The BankNifty witnessed another round of selling to towards 32400 - Angel Broking

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Sensex (49201) / Nifty (14683)

Yesterday morning, the global set up looked a bit sluggish and despite this, our benchmark managed to kick off the session with an upside gap. However, these gains were merely a formality, as we witnessed key indices paring down all gains to enter a negative territory in the initial trades. This was followed by a smart recovery in the subsequent hour after entering a sub-14600 territory.

This process got repeated as we witnessed swings on both sides throughout the remaining part of the session. Eventually, with the help of last hour gradual recovery, Nifty managed to secure three tenths of a percent gains. It was clearly a choppy session for indices but the real action was seen in individual pockets. The entire ‘Pharma’ space kept buzzing throughout the session along with the broader end of the spectrum.

So it seems, key indices have opted for some breather before deciding the next path of action. As we mentioned in the previous commentary, the banking plays a vital role here as it has reached a crucial support base and should now be considered a ‘Make or Break’ zone in the near term. If the Nifty has to see some recovery form heron, the banking counters need to regain strength. If they fail to do so, we may see further weakness in days to come.

As far as levels are concerned, 14750 followed by 14780 are to be seen as immediate hurdles; whereas on the flipside, 14550 – 14440 remains an intraday support zone. Since individual stocks are performing well and providing better opportunities, it’s better to stick to stock centric approach till the time indices confirm their near term direction.

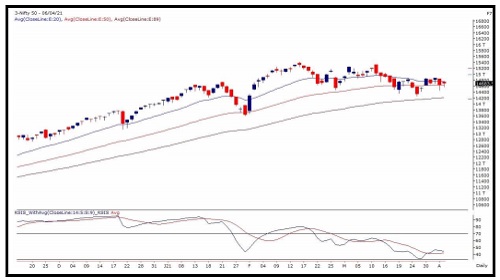

Nifty Daily Chart

Nifty Bank Outlook - (32501)

Although the global market were not so encouraging, we managed to start-off with an upside gap but within a blink of eye sneaked below 32350. However, this dip got bought into in next couple of minutes and we saw a sharp recovery towards 33000 mark.

In the midst, the BankNifty witnessed another round of selling to towards 32400 and then eventually concluded the choppy day with a cut of half a percent to its previous day close. As we already highlighted, the BankNifty is now placed around very crucial levels (around 89 EMA in daily chart which recently acted as demand zone) and follow up move from hereon shall dictated the near term directional move.

Hence, traders should keep a close tab especially on the banking index as any upmove in broader market without the support of BankNifty wouldn’t be sustainable. As far as levels are concerned, 32300 is a key level to watch out now and breach of this may open doors for sub-31000 levels; whereas, on the higher side 33000-33200 shall be the immediate supply zone.

Nifty Bank Daily Chart

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://trade.angelbroking.com/Downloads/ARQ-Disclaimer-Note.pdf

SEBI Registration number is INH000000164

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

On the higher side, immediate resistance is seen around 36000 - 36200 levels - Angel One

More News

Sold Stock Futures to the tune of 5114 Cr - Axis Securities Ltd