% YoY/QoQ mainly due to higher interest and depreciation cost. EPS for the quarter came at INR2.3.

Retail demand expected to rebound as housing picks up:

Retail demand for 3QFY25 declined by 300bps to 77%, compared to 80% in FY24. However, management expects demand to return to normal levels of 80% in the coming quarters, driven by a recovery in individual housing demand. Meanwhile, the share of government projects increased by 300bps to 11%, up from 8% in FY24. Private projects and exports contributed 8% and 3%, respectively.

Max plant’s higher utilization to boost margins with GVT growth:

Higher capacity utilization at the Max plant is expected to drive margin improvement. The plant's utilization rate has increased to 51%, up from 36% in 2QFY25, leading to a greater share of GVT products. GVT (Glazed Vitrified Tiles) revenue for the current quarter stands at 38%, compared to 34% in 3QFY24. Management aims to increase this share to 50% over the next 1–2 years, which is expected to improve margins by 100–150bps. Meanwhile, the revenue share of Ceramics and PVT products stands at 34% and 28%, respectively

View and Valuation:

We revise our FY25/26/27 EPS estimates downward by -32.3%/-28.8%/-19.3% due to lower retail share. We maintain our 'BUY' rating with a revised target price of INR 778, valuing the company at 22x (Unchanged) FY27 EPS. We expect volume growth to exceed industry growth, driven by an aggressive sales strategy addition of store count and market share gains. Additionally, we anticipate higher revenue contributions from Max plant and Bathware segment.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

.jpg)