Buy ACC Ltd For Target Rs. 2,380 by by Axis Securities

Beat Led By Incentive & Higher Other Income

Est. Vs. Actual for Q3FY25: Revenue – BEAT; EBITDA Margin – BEAT; PAT– BEAT

Change in Estimates post Q3FY25 (Abs.)

FY25E/FY26E: Revenue: 5%/5%; EBITDA: 25%/6%; PAT: 66%/3%

Recommendation Rationale

* Strong volume growth: In Q3FY25, the company achieved a 20% YoY increase in volume, reaching 10.7 mtpa, driven by higher trade volumes and an 11% YoY increase in premium product volumes, further strengthening its market leadership. It maintained its dominant position across key markets. The company’s capacity expansion plans remain on schedule, and they are expected to support sustained volume growth in the future. It is projected to deliver a volume growth of 14% CAGR over FY23-FY26E.

* Lower realisation impacts EBITDA margins (adjusted for incentive received): During the quarter, blended cement prices declined by 12% YoY and 2% QoQ, settling at Rs 4,867/tonne on an adjusted basis. This negatively impacted the EBITDA margin, leading to a decline of 1080 bps YoY and 190 bps QoQ despite stable production costs.

* Robust cement demand to sustain: Cement demand is expected to remain strong, with the industry projected to grow at a CAGR of 7-8% over FY23-FY26. This growth is likely to be driven by higher spending on infrastructure projects, affordable and rural housing initiatives, an increase in private capital expenditure, and sustained demand from the real estate sector.

Sector Outlook: Positive

Company Outlook & Guidance: The cement sector recorded a modest 1.5-2% growth during H1FY25. Cement demand is expected to rebound in Q4FY25 as construction activity picks up in the infrastructure and housing segments. The pro-infra and housing focus in Budget 2025 and increased government spending on infrastructure and construction will likely further drive this growth. Cement demand for FY25 is projected to grow in the range of 4-5%.

Current Valuation: 11x FY26 EV/EBITDA (Earlier Valuation: 12x FY26 EV/EBITDA)

Current TP: Rs 2,380/ share (Earlier TP: Rs 2,475/share)

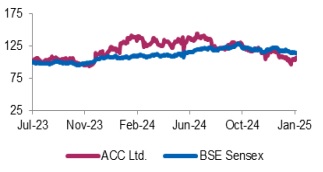

Recommendation: We change our rating from HOLD to BUY on the recent correction in stock price.

Alternative BUY Ideas from our Sector Coverage: Dalmia Bharat (TP-2,000/share), UltraTech Cement (TP-13,510), JK Cement (TP-5,380/share)

Financial Performance

ACC reported results that exceeded expectations, driven by higher incentives and other income during the quarter. Adjusted for these, sales were above expectations, while the EBITDA margin was below the anticipated 12%, coming in at 7.6%. The company posted a 6% YoY revenue growth on an adjusted basis, supported by a 20% volume growth to 10.7 mtpa, attributed to increased trade volumes and higher sales of premium products

The adjusted EBITDA margin of 7.6% compared to 18.4% YoY was below estimates, primarily due to lower realisations. ACC's blended EBITDA per tonne stood at Rs 1,043, up 3% YoY, while adjusted EBITDA per tonne was Rs 370. On an adjusted basis, blended realisations per tonne were Rs 4,867, down 12% YoY and 2% QoQ. Cost per tonne remained flat both YoY and QoQ at Rs 4,497. The company reported a profit of Rs 1,097 Cr, up 103% YoY, while APAT stood at Rs 371 Cr

Outlook: The company’s capacity expansion plans are progressing well and are expected to contribute to its volume growth in the future. The increased expenditure on infrastructure development, particularly in areas such as roads, railways, affordable housing, and other initiatives, will catalyse cement demand. Additionally, improved synergies with other group entities will further support the company’s growth trajectory in the foreseeable future. Given these factors, the company’s mid-to-long-term prospects remain positive. However, lower cement prices pose challenges to the company’s operational performance in the short term

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633