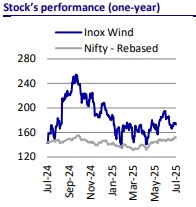

Buy INOX Wind Ltd for the Target Rs. 210 by Motilal Oswal Financial Services Ltd

Energizing India's Wind Opportunity

* Initiate with BUY and a TP of INR210: We initiate coverage on INOX Wind Limited (IWL) with a BUY rating and a TP of INR210/share, implying 21% upside. IWL is a leading vertically integrated player in India’s wind energy sector, delivering end-to-end solutions from conception and commissioning to O&M of wind power projects. With a manufacturing capacity of 2.5GW annually across four facilities, IWL produces 2MW and 3MW Wind Turbine Generators (WTGs). As of FY25-end, IWL holds a robust order book of ~3.2GW, offering strong revenue visibility for at least two years. Its listed subsidiary, Inox Green Energy Services Ltd. (IGESL) (55.93% stake), manages a significant 5.1GW O&M portfolio. Meanwhile, its other subsidiary, Inox Renewable Solutions Limited (IRSL, 93% stake), is diversifying beyond wind EPC into solar, hybrid EPC, and specialized services such as crane operations—broadening IWL’s market reach and service offering.

* Wind energy's critical role in India's renewable future: By 2030, wind energy is expected to account for ~20% of India’s Renewable Energy (RE) mix vs. 39% in the US and Germany, 33% in China, and 42% in the UK, highlighting the need for greater focus on wind energy development in India. Given the need for round-the-clock power, we believe that Hybrid and Firm and Dispatchable Renewable Energy (FDRE) tenders—which necessitate certain wind proportion—are the way forward. While there are concerns that the combination of solar energy and storage solutions may exert pressure on the wind proportion, in reality, this remains largely conceptual with very limited implementation on the ground.

* Strong domestic player backed by a rising order book and O&M synergies: IWL is well-positioned to capitalize on India’s ambitious target of expanding its installed wind capacity from 50GW at the end of FY25 to 100GW by 2030, supported by the projected increase in annual installations (6GW in FY26, 7- 8GW in FY27, and 9GW from FY28 onwards, according to Suzlon Energy Limited, (SUEL)). With a rapidly growing order book of 3.2GW as of FY25-end (58% turnkey), we believe the earnings growth outlook remains promising. IWL benefits from integrated operations and synergies across the group, including IGESL’s 5.1GW O&M portfolio (incl. solar and wind) and IRSL’s proven 3GW + EPC track record, enabling faster execution, cost optimization, and improved profitability.

* RLMM can be a game-changer for Indian OEMs; SUEL and IWL key beneficiaries: The Ministry of New and Renewable Energy (MNRE) has released a draft notification proposing amendments to the procedure for inclusion/updating of wind turbine models in the revised list of models and manufacturers (RLMM) of wind turbines. The draft amendment mandates local sourcing of key components, providing a strong boost to the prospects of Indian OEMs while diminishing the pricing edge for Chinese players. The draft, if finalized, also goes a long way in alleviating concerns regarding competition from Chinese OEMs and a potential loss of market share and pressure on margins (link).

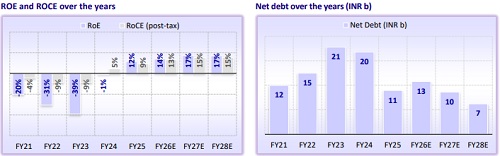

* 38% EBITDA CAGR in FY25-28 amid strong WTG execution and O&M capacity growth: We expect IWL to deliver a strong Consol. EBITDA CAGR of 38% over FY25-28, supported by a ramp-up in WTG execution from 705MW in FY25 to ~1.1/1.6/1.8GW in FY26/27/28 and sustained healthy EBITDA margins of ~17%. We also anticipate O&M contracted capacity (Wind + Solar) to nearly triple from 3.5GW in FY25 to 9.6GW by FY28. We estimate a CAGR of 27%/54%/65% in O&M revenue/EBITDA/adjusted PAT over FY25-28.

* EPC business set to gain from IPP foray: The EPC business is strategically positioned to capitalize on the group’s expansion into the IPP and solar/hybrid O&M (via INOX Clean Energy and INOX Green Limited), effectively complementing its existing and growing execution of wind projects. Additionally, IRSL is broadening its service portfolio beyond traditional wind EPC and power evacuation to include crane services, transformer manufacturing, and other related offerings. This diversification creates a unique value proposition, as no other company in India currently provides such a comprehensive suite of services under one umbrella.

* Group reorganization toward enhanced operational efficiency: Following the NCLT approval on 10th Jun’25, IWL completed its merger with IWEL. The transaction resulted in a ~INR20b liability reduction and is expected to streamline the group structure by removing the holding-subsidiary layer while enhancing transparency and operational efficiency. Meanwhile, IGESL is advancing the demerger of its power evacuation division to integrate it into IWL’s another subsidiary, IRSL. This restructuring aims to strengthen IGESL’s standalone performance by establishing an asset-light balance sheet, thereby reducing depreciation expenses while ensuring revenue remains largely unaffected. The move is projected to reduce depreciation by ~INR480m annually and, thus, boost IGESL’s PAT. The demerger scheme has been filed with the BSE and NSE, and the company expects the demerger to be completed by 2025.

* Valuation and view: We arrive at a TP of INR210 by applying a target P/E of 25x to FY27E EPS, which is at a 29% discount to our target multiple for SUEL. IWL is currently trading at FY27 P/E of 20.5x, which is at a 28% discount to its direct competitor, SUEL.

* Key risks: 1) Rising competition from Chinese and European players as wind installations pick up; 2) Potential pressure on realizations/margins for WTGs; 3) Dependency on ISTS waiver for project economics; 4) Technological changes leading to product obsolescence; 5) Delays in project execution leading to slower-than-expected execution of the order book; and 6) Volatility in raw material prices, operational expenses, and overhead costs.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)