BPCL Reports 62% Surge in Profit After Tax – Delivers Stellar All-Round Performance in Q3 FY26

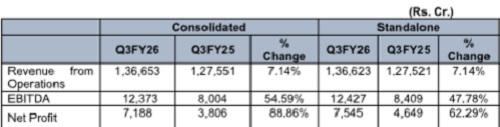

Bharat Petroleum Corporation Limited (BPCL), one of India’s leading energy companies, has announced its financial results for the 3 rd quarter and nine months of FY 2026, showcasing a robust operational and financial performance. BPCL on standalone basis achieves Rs.1,36,623.06 Cr in revenue for the 3 rd quarter of FY 2026, reaffirming its market leadership. Revenue for nine months of FY 2026 stood steady at Rs.3,87,771.85 Cr.

On Standalone basis, BPCL recorded a Profit After Tax (PAT) of Rs.7,545.27 crore in Q3 of FY 2026, marking a 62% increase compared to Rs.4,649.20 crore in the corresponding quarter of the previous fiscal year. This exceptional growth reflects the company’s strategic

focus on operational excellence, marketing efficiency, and strong sales momentum. BPCL declared Interim dividend of Rs.10/share, bringing total interim dividend for FY 2025- 26 at 17.5/share on face value of Rs. 10/share.

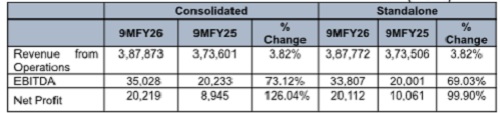

On Standalone basis, BPCL registers nine months Profit After Tax (PAT) of Rs.20,111.73 crore in FY 2026, compared to Rs.10,061.20 crore in corresponding period of previous fiscal year showing remarkable 100% jump over last year.

Key Highlights – Q3 FY2025-26

* Refinery Throughput: Achieved 10.51 million metric tonnes (MMT) with a capacity utilization of 119%, compared to 9.54 MMT in Q3 FY25.

* Domestic Market Sales: Registered quarterly domestic sales of 14.07 MMT, a growth of 4.76% over 13.43 MMT in Q3 FY25.

Q3 FY26 FINANCIAL HIGHLIGHTS

PRESS RELEASE

Key Highlights – 9M FY2025-26

Refinery Throughput: Achieved 30.75 million metric tonnes (MMT) with a capacity utilization of 116%, compared to 29.93 MMT in 9M of FY25.

Domestic Market Sales: Registered domestic sales of 40.32 MMT, marking a

growth of 3.44% over 38.98 MMT in 9M of FY25.

Gross Refining Margin (GRM): Reported strong GRM of $9.68 per barrel for 9M of

FY 2026, compared to $5.95 per barrel in the same period last year.

9M FY26 FINANCIAL HIGHLIGHTS

Above views are of the author and not of the website kindly read disclaimer