Axis Top Picks for the month of December 2025- Axis Securities

Base Building for Better Second Half; Earnings & Tariffs Continue to Drive Market

Strong 1500+ points Rally in Nifty 50 since Oct’25: After seeing some pullback in Jul/Aug’25, a broad-based recovery was seen since Oct’25. Nifty 50 saw a comeback with a 1500+ points rally. This was led by 1) Better-than-expected earnings performance for the first half, 2) Optimism building for 15% tariffs for India, 3) Early signs of consumption pickup, 4) Stable currency, 5) Relative attractiveness in valuations vs other emerging markets, and 6) Positive sentiments. Based on the above developments and after almost 14 months of underperformance, Nifty touched the all-time high level of 26,203 on 28th Nov’25 (similar levels were earlier seen in Sep’24). During the same period, the Midcap index is marginally up by 1% while the Smallcap index is still lower by 9%. In the coming weeks, the market will closely monitor developments in the India-USA negotiations on tariffs, RBI monetary policy, US FED meeting outcomes, and other high-frequency indicators.

Indian Economy on the verge of cyclical recovery; however, Global Challenges Likely to Persist: Despite external risks, India’s domestic growth trajectory remains intact, with key macroeconomic factors supporting a stronger FY26 compared to FY25. Both the RBI and the government are providing support by front-loading all pro-growth fiscal and monetary measures to the Indian economy. These include a) A 50 bps CRR cut in Dec’24, b) A 100 bps rate cut till now, c) Improved bank liquidity, d) The RBI Dividend, e) A consumption boost provided in the budget, and f) An uptick in the government CAPEX spending. On top of this, the government has implemented GST 2.0 reforms. These developments collectively indicate that our economy is at an inflexion point and will gain benefits in the second half and onwards. All these factors indicate an even better FY27 vs FY26. The reform agenda from the central government is again back on track, with recent reforms like GST 2.0, the New Labour policy, and PLI on rare earth magnets indicating that the focus is back on reforms. This has been further strengthened after the blockbuster victory of the ruling government in Bihar.

However, the current geopolitical situation has not been in India’s favour as the Trump administration continues to impose tariffs on Indian products, and the resolution is not on the cards till now. Any prolonged negotiations will further dent export orders, accentuating pressure on the currency and creating headwind for the earnings of the Indian corporates. Till then, the market would remain vigilant on developments around tariff negotiations. Along with the geopolitical situation, the substance of the earnings from Q3FY26 onwards remains critical for the market, as consumption has shown an early sign of pickup, but broad-based earnings and substance remain to be seen by the market. However, the base is building for the better second half, and that will likely drive the market performance further.

Relative Underperformance Provides an Opportunity to Add Equity for the Long Term: On a YTD basis, the Indian market has underperformed the US market and other emerging markets by a notable margin. FTSE India is now trading at a PE premium of 60% to the EM index (PE), vs. an average premium of 44%. During Sep’24, the Indian market traded at a 97% PE premium to EM. And now, after the correction, it is trading at a 60% premium, which looks attractive compared to the past. That said, it is to be noted that relative valuation stabilisation does not necessarily translate into an immediate rally in the current scenario. Markets, in addition to various other developments, are expected to track the following four key parameters: 1) Progress on US trade negotiations, 2) Revival of the earnings growth cycle, which is likely to start from Q3FY26 onwards, 3) Revival in a credit growth cycle, and 4) Transmission of fiscal and monetary benefits into consumption growth.

Style & Sector Rotation - A Key to Generating Alpha Moving Forward: RiskReward is slowly building towards Mid and Smallcaps. Nonetheless, recovery will be slow and gradual as we progress towards FY26, led by strong earnings expectations, improving domestic liquidity, and stable Indian macros. We believe the market needs to sail through another couple of months smoothly before entering into a concrete direction of growth. As a result, we expect near-term consolidation in the market, with breadth likely remaining narrow in the immediate term. Against this backdrop, our focus remains on Growth at a Reasonable Price, ‘Quality’ stocks, Monopolies, Market Leaders in their respective domains, and domestically-focused sectors and stocks. These, we believe, may outperform the market in the near term. Based on the current developments, we 1) Continue to like and overweight BFSI, Telecom, Consumption, Hospitals, and Interest-rate proxies, 2) Continue to maintain positive view on Discretionary and Retail consumption plays, 3) Prefer certain capex-oriented cyclical plays that look attractive at this point due to the recent price correction as well as reasonable growth visibility in the domestic market in FY26, and 4) Maintain cautious stance on export-oriented sector due to tariff overhang and macroeconomic uncertainties

Based on the recent developments, we have made a few changes to our Top Picks recommendations. This includes booking profit in Hero Motocorp and Shriram Finance, and the addition of Chalet Hotels and Ujjivan Small Finance Bank. Our modifications reflect our increasing comfort with ‘Growth at a Reasonable Price’ picks. Our Key Themes

Key Monitorables in FY26: Most significant events are now behind us, with the majority of negative concerns regarding earnings already factored into the price. Hereon, the market will closely monitor the following global events: 1) Developments in the US government’s policies and negotiations, 2) Developments in the reciprocal tax, 3) Further rate cuts by the US FED in 2025 based on the growth and inflationdynamics, and 4) The direction of currency and oil prices in the remaining part of FY26.

On the domestic front, a series of domestic events suggests better days ahead in FY26 than FY25. These are 1) A 50bps CRR cut by the RBI in Dec’24, 2) Consumption boost in the Union Budget, 3) 100 bps of rate cuts by the RBI, 4) Improved liquidity measures by the RBI, 5) GST 2.0 reforms, and 6) RBI MPC meeting outcome on rate cuts. These events indicate better days ahead in FY26, with improved credit growth and overall consumption improvements. These developments suggest a revival of economic momentum in FY26 compared to FY25, which would remain the primary driver of earnings growth for Indian corporates moving ahead. Domestically, the key risk lies not in the intent of policy but in the pace of its transmission. While rate cuts, fiscal relief, and capital spending are already in motion, delayed reflection in corporate earnings could keep investor sentiment cautious. On the positive side, rural demand is showing early signs of recovery. If this holds alongside government spending, domestic risks should be well contained.

We roll over the Nifty target to Dec’26 at 28100

We believe the Indian economy remains well-positioned for growth, serving as a stable haven amidst global economic volatility. We remain confident in India’s longterm growth story, supported by its favourable economic structure, rising capex, and the consumption boost from the recent Union Budget and GST 2.0 reforms, driving credit growth for banks. This is expected to support double-digit earnings growth, ensuring that Indian equities can deliver strong double-digit returns over the next 2-3 years. Against this backdrop, we foresee Nifty earnings to post excellent growth of 13% CAGR over FY23-28. Financials will remain the biggest contributors for FY26/27 earnings. However, trade policy uncertainty, rupee depreciation, and delay in earning revival remain key risks to near-term market multiples. In our base case, we roll over the Nifty target to Dec’26 to 28,100 by valuing it at 20x on Dec’27 earnings. Based on the expectations of the earnings upgrade starting from Q3FY26 onwards, we see upside risk to our target.

The current level of India's VIX is below its long-term average, indicating that the market is currently in a neutral zone (neither panic nor exuberance). While the medium to long-term outlook for the overall market remains positive, we may see volatility in the short run. Hence, we recommend investors maintain good liquidity (10-15%) to use any dips in a phased manner and build a position in high-quality companies (where the earnings visibility is quite high) with an investment horizon of 12-18 months.

Bull Case: In the bull case, we value NIFTY at 21x, translating into a Dec’26 target of 29,500. Our bull case assumption is based on the Goldilocks scenario, which assumes an overall reduction in volatility and a successful soft landing in the US market. The market is keenly watching the global growth scenario in 2026 under Trump's presidency, in which uncertainty related to tariffs is likely to be reduced compared to 2025. Furthermore, private Capex, which has been sluggish for the last several years, is expected to receive a much-needed boost in the upcoming years, with the expectation of policy continuity. Backed by expectations of political stability, policy continuity, fiscal prudence, an improving private Capex cycle, rural revival, and a soft landing in the US market, Nifty earnings are likely to grow ever higher than 13%+ CAGR for FY23-28. This would augur well for capital inflows into emerging markets (EMs) and increase the market multiples in the domestic market.

Bear Case: In the bear case, we value NIFTY at 17x, translating into a Dec’26 target of 24,000We assume the market will trade at above-average valuations, led by the likelihood of a policy shift in the Trump regime. Moreover, we presume that inflation will continue to pose challenges in the developed world. The global market has not seen such elevated interest rates in the recent past. Hence, the chances of going wrong have increased significantly. Nonetheless, the direction of currency, oil prices, and global trade developments will likely put pressure on export-oriented growth in the remaining part of FY26. Moreover, the question mark on the global growth has significantly increased after the imposition of Trump tariffs. These developments will likely bring down the market multiple in the near term. However, based on the recent developments, the chances of this scenario playing out have reduced significantly.

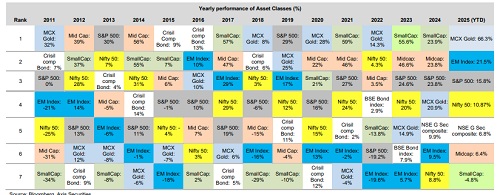

Multi-Asset Scorecard

* In 2025, Gold emerged as the top-performing asset class once again

* Gold led asset performance in 2024 until the end of May, after which the broader market took the lead. However, by Oct'24, Gold reclaimed its position as the top-performing asset class. On a YTD basis, Gold remains the best-performing asset.

* The broader market was the best-performing asset class domestically in 2023 and 2024. However, a sharp correction since Oct’24 impacted overall returns. Nonetheless, recovery is clearly visible since the last 3-4 months.

* Nifty 50 ranked at the bottom in 2024 for the first time in history, primarily due to sustained FII selling in the last three months of the year.

* On a YTD basis, Emerging and Developed Markets have outperformed the Indian market by a notable margin.

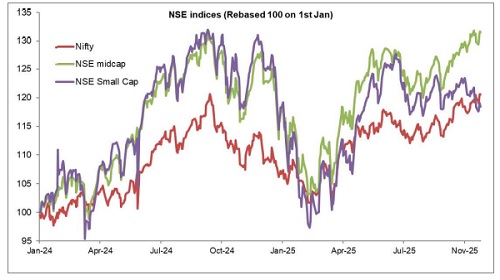

All Three Indices Moving in Tandem; Strong Recovery in the Midcap Index

After almost 14 months of underperformance, Nifty touched the all-time high level of 26,203 (similar levels earlier seen in Sep’24). During the same period, the Midcap index is marginally up by 1% while the Smallcap index is still lower by 9%.

* Nifty 50: 16%

* NSE Mid Cap 100: 21%

* NSE Small Cap 250: 2

Performance on a YTD basis

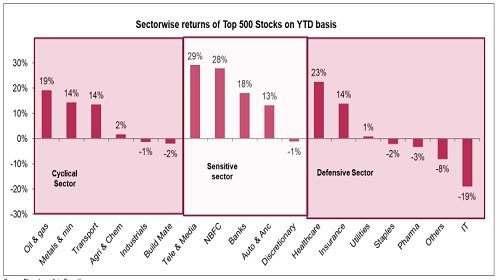

* Cyclical and rate-sensitive sectors have outperformed the Defensive sector by a notable margin.

* Market positioning is slightly shifting towards rate-sensitive and domestic-oriented sectors.

* Export-oriented sectors continue to face challenges in the volatile global environment of the Trump tariff

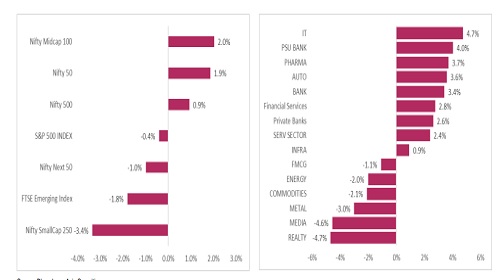

What Happened in the Last One Month

* Strong recovery was seen in the broader market; the Indian market outperformed in the last month

* Midcap index saw the strongest recovery

* PSU Banks, IT, Pharma, Auto, and Banks saw a good rally, while Media and Realty showcased subdued performance

* After underperforming for a couple of years, the BFSI sector has been witnessing a strong comeback

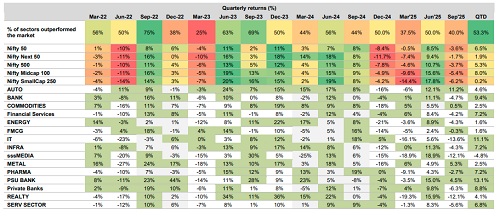

Quarterly Sector Scoreboard

* 53% of the sectors have outperformed the Nifty 50 in the current quarter, indicating that a majority of the negatives are already priced in.

* Dec’24 and Mar’25 quarters’ performance was similar to the Jun’22 (Russia-Ukraine) and Mar’23 (Adani crisis) quarters.

* In the current quarter, the PSU Banks, IT, Banks, Infra, Pharma, and Services sector have outperformed the Nifty 50 index

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

More News

Stocks in News & Key Economic Updates 04th December 2025 by GEPL Capital