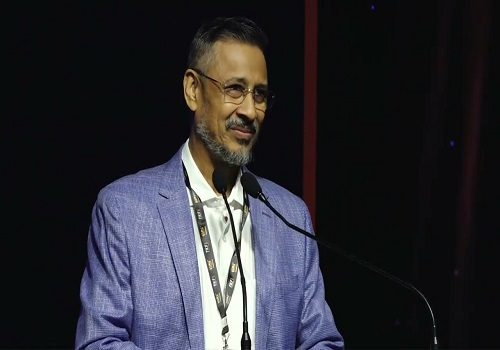

Pre-Budget Expectation : Deductions limit should be raised in line with inflation Says Col. Sanjeev Govila, Hum Fauji Initiatives

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Below is Quote On Pre-Budget Expectation 2023 by Col.Sanjeev Govila, CEO, Hum Fauji Initiatives, a financial planning firm:

80C is the only general Income Tax section available to everybody for saving some tax. This section covers a huge canvas from PPF/EPF, ELSS, NSC, NPS and SSY to Life Insurance policies, tuition fee and principal part of home loan. Even after increasing it to 3 Lakhs, a major part of one’s investments in these instruments for a middle-income person remain taxable.

The 80C limit was last revised from Rs 1 Lakh to 1.5 Lakhs in FY 2014-15, 8 years back, when the Cost Inflation Index (CII) was 240. It is 331 now and considering current inflation only at 6%, it comes out to about 351 for the next FY for which this increase is being discussed. With that, the current limit should be about Rs 2.19 Lakhs.

However, also considering that the Govt takes an unduly long time to revise this limit, it should go to at least Rs 2.5 Lakhs, and preferably to Rs 3 Lakhs.

Above views are of the author and not of the website kindly read disclaimer

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">