Buy Kotak Mahindra Bank Ltd For Target Rs. 2,188 - Religare Broking

Stable Bank with Strong Financials

Kotak Mahindra Bank is a prominent financial services group offering a wide range of services, including banking, retail broking, treasury and corporate banking, insurance, investment banking, and asset management. With 2,068 branches across India, it provides comprehensive financial solutions to individuals, businesses, and institutions, making it a key player in the country’s financial sector.

Secured and corporate loans to drive loan growth: The asset portfolio is well diversified, with a shift towards safer, secured segments like corporate lending, as unsecured segments like credit cards and microfinance are facing some stress. With a pick-up in private and government-driven capex, the company sees strong growth potential in this corporate segment. Going forward, we expect corporate and banking segments to grow faster than retail, with a 17.1% CAGR from FY24 to FY27, while retail growth will comparatively slow pace of 13.7%. Overall, net advances are expected to grow at a healthy 15.5% CAGR from FY24 to FY27E.

Deposit growth will be fueled by innovative products and cyclical trends: The deposit crunch caused by cyclical factors seems to be easing, and Kotak’s innovative products will help it benefit as the cycle normalizes. As a leader in CASA among peers, Kotak is expected to see strong deposit growth, with its CASA ratio reaching 47.6% by FY27 due to higher growth in current and savings deposits.

Industry leading asset quality: The bank’s cautious lending strategy has helped maintain strong asset quality by customizing its approach for retail and wholesale loans. With an overall smaller unsecured loan portfolio and robust underwriting standards, it has kept its GNPA/NNPA ratios lower than peers. Despite potential increases in credit costs expected as they, its disciplined approach and healthy capital adequacy will keep its asset quality strong.

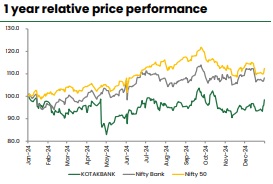

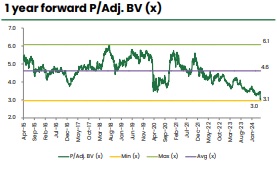

Further possibility for de-rating risk looks limited: Kotak Mahindra Bank’s P/B ratio has declined from 4.41 in March 2019 to 2.65, due to challenges like the pandemic, leadership transition, and increased regulatory scrutiny. With a consistent 12-16% ROE, the bank is well-positioned for a valuation rebound unless another major crisis occurs.

Outlook and valuation: Kotak Mahindra Bank stands out for its strong credit growth and asset quality, driven by a risk-conscious approach. The bank’s margins remain solid, and non-interest income continues to grow. Its subsidiary will play a key role in the bank's future growth. We are reinitiating coverage on Kotak Mahindra Bank with a Buy rating and a target price of Rs 2,188, based on our SOTP valuation, and valuing the standalone bank at 2.2x its FY27E adjusted book value.

Please refer disclaimer at https://www.religareonline.com/disclaimer

SEBI Registration number is INZ000174330