S&P Global Platts Analytics : Supply woes, volatility to keep India's coal importers on edge

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Supply woes, volatility to keep India's coal importers on edge

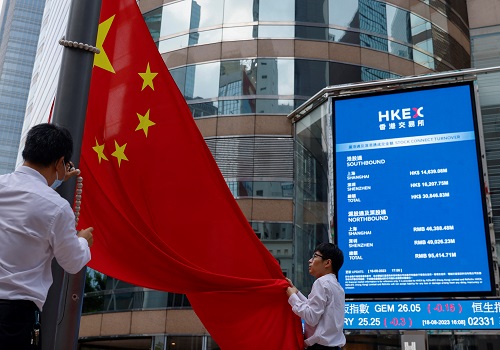

* Indian coal importers are bracing for another year of market volatility and supply upheaval as China's efforts to absorb plentiful cargoes to make up for the Australian supply vacuum, as well as production hurdles at mines across the globe due to the pandemic, will keep the market on tenterhooks.

* Industry officials and analysts said that how Indian utilities manage their coal stockpiles in 2022, after a year of turmoil, will be a key factor that will determine availability in the domestic market, although the rising diversion of Australian coal flows from China to India offers a ray of hope.

* The price of Indonesia's 4,200 kcal/kg GAR coal price surged to a high of $158/mt FOB around mid-October from below $45/mt in early January 2021, according to Platts data. It then corrected sharply to $66.05/mt by the third week of December. The price for the grade averaged $67.70/mt FOB over the 12-month period.

* The price of Indonesian 4,200 kcal/kg GAR is forecast to average $56.72/mt FOB in 2022, according to S&P Global Platts Analytics.

* Similarly, the price of Australian 5,500 kcal/kg NAR touched a high of $174.50/mt FOB Oct. 19, rising from $50.50/mt in early January and then easing to $104.20/mt by the third week of December, according to Platts data. It averaged $82.20/mt FOB over January-December.

* According to Platts Analytics, supply challenges will continue to restrict production, which will limit coal exports to around 2021 levels in 2022.

* "We will not see a return to pre-pandemic seaborne import demand levels above 1 billion mt in 2022," Platts Analytics said in a report. "Additional renewable capacity in China and India, as well as a lack of coal-fired power plant build pipeline, will cap seaborne import demand."

Above views are of the author and not of the website kindly read disclaimer

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">