Aluminium Long Term Report by Kedia Advisory

Aluminium Performance

Strengths

* Aluminium climbed above 4% in a month tracking LME above $2,715, hitting a near six-month high and SHFE prices above 21100, hitting 10-month high.

* The dollar index fell toward 97, hitting an over two-month low ahead Fed rate cut decision.

* China's aluminium production fell by 0.5 % to 3.8 million metric tons in August

* China’s factory activity in August expanded at the quickest pace in five months to 50.5 on the back of rising new orders.

* Persistent bauxite supply risks from Guinea’s dispute with Emirates Global Aluminium support price floors.

* European factories face limited supply due to sanctions on major producer Russia, indirectly supporting global aluminium prices.

Opportunities

* China unveiled a series of measures aimed at boosting services consumption.

* RUSAL’s decision to cut production by more than 6%, and news of raw material shortages triggered systemic buying.

* Goldman Sachs raised its aluminium price forecast for H2 2025 by $140/ton to $2,280

* The global aluminium market will see a deficit this year, BofA said

* China’s GDP growth target was set at 5%, and is implementing stimulus measures to boost the economy.

* Ratings agency S&P Global affirmed China’s long-term, short-term, and local currency sovereign credit rating at A+, citing strong fiscal stimulus.

Weakness

* Gains on metals markets were restrained by worries about US tariffs, which helped to dampen factory activity in parts of Asia.

* China’s Industrial production in August fell to a one-year low, while retail sales slowed to an eight-month low.

* Aluminium inventories in warehouses monitored by the Shanghai Futures Exchange rose 3.3% from last Friday

* Global primary aluminium output in July rose 2.5% year-on-year to 6.373 million tonnes – IAI

* Japan's August aluminium stocks rise 6.3% m/m in August

Threats

* Goldman forecast a global aluminium market surplus of 580,000 tons in 2025, versus its previous forecast of a 76,000 tons deficit.

/* China’s economy continues to face multiple risks and challenges, citing August 2025’s weak performance amid mounting global headwinds.

* The IMF and OECS’s has downgraded global growth projections for 2025, intensifying market pressure

* As per Daily chart, Rising Wedge Chart pattern is in formation.

* As per Daily chart, RSI started to move down from overbought zone

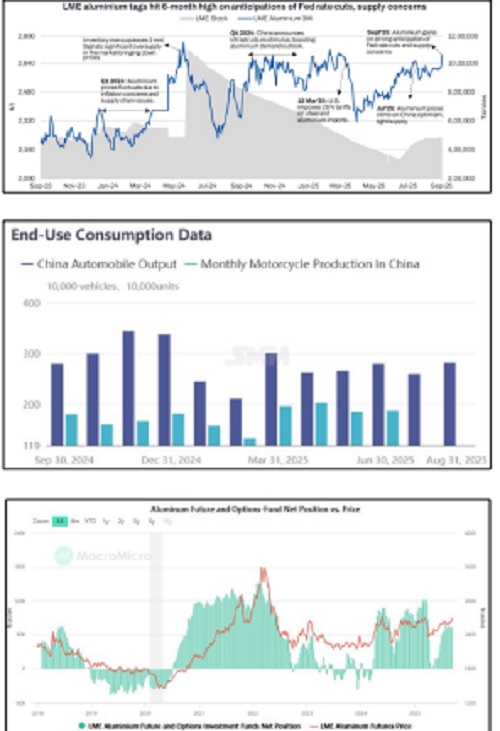

Aluminium Hits Multi-Month Highs on Supply

Strains Aluminium has gained nearly 2% in September, with LME prices above $2,715 (six-month high) and SHFE touching a ten-month high above 21,100. Gains were driven by tighter supply as China’s August output fell 0.5% YoY to 3.8 Mt, while RUSAL cut production by 6% amid raw material shortages. Persistent bauxite risks from Guinea and sanctions on Russian supply continue to support global prices. Inventories, however, are mixed, with SHFE stocks up 3.3% WoW and Japan’s August stocks rising 6.3% MoM.

Aluminium Premiums Supported Amid Tariff and Trade Uncertainty

Aluminium’s September rally is restrained by tariff concerns, which dampened Asian factory activity. The dollar index fell near 97, a two-month low, ahead of the Fed’s rate cut decision, offering temporary support to metals. Europe faces constrained supply due to sanctions on Russian aluminium, amplifying reliance on alternative sources. At the same time, inventories are building, with SHFE stocks up 3.3% WoW and Japan’s stocks rising 6.3% MoM. While Goldman Sachs sees a surplus of 580,000 tonnes in 2025, BofA expects a deficit, reflecting forecast divergence.

Aluminium End-Use Consumption Trends – China

China’s aluminium end-use demand showed mixed signals across the automobile and motorcycle sectors. Automobile output (blue bars) remained the dominant driver but displayed volatility: peaking near year-end 2024 before softening in March 2025, followed by moderate recovery through August 2025. Motorcycle production (teal bars), though much smaller in scale, showed steadier momentum, with visible gains around March 2025 but easing again by mid-year. The data suggests that while auto output remains the primary consumer of aluminium, demand growth is uneven, reflecting broader economic headwinds and policy adjustments.

Aluminium Market Squeezed by Tariffs, Speculation and Supply Strains

In September 2025, the aluminium market is experiencing renewed tightness due to a mix of speculative activity, trade policy, and supply chain disruptions. A major trading house has accumulated nearly 90% of available LME aluminium warrants, signalling large-scale delivery intentions that have restricted short-term availability. At the same time, U.S. import tariffs of 50% continue to inflate regional premiums, especially in the Midwest, creating a wide gap between physical and paper markets. Meanwhile, LME warehouse inventories have risen by about 40% since late June, but delivery bottlenecks keep end-user access strained.

Policy Support and Demand Signals Balance Aluminium Outlook

China’s factory PMI rose to 50.5 in August, the fastest in five months, supported by new orders and government stimulus to boost services consumption. Still, broader activity softened, with industrial production hitting a one-year low and retail sales slowing to an eight-month low. Aluminium markets remain underpinned by deficits, as BofA expects a global shortfall in 2025, despite Goldman Sachs shifting to a 580,000-tonne surplus forecast. Investor focus remains on policy easing, China’s 5% GDP growth target, and credit strength affirmed by S&P at A+.

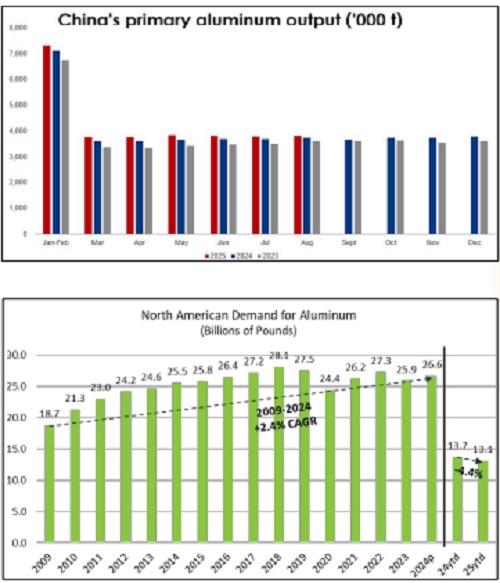

China’s Primary Aluminum Output Rises Despite Cost Pressure

China’s primary aluminum output reached 30.1 million tonnes in January–August 2025, up 2.2% YoY, according to NBS data. August production stood at 3.8 million tonnes, slightly down 0.5% YoY but 0.5% higher MoM. Rising smelting costs, averaging Yuan 16,111/t ($2,262/t), squeezed margins, while aluminum ingot prices dipped marginally to Yuan 20,663/t. Demand was weak early August during the seasonal lull but recovered later, supported by EV manufacturing and power grid investment. Inventories at 16 major city warehouses climbed to 610,000 tonnes, up 85,000 tonnes MoM.

Aluminium and Energy Dependency

Aluminium remains one of the most energy-intensive metals to produce, making power costs a key driver of supply. In 2025, global smelters face heightened cost pressure amid fluctuating energy markets and policy-driven transitions. Russian supply restrictions and higher natural gas prices in Europe are squeezing smelter economics, while Chinese producers balance between curbing emissions and sustaining output. These conditions have pushed firms like RUSAL to cut output by 6%, signaling how energy and environmental costs directly impact production volumes.

Aluminium Demand Weakness in North America – H1 2025

North American aluminium demand dropped 4.4% year-on-year in the first half of 2025, totaling 13,101 million pounds versus 13,706 million pounds last year, according to the Aluminum Association. Shipments from US and Canadian producers fell 4.5%, driven by an 11% plunge in ingot demand and lower mill product exports. Unwrought aluminium imports declined, with US inflows from Canada down 14% and Canada’s imports from the US also shrinking. However, overall aluminium and product imports into the region rose 15.8%. In contrast, aluminium scrap inventories surged 14.7%, suggesting a structural shift between primary aluminium demand and scrap flows, raising deeper questions about trade policies and industrial health.

Above views are of the author and not of the website kindly read disclaimer

.jpg)