Buy Poonawalla Fincorp Ltd for the Target Rs. 605 by Motilal Oswal Financial Services Ltd

Beat on PPoP; elevated opex and credit costs weigh on earnings

AUM surges ~68% YoY; NIM improves ~25bp sequentially

* Poonawalla Fincorp’s (PFL) 2QFY26 PAT stood at ~INR742m (inline) vs a loss of ~INR4.7b in 2QFY25. PPOP in 1HFY26 was flat YoY, and we expect PPOP in 2HFY26 to grow by ~66% YoY. NII in 2QFY26 grew ~37% YoY to ~INR7.6b (~13% beat). Other income rose ~64% YoY to ~INR1.4b. Higher non-interest income was primarily due to higher fee income during the quarter.

* Opex rose 44% YoY to ~INR5.2b (~7% higher than est.), with the C/I ratio remaining elevated at ~57% (PQ: ~58% and PY: ~56%). PPoP grew ~36% YoY to ~INR3.9b (~18% beat) primarily because of the healthy NIM expansion. Provisions stood at INR2.9b (v/s MOFSLe: INR2.3b), translating into annualized credit costs of ~2.8% (PQ: 2.7% and PY: ~14.4%).

* Management reiterated that its strategy is to scale six to seven recently launched businesses, each progressing at a different pace, to build a more diversified and balanced portfolio mix.

* The company also shared that the erstwhile STPL book has declined to just 2% of the AUM as of Sep’25 (from ~8% in Mar’25). Notably, ~70% of the STPL book is now 0dpd, and the company does not anticipate any further stress from this segment. The remaining STPL book is adequately provided, which will mitigate any potential impact on credit costs. Management also shared that multi-layered risk controls, including advanced data models and geo-intelligence, have driven a 70% reduction in first EMI bounces and a 40% improvement in collection efficiency.

* We broadly retain our FY26E and FY27E EPS. We model ~50% AUM CAGR over FY25-FY28E and expect PFL to deliver an RoA/RoE of ~2.5%/~16.0% in FY27. Reiterate BUY with a TP of INR605 (based on 3.7x Sep’27E BVPS).

AUM jumps ~68% YoY; healthy traction continues in new businesses

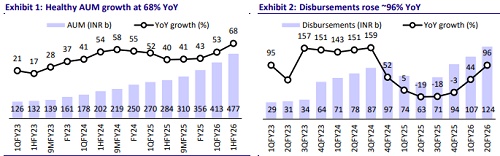

* PFL’s AUM grew ~68% YoY/~16% QoQ to ~INR477b. The AUM mix comprised ~36% MSME finance, ~26% personal and consumer finance, ~26% LAP, and ~11% pre-owned cars. Disbursements grew ~96% YoY to ~INR124b in 2Q.

* PFL shared that new products accounted for 17% of total disbursements, with ~INR21b disbursed under these segments in 2QFY26. The company is steadily scaling its new businesses, expanding its physical footprint, and strengthening partnerships with OEMs and dealers. During the quarter, the company expanded its distribution reach with 260 new branches, including 160 gold loan branches. We model AUM growth of ~69%/46% in FY26/FY27, respectively.

NIM (calc.) improves ~25bp QoQ; the share of NCD continues to rise

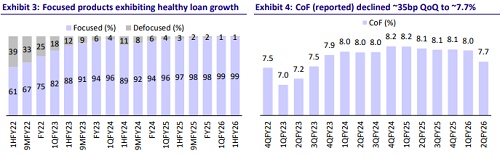

* NIM (calc.) improved ~25bp QoQ to ~7.5%, driven by improvement in yields by ~30bp QoQ to ~13.7%. CoB (calc.) declined ~5bp QoQ to ~7.7%. Reported CoF declined ~35bp QoQ to 7.7%.

* Management highlighted that the company is well-positioned to benefit from a declining interest rate environment, with 55% of its total borrowings on floating rates. Additionally, it has strengthened and diversified its borrowing profile by increasing low-cost NCDs, raising their share to 24% in Jun’25 from 7% in Mar’25, and further to ~26% in Sep’25. This enhanced its long-term funding mix. We model an NIM of ~7%/7.5% in FY26/FY27 (vs. ~7.8% in FY25).

Credit costs remain elevated; GS3 improves ~25bp QoQ

* GS3 declined ~25bp QoQ to ~1.6%, while NS3 declined ~5bp QoQ to ~0.8%. PCR on S3 loans declined ~430bp QoQ to ~50% (PQ: ~54% and PY: ~85%).

* The company noted an increase in the proportion of Stage 1 assets, reflecting disciplined underwriting. For its newer businesses, management highlighted that professional agencies were engaged to assess PD and LGD, with practices benchmarked against industry peers.

* Management highlighted that it seeks to optimize credit costs to best-in-class levels, supported by strong underwriting standards and a well-diversified portfolio mix. We model credit costs of ~2.1%/1.7% (as a % of loans) in FY26/FY27 (vs. ~5.1% in FY25).

Highlights from the management commentary

* The company plans to expand its gold loan network to 400 branches by Mar’26, targeting Gujarat, Haryana, Rajasthan, and Maharashtra, with a focus on Tier 2 and Tier 3 markets. Additionally, it aims to scale its Consumer Durables business to over 12k distribution points by Mar’26, up from the current 10k+.

* Around 18-20% of sourcing is currently through in-house channels such as branches, websites, and digital platforms, with the remainder via DSAs, fintechs, and other partners. The company will increase self-reliance in sourcing by building a multi-channel strategy with 5-6 distribution models tailored across products and geographies.

Valuation and view

* PFL reported healthy AUM and disbursement growth during the quarter. However, credit costs and opex continued to remain elevated for the company due to continued investments in new businesses. FY26 will be a crucial year for the company to demonstrate its ability to scale its newer businesses while sustaining asset quality and keeping credit costs contained. We continue to closely monitor the on-the-ground execution of the company's stated strategy. Reiterate BUY with a TP of INR605 (premised on 3.7x Sep’27E BVPS).

* Key downside risks: a) inability to execute its articulated strategy despite a new management team and investments in technology, distribution, and collections; and b) an aggressive competitive landscape leading to pressure on spreads and margins and/or deterioration in asset quality.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412