Buy Dixon Technology Ltd for the Target Rs. 22,500 by Motilal Oswal Financial Services Ltd

In-line 2Q; to benefit from volume and margin improvement

Dixon Technology (Dixon)’s 2QFY26 revenue/PAT came in line with our estimates, with the mobile segment registering a strong growth of 42% YoY. Due to the base effect of Ismartu integration and improved volumes from existing clients, mobile volumes jumped YoY during the quarter. This quarter's performance was hit to an extent by demand slowdown due to GST rate changes and the postponement of decision-making from customers. Demand has started recovering for the consumer durable segment post GST rate cut, and we believe this will further be reflected in 3QFY26 results. With continuous focus on backward integration through component PLI and plans for long-term JV agreements with clients, we believe DIXON will continue to benefit from volume and margin improvements even after the PLI period ends by Mar’26. We marginally revise our estimates to bake in improved margin performance in the home appliances segment. We reiterate our BUY rating with an unchanged TP of INR22,500, based on DCF for the core business and the addition of valuation from its stake in Aditya Infotech.

Reported PAT boosted on fair-value gains

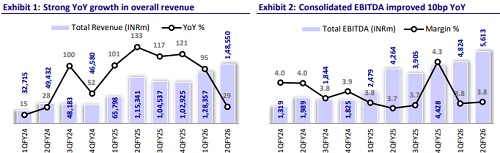

During 2QFY26, Dixon’s revenue and PAT were in line, while EBITDA beat our estimates. The reported PAT was boosted by fair-value gains on Dixon’s stake in Aditya Infotech. Consolidated revenue grew 29% YoY to INR148.6b. Absolute EBITDA grew 32% YoY to INR5.6b, beating our estimate by 7%, while margins expanded 10bp YoY to 3.8% vs. our estimate of 3.6%. The company’s adj. PAT, after excluding the fair value gains on Dixon’s stake in Aditya Infotech and gains on the transfer of the lighting business undertaking, stood at INR2.5b (+16% YoY), broadly in line. Among the segments, the mobile & EMS segment registered 41% YoY growth, while the consumer electronics and home appliances segments remained weak due to deferred demand on GST rate cuts.

Mobile segment to benefit from new client additions

The mobile & EMS segment remained Dixon’s cornerstone, with revenue increasing 41% YoY to INR133.6b, while operating profit rose 53% to INR4.7b. Dixon has received PN3 approval for the 74:26 JV with Longcheer; further, the PN3 approval process for the 51:49 JV with Vivo and the 74:26 JV with HKC are expected in the coming weeks. During the quarter, management indicated steady momentum across smartphone brands and reiterated guidance of around 42m units for FY26, which is expected to increase to 55m-60m units in FY27, including Vivo and Longcheer JV. The construction of the 1m sq. ft. manufacturing campus in Noida remains on track, with commissioning expected by early FY27. Moreover, Dixon continues to diversify its customer base, with discussions underway with another major OEM for production beginning by 4QFY26 with a potential volume of 0.5m per month. This multi-client approach, coupled with higher ODM content, positions the mobile division as a strategic gateway for Dixon’s exports push in the coming years. We expect the Mobile & EMS segment to deliver a CAGR of 38% over FY25-28, with margins improving 60bp by FY28E once the display facility and camera module production start ramping up.

Telecom and IT hardware to be the next growth engine after mobile phones

Dixon’s telecom and networking division has emerged as the company’s next major growth pillar, reflecting its success in diversifying beyond consumer electronics. Revenues in this segment jumped sharply 148% YoY to INR16.4b, driven by strong demand for broadband CPE devices and set-top boxes, as well as deeper engagements with global telecom partners. Dixon also received a large order from a leading US telecom customer to produce microwave radio units used in radio access networks. Pilot production is scheduled for Dec-end, with commercial manufacturing to start by 4QFY26, followed by export shipments from mid-FY27. Management estimates this opportunity could evolve into a USD1b business in the next few years. The segment is seeing greater localization of components like plastics and power supplies, boosting margins. With India’s broadband growth and global supply chains shifting from China, Dixon’s timely entry into network equipment manufacturing could soon make telecom its next major growth engine after mobiles. The IT hardware division recorded a near fivefold YoY jump to INR3.3b, driven by ramp-up at the Chennai facility for global clients such as HP, Lenovo, and Acer. The upcoming JV with Taiwan’s Inventec will further enhance manufacturing depth across notebooks, servers, and desktops, supported by inhouse component integration.

Consumer electronics and home appliances remain weak during 2QFY26

The consumer electronics segment witnessed temporary volume softness due to deferred decision-making after the GST rate cuts, but Dixon continued to strengthen its position through design and technology upgrades. LED TVs led revenue from this segment, where the company increased its ODM share to 60% by offering multiple OS platforms such as Google TV, Fire OS, WebOS, and Tizen. Refrigerators, impacted by new energy norms and GST timing, are gaining traction in mini-bar and deepfreezer models, with plans to enter the two-door and side-by-side categories. In home appliances, revenue was INR4.3b with margins of 11.7%, and expansion at Tirupati is nearing completion. In lighting, Dixon’s 50:50 JV with Signify (Philips) has already executed pilot orders for leading US and German retailers, marking a step into higher-value, design-led exports.

Investing in component PLI and has received mobile PLI too

The company has filed for component PLI with an investment commitment of INR30b over three years for displays, camera modules, lithium-ion batteries, SFPs, mechanical enclosures, etc. With this, it would remain focused on backward integration. Dixon’s PLI receivable stands at about INR14-15b, with INR2.9b already booked in the first half and additional inflows expected from mobile, telecom, and lighting segments.

Financial outlook

We revise our estimates to factor in better margin assumptions in home appliances and expect a CAGR of 36%/41%/46% in revenue/EBITDA/PAT over FY25-FY28. Revenue growth would be mainly driven by the mobile segment, while consumer electronics will remain under pressure for some more time. We expect an EBITDA margin of 3.8%/4.1%/4.4% for FY26/FY27/FY28, led by increased focus on backward integration post PLI. This will result in a PAT CAGR of 46% over FY25-FY28E.

Valuation and view

The stock is currently trading at 60.3x/45.9x P/E on FY27/28E earnings. We reiterate our BUY rating on the stock with an unchanged DCF-based TP of INR22,500.

Key risks and concerns

The key risks to our estimates and recommendations would come from the lowerthan-expected growth in the market opportunity, loss of relationships with key clients, increased competition, and limited bargaining power with clients.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412