Buy Marksans Pharma Ltd For Target Rs. 315 By Choice Broking Ltd

Business Overview: Marksans Pharma (MRKS) is engaged in the research, manufacturing, and marketing of generic formulations across both OTC and prescription (Rx) segments. The company derives ~96% of its FY25 revenue from regulated markets such as the US, UK, Europe, Australia, and New Zealand, while also exporting to over 50 countries globally. MRKS operates four manufacturing facilities, including the recently acquired plant from Teva that became operational in FY25, boosting its total annual capacity to ~16 Bn units. Its diversified product portfolio includes over 300 molecules and 1,500 SKUs, with dosage forms ranging across tablets, capsules, soft gels, oral liquids, and ointments.

Is MRKS Well Positioned to Scale Profitably Through Front-End Expansion and Capacity-Led Growth?

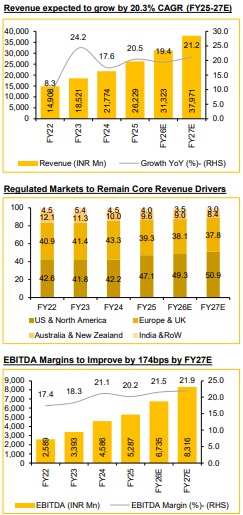

MRKS is steadily transitioning from a backend generics supplier to a front-end focused player, with the US, UK, and European markets contributing ~86% of its revenue. The company has a strong product pipeline, especially in the US and UK, and is actively filing new products to expand its presence in these regions. The EU market remains underpenetrated and is a key focus for future growth, supported by increased R&D and regulatory investments. We believe continued momentum in these geographies will help MRKS achieve its target revenue of INR 3,000 Cr by FY26, implying ~14% growth over FY25. While its significant US exposure may raise investor concerns regarding tariff uncertainties, however, as per our conversation with the CFO, the company is confident that it will be able to pass on any additional costs to end customers, thereby mitigating potential margin pressures

MRKS is leveraging its regulatory-compliant manufacturing infrastructure to strengthen its presence in key regulated markets. The recently commissioned Teva plant is emerging as a strategic growth driver, with management estimating a revenue potential of up to INR 1,000 Cr over time (INR 300–350 Cr in FY25). The expanded capacity from this facility not only caters to current demand but also positions the company for future growth through new product launches and volume ramp-up, particularly in the US and UK. We believe the high operational costs incurred during the integration phase are now tapering off, which should support EBITDA margin expansion. To further capitalize on growing demand, the company also plans to explore new facility acquisitions, with India being a priority region.

Why Invest in MRKS?

MRKS is poised for strong growth on the back of several key factors:

* Revenue Visibility in Regulated Markets: MRKS is targeting INR 3,000 Cr in revenue by FY26E (14%+ growth), driven by robust expansion in the US and UK, supported by 8–10 product launches in North America and increased filings in the UK.

* Increased Production Capacity: The newly acquired Teva facility adds 8 Bn units per annum, taking total capacity to 16 Bn units, enabling scale-up across key regulated markets.

* Margin Expansion from Capacity Ramp-up: The Teva Goa facility is expected to drive operating leverage from higher utilization, supporting EBITDA margin improvement by FY26E.

Recommendation: We currently have a ‘BUY’ rating on the stock with a target price of INR 315.

Key Risks:

* Regulatory and Compliance Risks: Adverse regulatory actions in key markets like the US or UK could disrupt operations and delay product approvals.

* Execution Risk on Capacity Ramp-Up: Delays in achieving optimal utilization of the Teva Goa plant may impact revenue growth and margin expansion.

* Generic Pricing Pressure: Intense competition in the US and other regulated markets could compress margins despite frontend integration efforts.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131