Building Materials : Jul-Sep'25 Earnings Preview by JM Financial Services Ltd

Extended monsoon to impact BM sector

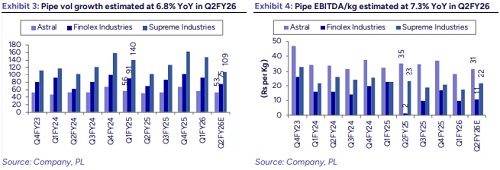

Building materials (BM) companies under our coverage are expected to report single-digit revenue growth due to weak demand and extended monsoon; however, margins are expected to expand due to cost reduction measures and cooling of timber cost. We anticipate moderate volume growth of 6.8% YoY in the plastic pipe sector. Tiles and bathware sectors are likely to experience single-digit growth anticipating demand to pick up in H2FY26. We expect coverage companies to register sales/EBIDTA/PAT growth of 4.3%/18.1%/16.6% YoY. Expecting Century Plyboards to outperform in the BM space.

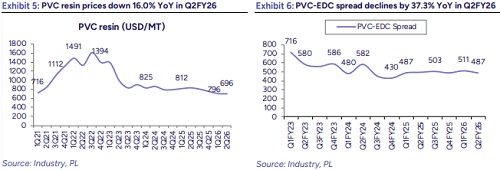

* Plastic pipe - Weak volume growth continues:

Plastic pipe companies under our coverage are expected to report soft volume growth of 6.8% YoY, due to low channel inventory resulting from delays in ADD implementation, extension of BIS for PVC resin, subdued demand and extended monsoon. We estimate revenue growth of +3.6% YoY. However, EBITDA and PAT are expected to increase by 13.5% and 12.8% YoY, respectively, due to margin expansion of ~115bps YoY. Supreme Industries (SI) and Astral are expected to post soft sales growth of +4.7% and +2.9% YoY, respectively, with volume growth in the pipes & fittings (P&F) segment at 7.0% for SI and 5.0% for Astral due to weak demand during the quarter. However, Finolex Industries are expected to outperform with volume growth of 7.7%.

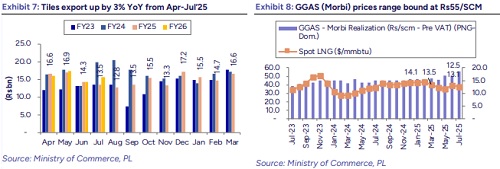

* Tiles & bathware – Soft performance for KJS & CRS:

Kajaria is expected to report muted revenue growth of ~1.2% YoY, driven by modest tiles volume growth of 2.5% YoY. Domestic demand remains moderate, due to extended monsoon and increased competitive intensity driven by reduced exports from Morbi players, leading to increased domestic supply. However, as exportrelated challenges begin to ease, Morbi exports are expected to pick. Despite steady volumes, EBITDA margin for Kajaria is expected to expand to 17.0%, due to cost rationalization measures and closure of the low-margin plywood business. Cera Sanitaryware (CRS) is expected revenue to increase by 6.0% YoY. EBITDA margin is expected to decline by 90bps to 13.7%, with PAT likely to decline by 13.3% YoY.

* Woodpanel – Plywood to continue to outperform:

Century Plyboards (CPBI) is expected to sustain volume growth in the plywood segment, driven by market share gains. CPBI is expected to deliver moderate sales growth of 9.8% YoY, with EBITDA margin of 12.6%. In the MDF segment, realizations are expected to be maintained on account of decline in MDF imports with BIS implementation and no major capacity addition expected in FY26 and FY27. We expect MDF volume growth of +7.0% YoY for CPBI and +8.4% YoY for Greenpanel. Plywood volume growth is estimated at +9.0% YoY for CPBI and -8.2% YoY for Greenpanel. Additionally, CPBI’s laminate segment is expected to see volume growth of 10.0% YoY, aided by an improvement in the exports business. Overall, the wood panel coverage universe is expected to report revenue growth of +8.4% YoY, while EBITDA and PAT are likely to increase by 34.6% and 35.6% YoY, respectively, due to estimated EBITDA margin expansion of ~220bps YoY.

* Coverage TP changes:

As we roll forward our TP to Sep’27E and introduce FY28 numbers, we upward revise our TP for all the companies and upgrade our rating for CRS to ‘BUY’ from ‘Accumulate’ and SI to ‘Accumulate’ from ‘HOLD’, while maintaining for other companies.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361