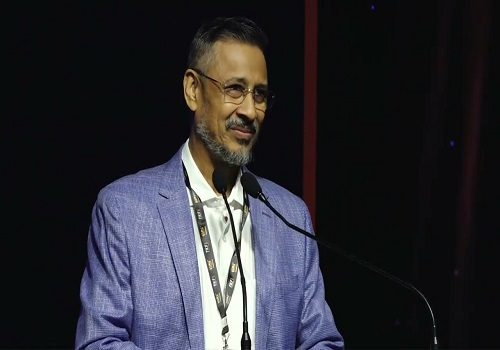

Pre-Budget Expectation : Various deductions limits should be enhanced Says Mr. Shailendra Kumar, TIOL Knowledge Foundation

Below is Quote On Pre-Budget Expectation 2023 by Mr. Shailendra Kumar, Chairman, TIOL Knowledge Foundation, a fiscal think tank:

Given the sluggish growth in the housing sector, the exemption limit of Rs 2 lakh on home loan interest payment should be raised to Rs 3 lakhs. Two-fold benefits will be a relief to salaried-voters in the next 16 months election season & also a push to dawdling the real estate sector which accounts for 8 per cent of GDP.

Given the precipitous drop in the national gross savings from 37 percent to 27 per cent, the perimeter of Sec 80C needs to be expanded to RS 2.5 lakh. This will put more money in the hands of the government to bankroll the infrastructure sector or higher capex.

A complete recast of capital gains regime is overdue. The I-T Act needs to be decluttered and level-playing is required in the treatment of different assets.

Given the exigency of health expenditure, and the risk of fourth Covid wave, Sec 80D limit should be hiked to Rs 40,000.

Above views are of the author and not of the website kindly read disclaimer