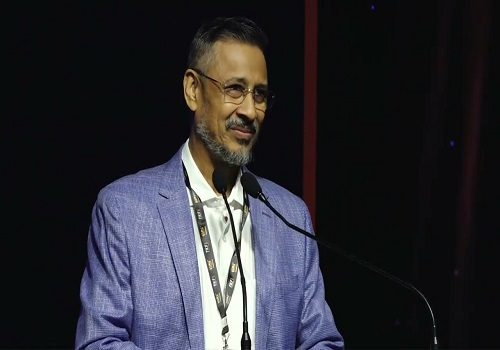

Pre-Budget Expectation : Personal tax rates should be rationalized and brought in line with the corporate tax rates Says Vivek Jalan, Tax Connect Advisory

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Below is Pre budget views By Mr. Vivek Jalan, Partner, Tax Connect Advisory, a multi-disciplinary tax consultancy firm:

It has become an urgent necessity to reduce the personal tax rates for individuals so that there is a degree of equity and fairness in relation to structuring decisions as well as being competitive with other countries.

Because, after the reduction of corporate tax rates a few years back, the differential between personal and corporate tax has widened. The highest marginal rate for individuals has now gone up to 42.74% (highest slab) against the normal Corporate Tax Rate of 25.17%. The high personal tax rate for individuals in India stands out as an exceptionally high rate as compared to other countries. For example, the maximum rates of personal income in Hongkong are 15%, Sri Lanka – 18%, Bangladesh – 25% & Singapore – 22%. Further, the huge gap in the tax rates as mentioned between individual and corporate tax rates is leading to several structuring decisions being adopted in favour of the corporate model (for example, proprietorship business moving to company format).

Further, The Finance (No.2) Act, 2014 had fixed an overall limit to Rs.1.5 lakhs in respect of deduction under section 80C of the Act. Even if we consider an inflation of 6% per annum, the deduction Needs to increase to at least Rs.2.5 Lakhs. This would act as a fillip to investments and also generate greater savings for the taxpayer.

Above views are of the author and not of the website kindly read disclaimer