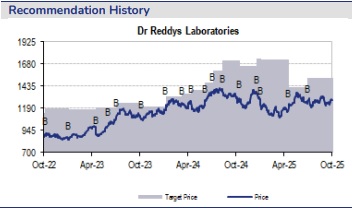

Buy Dr Reddys Laboratories Ltd For Target Rs. 1,522 By JM Financial Services

Ex-US strength drives 2Q; Sema to fuel future growth

Dr. Reddy’s (DRRD) reported healthy 2Q results with Revenue/EBITDA/PAT growth of +10%/- 4%/+9% YoY, slightly below street expectations (+1%/-5%/+1%). The EBITDA miss was due to a 492 bps YoY rise in SG&A expenses from investments in the acquired NRT business, branded generics, a one-time INR 700 mn VAT provision, and charges for a discontinued product. US revenue declined 13% YoY from gRevlimed price erosion, while India grew 13% on better pricing, volumes, and Stugeron acquisition benefits. Europe surged 139% YoY, driven by the NRT portfolio and new launches, while emerging markets rose 14%, led by strong growth in Russia (+28% YoY). PSAI grew 12% YoY. Future growth will be driven by double-digit expansion in ex-US markets from the NRT business, biosimilar launches in the EU, and strong India growth. Additional upside is expected from gSemaglutide pen sales (12 mn in CY26, 15 mn in CY27) and pipeline products like Abatacept. While lower gRevlimid sales may weigh postFY26, DRRD is well positioned to benefit from the upcoming generic GLP-1 wave. Overall the stock remains attractive, and we maintain our BUY rating with a target price of INR 1,522.

* US – Price erosion and lower Lenalidomile sales underpin growth decline:

The generics segment in the US experienced tightness due to product-specific price erosion and lower Lenalidomide sales. Approximately five products faced heightened competition and subsequent price reductions, impacting overall performance in this market. The company however has continued to engage in strategic efforts, including new product launches like Sacubitril Valsartan and Fluorouracil Cream, to drive growth. Management has also expressed uncertainty regarding the future of biologics in the US market on account of US tariffs outcome when it comes, and signalled that a backup plan may be needed.

* Europe - NRT business drives overall growth, momentum to continue with biosimilars launches:

The performance in this region has largely been driven by the contribution from the NRT portfolio and new product launches. This strategic focus on expanding product offerings and tapping into high-demand therapeutic areas is expected to continue driving growth in the coming periods. The growth in the European market is also expected to be supported by the integration of the acquired NRT business, along with the leveraging of the generics portfolio and the launch of biosimilars.

* India - Price and volume driven growth; upgraded to 9th position in IPM:

Growth in 2Q has been driven by a combination of better pricing and increased volumes, along with inorganic growth from the acquisition of Stugeron. Price improvements contributed around 5% to the overall growth, with the remaining growth driven by volume increases and the successful launch of new products. As per IQVIA, the company has moved up to the 9th position in the Indian pharmaceutical market, reflected by a 9.4% YoY growth. Growth in India is expected to continue at the current pace, maintaining its momentum.

* Rituximab – confident of approvals, to drive EU growth:

Management is confident that Rituximab will receive approval, although the USFDA has issued a Complete Response Letter (CRL) concerning unresolved observations related to the Biologics License Application (BLA). If issues with the first fill and finish line (FFM1) persist, the company may consider shifting the product manufacturing to FFM2. Rituximab is recognized as one of the key biosimilars that is expected to contribute significantly to future growth in the European market, alongside other biosimilars like Denosumab and Bibasubovam.

* gSemaglutide – eyeing 12mn pen sales and global expansion in 87 countries:

The company is anticipating feedback from Health Canada in the coming weeks and is confident about selling the planned 12mn pens for Semaglutide. However, if approval or favorable pricing is not secured in Canada, the volume will be absorbed by launches in 87 other countries, including key markets like India, Brazil, and Turkey, along with B2B partnerships. In India, while the company can produce and export the product, the launch is currently constrained until March 2026. Looking ahead, sales volume for Semaglutide is projected to increase to at least 15 million units by CY27. The internal capacity expansion, with two cartridge lines at FTO-11, will not affect launches in the next 12 months but will become relevant for future launches, potentially supporting up to 50mn units. The peptide capacity, currently built up to 800 kg, is small but is expected to grow as it meets the demand for Semaglutide, Liraglutide, and 40 other identified peptides.

* Abatacept (IV) – approvals by CY27, US CMO to aid manufacturing:

The BLA submission for the IV version of Abatacept is scheduled for the end of December 2025, with the Phase 3 trial expected to be completed soon. Approval for the IV version is anticipated to align with the patent expiry, projected for early CY27. To support production, the company plans to utilize a CMO located in the US, in addition to the capacity already built at the Bachupally facility. The CMO will eventually undergo a technology transfer from Bachupally. Meanwhile, approval for the Sub Q version of Abatacept is expected at the beginning of 2028.

* Other financial details:

* SG&A spend increased by focused investments in the acquired NRT consumer healthcare business and in branded generics

* SG&A included a one-time provision of INR700mn for a VAT liability in one subsidiary and charges related to a discontinued pipeline product

* R&D spend declined 15% YoY due to reduced development spends on biosimilars as major investments for Abatacept have already been completed

vOther operating income was significantly higher due to product-related IP settlement income in the United States and a one-time reversal of INR880mn in liabilities related to the discontinuation of a pipeline product

* An impairment charge of INR660mn was recorded, including INR540 mn for PPE at the Middleburgh facility following the discontinuation of the pipeline product conjugated estrogen

* ETR was lower primarily due to a favorable jurisdictional mix

* The company has a net cash surplus of USD 310mn as of Sep-25

* During 2Q it completed filing 43 global generics

* Other Guidance:

* SG&A spend is expected to be in the zone of 28% to 30%

* R&D spend will likely stay in the range of 7% of sales

* The overall pipeline consists of about 100 products, of which approximately 20 are considered complex generics

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361