Astra Microwave Products moves up on incorporating wholly-owned subsidiary

Astra Microwave Products is currently trading at Rs. 653.00, up by 2.65 points or 0.41% from its previous closing of Rs. 650.35 on the BSE.

The scrip opened at Rs. 659.80 and has touched a high and low of Rs. 659.80 and Rs. 646.00 respectively. So far 3985 shares were traded on the counter.

The BSE group 'A' stock of face value Rs. 2 has touched a 52 week high of Rs. 690.00 on 09-Feb-2024 and a 52 week low of Rs. 213.15 on 28-Mar-2023.

Last one week high and low of the scrip stood at Rs. 689.10 and Rs. 627.00 respectively. The current market cap of the company is Rs. 6174.75 crore.

The promoters holding in the company stood at 6.54%, while Institutions and Non-Institutions held 17.73% and 75.73% respectively.

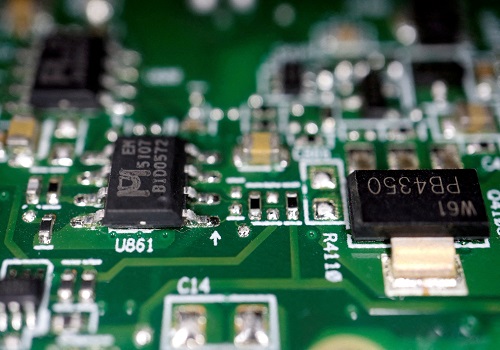

Astra Microwave Products (AMPL) has incorporated wholly-owned subsidiary of the company in the name of ‘Astra Space Technologies’ on February 17, 2024. The said subsidiary has been incorporated for Design, development, manufacture and integration of satellites, satellite pay loads, launching of satellites and establishment of ground stations for satellite tracking.

Astra Microwave Products (AMPL) designs, develops and manufactures sub-systems for RF and microwave systems used in defense, space, meteorology and telecommunication.