Asian shares hit 11-month lows; focus on US economic data

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

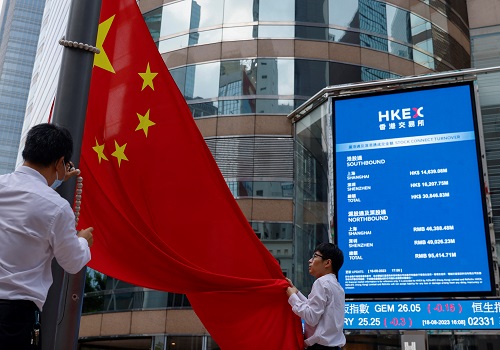

Asian equities slipped to their lowest in more than 11 months on Tuesday, while the dollar wobbled in cautious trading ahead of a slew of economic data that will provide clues to the next steps from the U.S. Federal Reserve.

Oil prices recovered some of the previous day's losses in early Asia trade as nervousness prevailed in the market amid worries that the Israel-Hamas war could escalate into a wider conflict in the oil-exporting region.

MSCI's broadest index of Asia-Pacific shares outside Japan was 0.28% lower at 473.37, having touched 472.73 - the lowest since November 2022. The index is down 3% for the month and set for its third consecutive month in the red. Japan's Nikkei fell nearly 1%.

China shares remained under pressure, with the Shanghai Composite Index 0.32% higher, while Hong Kong's Hang Seng Index slid 0.5%.

China's blue-chip CSI300 Index was 0.2% higher after closing at its lowest level in 4-1/2 years on Monday.

"The looming spectre of inflation grows even more imposing, especially considering the recent sharp ascent in oil prices," said Dalma Capital Chief Investment Officer Gary Dugan.

"If oil prices persist at this level throughout the rest of 2023 and into 2024, this could potentially inject another bout of inflation into the global economy."

Overnight, U.S. stocks wavered to a mixed close on Monday, with investors shifting their focus to this week's high profile earnings, including Microsoft, Facebook-parent Meta Platforms and Amazon.

Beyond earnings, the spotlight will also be on a slate of economic data this week ahead of the Fed's meeting on Oct. 31 - Nov. 1.

The U.S. Commerce Department on Thursday will announce third-quarter gross domestic product, which is seen accelerating to 4.3%. Its wide-ranging Personal Consumption Expenditures (PCE) report, due on Friday, is expected to show annual headline and core inflation cooling down to 3.4% and 3.7%, respectively.

But before that investors will parse through the flash purchasing managers' index (PMI) data from Britain, France, the Euro zone and the United States due later on Tuesday.

The yield on the benchmark 10-year U.S. Treasury note briefly rose above 5.0% on Monday before quickly declining. In Asian hours, the yield was up 1 basis point to 4.848% on Tuesday.

The run-up in yields on the 10-year Treasury note, seen as a safe haven in times of economic uncertainty and a benchmark for borrowing costs around the world, has been driven by investors pricing in stronger U.S. growth as well as the need for more bonds to be issued to fund higher government spending.

In the currency market, the dollar was soft against a basket of currencies, having dropped 0.5% on Monday. The dollar index was 0.038% lower at 105.56.

The yen remained under pressure but found some relief due to dollar's retreat. The Japanese currency was last at 149.62 per dollar, having hit the symbolic 150 level on both Friday and Monday.

In cryptocurrencies, bitcoin was back in vogue as speculation about the possibility of a bitcoin exchange-traded fund drove enthusiasm about the sector and prompted short-sellers to exit positions.

The world's biggest cryptocurrency traded as high as $34,283, an 18-month peak, on Monday. It was last up 3% at $34,176 in Asian hours.

"There is every reason to feel the market has largely discounted a positive decision on a spot ETF," said Chris Weston, head of research at Pepperstone.

"However, as we've seen over the years there are few markets that promote FOMO (fear of missing out) and traders chasing than Bitcoin and that could drive price towards $35k and beyond."

In commodities, U.S. West Texas Intermediate crude futures rose 0.61% to $86.01 per barrel and Brent futures were at $90.41, up 0.65% on the day.

Spot gold added 0.2% to $1,975.59 an ounce.