The Nifty started the week on a positive note and continued to march upward throughout the session - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

NSE(Nifty): 14923

Technical Outlook

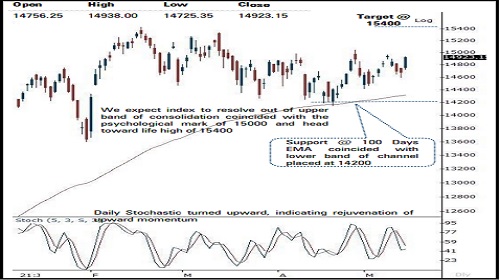

* The Nifty started the week on a positive note and continued to march upward throughout the session as intraday pullbacks were bought into. As a result, the daily price action formed a sizable bull candle carrying higher high that retraced 90% of past three sessions decline in just a single session, indicating rejuvenation of upward momentum

* Going ahead, we expect index to resolve out of upper band of consolidation coincided with the psychological mark of 15000 and head toward life high of 15400 in the month of May 2021 as discussed in the Monthly Technical outlook report. Key point to highlight is that, the Bank Nifty has seen faster pace of retracement on the smaller degree chart as it retraced past three sessions decline in just a single sessions, highlighting structural improvement. We believe, the follow through strength in financials would drive index higher as Bank Nifty constituents carries 38% weightage in Nifty. Hence any dip from here on should be capitalised to accumulate quality large cap and midcaps

* The broader market indices are hovering at their 52 weeks high after past three weeks sharp up move. We expect, Nifty midcap and small cap indices to regain upward momentum post a higher base formation and endure its relative outperformance in coming weeks amid progression of Q4FY21 result season

* Structurally, we believe Nifty has formed a strong base formation at 14200 mark which we do not expect index to breach. Despite elevated volatility owing to concern over second Covid-19 wave, it has managed to hold the key support of 14200. Hence 14200 would continue to act as a key support as it is confluence of

* a) 100 days EMA placed at 14318

* b) last month’s low placed at 14151

* In the coming session, index is likely to witness gap up opening above the psychological mark of 15000. We expect index to trade with a positive bias while maintaining higher high-low formation. Hence, use intraday dip towards 15010-15035 to create long for target of 15124.

NSE Nifty Daily Candlestick Chart

Nifty Bank: 33459

Technical Outlook

* The daily price action formed a strong bull candle with a higher high -low . The index in the process recovered its entire last four sessions decline (33297 -32115 ) in just a single session signalling strength and resumption of the up move

* The index has registered a breakout above the last two weeks consolidation range (31900 -33300 ) . Goining ahead, we expect it to maintain positive bias and head towards our medium term target of 34900 levels in the coming weeks as it is the 61 . 8 % retracement of the entire recent decline (37708 -30405 )

* The index has immediate support at 32000 -31500 levels being the confluence of the last two weeks low and the 61 . 8 % retracement of the previous up move (30405 -34287 )

* The index in the last two weeks has formed a higher base above the 61 . 8 % retracement of the preceding two weeks up move (30405 -34287 ) . A shallow retracement highlights higher base formation and a positive price structure

* The index has maintained the rhythm of not correcting more than 20 % as witnessed since March 2020 . In the current scenario, it rebounded after correcting 19 % from the all -time high (37708 ) . Hence it provides favourable risk -reward setup for the next leg of up move

* In the coming session, the index is likely to open on a gap up amid firm Asian cues . We expect the index to continue with its previous session up move . Hence, after a positive opening use dips towards 33650 -33720 for creating long position for the target of 33980 , maintain a stoploss of 33540

* Among the oscillators, the daily stochastic has resume its up move and is at the cusp of generating a buy signal moving above its three periods average thus supports the positive bias in the index

Nifty Bank Index – Daily Candlestick Chart

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct

More News

Banknifty closed at 45669 on 19th July with a gain of 258 points- Axis Securities