Spreads See Mild Uptick in November 2025 by CareEdge Ratings

Synopsis

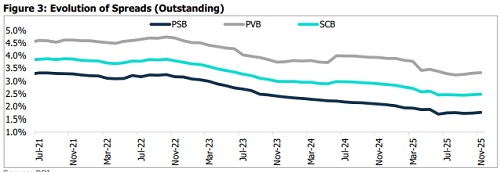

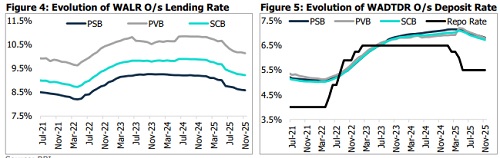

* In November 2025, the spread between the outstanding (o/s) weighted average lending rate (WALR – Lending Rate) and the o/s weighted average domestic term deposit rate (WADTDR – Deposit Rate) for scheduled commercial banks (SCBs) marginally increased by two basis points (bps) on a month-on-month (m-o-m) basis, to 2.48%.

* The SCBs’ lending rate on o/s rupee loans fell by three bps m-o-m to 9.21%, driven by ongoing policy rate cut transmission, softer credit demand, and competitive pricing pressure among banks.

* The deposit rate on o/s rupee term deposits declined by five bps to 6.73%, driven by seven, six and five-bps reduction by foreign banks (FBs), private sector banks (PVBs) and public sector banks (PSBs) respectively, reflecting efforts to protect margins.

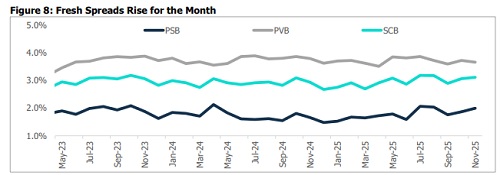

* In November 2025, SCBs’ fresh spread increased by five bps, standing at 3.12%. This uptick was primarily driven by credit growth and a strategic shift in loan portfolios toward higher-yielding segments such as MSMEs. Additionally, banks defended their margins amid ongoing policy rate cuts by optimising their asset mix and repricing liabilities.

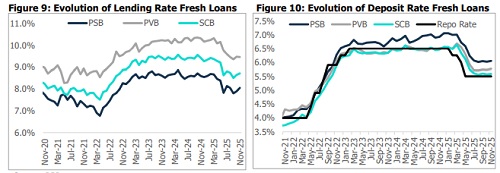

* As of November 2025, lending and deposit rates on fresh loans for SCBs increased by seven and two bps m-o-m to reach 8.71% and 5.59%, respectively. Banks have made deliberate efforts to protect lending rates by shifting exposures from low-yield segments to those offering slightly higher yields. At the same time, competitive pressures on deposits have kept the increase in the fresh deposit rate at a slower pace.

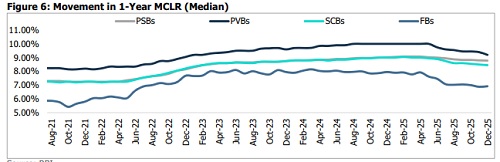

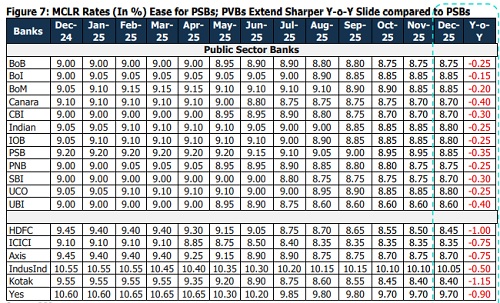

* In December 2025, the one-year median MCLR declined by five bps m-o-m to 8.45%. The moderation was led by PVBs, whose one-year median MCLR fell by 20 bps to 9.20%, and PSBs, whose one-year median MCLR fell by two bps to 8.78%. In contrast, foreign banks (FBs) increased their MCLR by four bps to 6.92%, suggesting transmission by PVBs relative to peers during the month

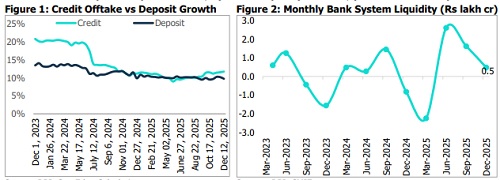

Credit Offtake Outpaces Deposit Growth; Systemic Liquidity Declines, yet Remains in Surplus

* Bank credit offtake continued to exhibit steady momentum, registering a y-o-y growth of 11.7% as of the fortnight ended December 12, 2025, higher as compared to 11.3% a year earlier. This expansion reflects the supportive impact of recent GST rate reductions, robust demand from the retail and MSME segments, led by rural markets, a steady recovery in urban demand, early signs of a revival in industrial credit, and opportunistic corporate borrowing. As of December 12, 2025, aggregate bank deposits stood at Rs 242.1 lakh crore, registering a year-on-year growth of 9.7%. Deposit growth trailed the 11.5% expansion recorded in the corresponding period last year, attributable to lower bank deposit rates and savers' shift toward alternative investment avenues yielding higher returns.

* The banking system liquidity reduced yet remained comfortable at an average surplus of Rs 0.5 trillion by the end of December 2025. As per CareEdge Economics, liquidity conditions have benefited from the final tranche of the CRR cut (injecting ~Rs 600 billion in end Nov) and recent OMO purchases. Additionally, the RBI announced liquidity measures in January 2026, including Rs 1 trillion in OMO purchases and a three-year USD/INR buy-sell swap of USD 5 billion, to maintain adequate liquidity and support policy transmission.

O/s Spread Witness a Marginal Uptick in November 2025

As of November 2025, the o/s spread between lending and deposit rates for SCBs improved marginally by two bps m-o-m to 2.48%, primarily driven by a faster decline in outstanding deposit rates. Improved liquidity conditions and a favourable loan mix further supported this modest expansion in spreads.

Outstanding Business: Deposit and Lending Rates Decrease

* As of November 2025, SCBs' outstanding lending rate decreased by three bps m-o-m to 9.21%, with PSBs reducing by two bps to 8.58%, while PVBs reduced by four bps to 10.13% as banks passed on the rate cuts but moderated the impact of falling yields by adjusting the loan mix. Meanwhile, the outstanding deposit rates of SCBs decreased by five bps to 6.73%, reflecting repricing of deposit portfolios toward lower market rates, thereby easing funding costs and protecting margins. PSBs, PVBs, and FBs declined by five, six and seven bps, reaching 6.80%, 6.73% and 5.07% respectively.

MCLR Rates Witness a Downtick For the Second Consecutive Month

* On a m-o-m basis in November 2025, the one-year median MCLR decreased for the second consecutive month by five bps to 8.45%, supported by recent reductions in term deposit rates. On a y-o-y basis, the MCLR is now 55 bps lower, but it remains 25 bps above the pre-pandemic level of February 2020.

* In November 2025, fresh spreads increased m-o-m, with SCBs standing at 3.12%, supported by PSBs, which increased by 13 bps to 2.00%. This was due to credit growth, a cautious portfolio shift toward the higher-yield segment, and banks' defending margins amid slower rate-cut transmission. In contrast, PVBs declined by six bps to 3.67%, attributable to competitive pressures and lower deposit costs. Additionally, fresh spreads continue to remain higher than outstanding spreads.

Fresh Lending and Deposit Rates Witness an Uptick

* The lending rate on fresh loans for SCBs increased by seven bps m-o-m, to 8.71%. PSBs increased by 16 bps, reaching 8.05%, likely due to changes in the portfolio mix. In contrast, PVBs declined marginally by two bps to 9.44% as of November 2025, attributable to competitive pricing. Additionally, fresh deposit rates for SCBs increased marginally by two bps m-o-m to 5.59%. PSBs and PVBs saw slight increases of three and four bps, respectively, standing at 6.05% and 5.77% as of November 2025, due to competitive pressures in deposits, and rate-sensitive savers are also pushing banks to raise deposit rates.

Conclusion

As of November 2025, SCBs witnessed a marginal uptick in spreads, supported by a modest rise in lending yields despite ongoing competitive pressures. Following the RBI’s 25 bps repo rate cut in December 2025, the lending rates are expected to soften. However, the transmission may be partial and delayed, as banks remain cautious in repricing amid persistent deposit cost pressures. Going forward, the sustainability of net interest margins (NIMs) will depend on banks’ ability to navigate this evolving rate environment. Strategic portfolio rebalancing toward higher yield segments, coupled with calibrated deposit repricing, will be critical. As a result, margins are likely to face mild downward pressure post the rate cut, with the extent of impact varying across bank groups

Above views are of the author and not of the website kindly read disclaimer