Opening Bell: Markets likely to make negative start ahead of RBI policy outcome

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Indian markets fell for a seventh straight session on Thursday as the selloff in the global markets continued. Today, start of the session is likely to be negative as the Street eyes the Reserve Bank of India's (RBI) interest rate hike announcement later in the day coupled with lingering fears of a global recession. The central bank is likely to raise key repo rate by up to 50 basis points today as it struggles to tame record inflation. Traders will be concerned as the Reserve Bank of India (RBI) said India’s current account deficit (CAD) in April-June was at $23.9 billion, or 2.8 per cent of gross domestic product (GDP), much higher than the $13.4 billion, or 1.5 per cent of GDP, in January-March 2022. Some pessimism will also come as another data released by RBI showed that India's external debt has risen by 7.1 per cent as it stood at $617.1 billion in June 2022, against $575.3 billion during the corresponding period of last year. Besides, foreign institutional investors sold a net Rs 35.99 billion ($441.7 million) worth of equities on Thursday, as per provisional data available with the National Stock Exchange. However, some respite may come later in the day as S&P Global Ratings said rising rates and increased European energy insecurity are hitting growth in almost every country, but India with an estimated 7.3 per cent growth this fiscal, would be the star among emerging market economies. Traders may be taking encouragement as Union Minister Piyush Goyal said India will be the pillar of the global economic revival as it exhibited steady growth and emerged as the fastest-growing country among large economies of the world. Besides, Economic Affairs Secretary Ajay Seth said India’s economic recovery remains on course, supported by key structural reforms, despite exogenous shocks and challenges. Traders may take note of report that the Centre has reduced its borrowing target for the financial year 2022-23 (FY23) by Rs 10,000 crore to Rs 14.21 trillion amid robust tax collections. Meanwhile, capital markets regulator Sebi has allowed Foreign Portfolio Investors (FPIs) to participate in the exchange-traded commodity derivatives segment, a move that will further increase depth and liquidity in the market. Auto stocks will be in focus as the government deferred until October 2023 the implementation of norms mandating six airbags in all cars, giving the industry a one-year extension. Also, Moody's Investor Service said robust car sales during the ongoing festive season amid the easing of chip shortage will help the Indian automobile industry outshine its regional and global peers this year. There will be some reaction in gems and jewelry industry stocks as ICRA Ratings expects India’s exports of cut and polished diamonds (CPDs) to taper by 8-10% to $22.0-22.5 billion in FY2023, amid the demand moderation.

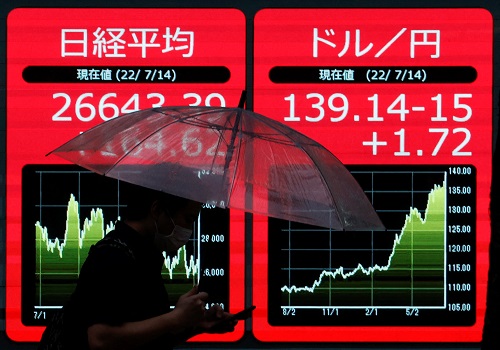

The US markets ended lower on Thursday on worries that the US Federal Reserve's aggressive fight against inflation could hobble the US economy, and as investors fretted about a rout in global currency and debt markets. Asian markets are trading in red on Friday following weakness overnight on Wall Street.

Back home, Extending their losing streak for seventh straight session, Indian barometer gauges ended the F&O expiry session in red terrain ahead of Reserve Bank of India’s (RBI) policy outcome amid expectations of yet another rate hike of 50 basis points to check high inflation, in line with similar actions taken by other major central banks, including the US Fed. Markets started the day on an optimistic note as traders took encouragement with report that rating agency ICRA retained its India’s previous growth forecast of 7.2 per cent for the current fiscal, citing revival in contact-intensive services and a pick-up in government and private expenditure. It said growth is expected to pick up to pre-Covid levels on the back of pent-up demand. Some support also came with report that Goods and services tax (GST) collections in September are likely to be about Rs 1.45 trillion, and the monthly average mop-up in FY23 could be around Rs 1.55 trillion. However, initial rally get fizzled out and markets started losing gains as traders turning cautious on report that India’s current account deficit (CAD) is expected to more than double sequentially to over $30 billion in the first quarter of financial year 2022-23 (Q1FY23) to rise above 3 per cent of gross domestic product (GDP) from $13.4 billion, or 1.5 per cent of GDP, in the previous quarter. Selling in second half of the trade mainly played spoil sports for local bourses and dragged them to end below neutral lines as market participants were largely remained on sidelines amid a private report stating that India’s central bank is expected to increase its policy rate by half a point for the third time in a row as the currency’s plunge to a record low this month complicates the battle against inflation. Finally, the BSE Sensex fell 188.32 points or 0.33% to 56,409.96 and the CNX Nifty was down by 40.50 points or 0.24% to 16,818.10.

Above views are of the author and not of the website kindly read disclaimer

Tag News

Weekly Market Analysis : Markets strengthened recovery and gained nearly 2% in the passing w...